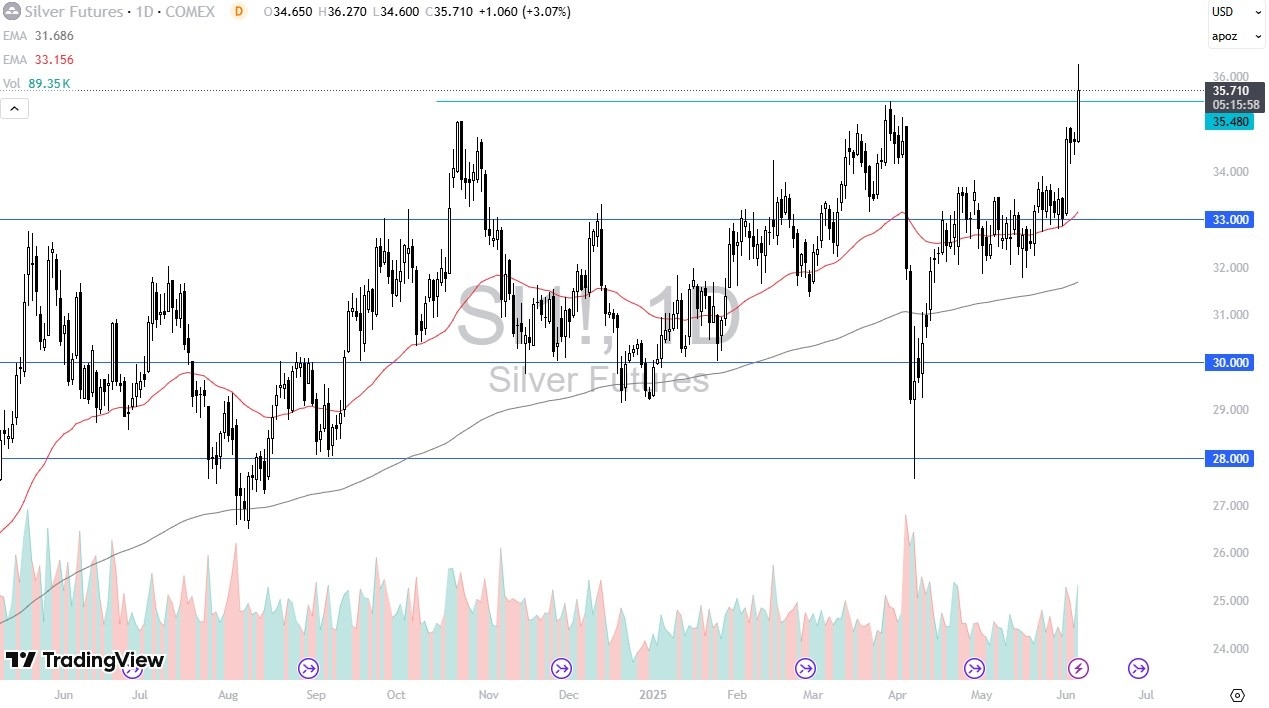

Potential signal:

- I’m a buyer of silver on a break above the high of the Thursday candlestick, with a stop loss at the $35.25 level.

- I would aim for $37.50, but I would also keep the position size fairly small.

During the trading session on Thursday, we have seen the silver market take off to the upside, breaking well above the crucial $35.48 level, which was a major swing high previously. At this point in time, I think we have quite a bit of interest in this market, as breaking above that swing high leads to a bit of a “air pocket” above. I think ultimately, part of the reason that we gave back some of those gains once the fact that Non-Farm Payroll started to become part of the focus as it is of course on Friday.

The volatility will continue to be a major factor of the silver market, as per usual. Silver is one of the more volatile assets that I follow, so therefore I’m always very cautious about the overall position sizing this market, especially when it gets to be very volatile like this. I suspect that sometime during the early part of Friday, we will see the silver market just simply go sideways, or perhaps even drift a little lower as traders are quick to take profit ahead of that major event.

Technical Analysis

If we can break above the candlestick for the Thursday session, that would obviously be a very bullish sign and I think that could send silver racing to the upside, perhaps even as high as $50 before it is all said and done, but in the meantime the so-called “measured move is more likely going to suggest that silver could go looking to the $37.50 level. On the other hand, if we were to break down from here, I think there is a massive amount of support near the $34.50 level, and again at the $33 level where the 50 Day EMA currently resides.

Friday might be a bit interesting for silver, because a lot of traders may be forced into closing profitable positions in order to cover horrible positions elsewhere, but they may also react to the jobs number because silver is an industrial metal, and therefore if we do in fact see a strong jobs market in the United States, the pass-through effect could very well be more industrial demand.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.