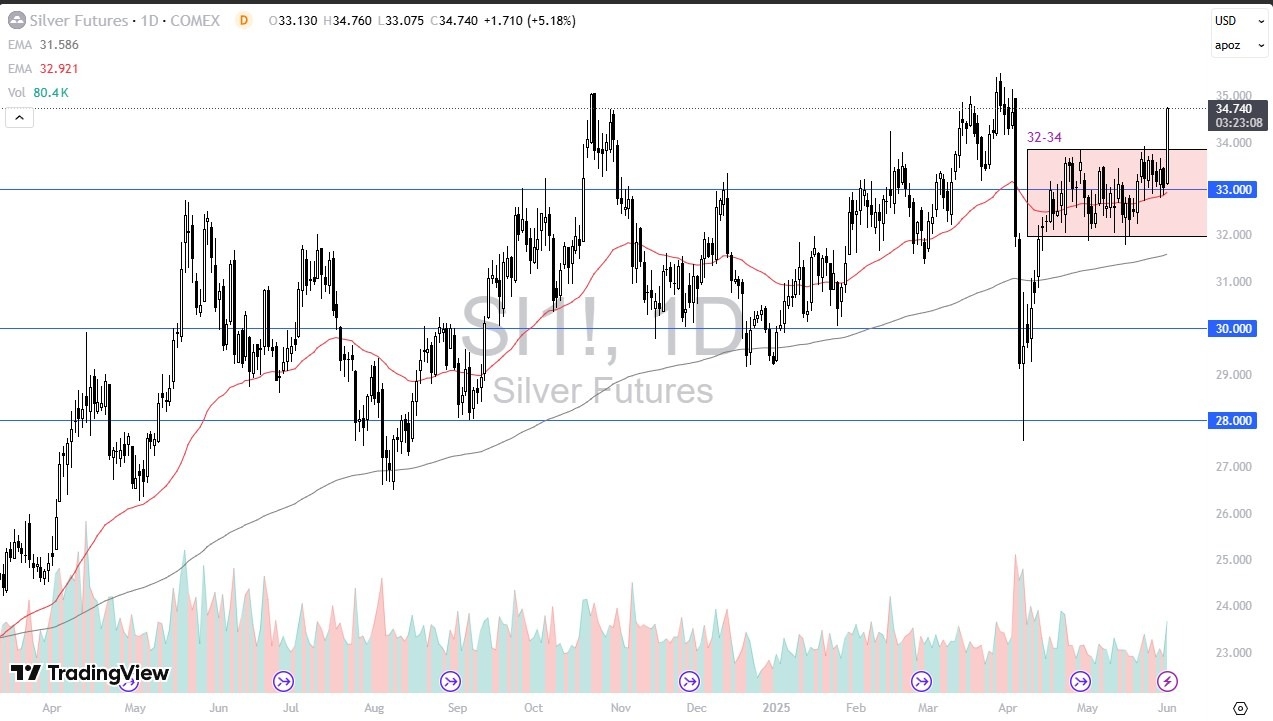

- Silver markets have rallied rather significantly during trading on Monday, smashing through the $34 level resistance barrier.

- Quite frankly, this was a bit of surprise, although ideas anticipate that silver was going to rally sooner or later, the reality is I thought we had some time before it really would take off.

- After all, by the time the Americans woke up, we still were well within the previous range that had been so important for this market. Because of this, it’s obvious that some things have changed in the silver market.

Technical Analysis

The technical analysis for the silver market is obviously very bullish, but now we are looking at the resistance barrier in the form of $35 that we need to pay close attention to. This is an area that’s been very important because we had seen a massive amount of silver dumping from that level early in the month of April. If we can break above the $35 level, that would be a very bullish turn in events, but I don’t know if we can do it right away.

The size of the candlestick, and the fact that the rally was over 5%, suggest that we could probably see buyers jumping into the market in order to pick up value on short-term pullbacks, extending all the way down to the $35 level I anticipate, as the previous resistance will now become support based on “market memory.” Because of this, I think you got a situation where it’s interesting that the 50 Day EMA held as support, right along with the $33 level, and we have since launched. When you look at the recent action, the pullbacks had been a little bit shallower, and it looks like the $33 level was crucial.

On the other hand, if we were to break above the $35.50 level, then I think it’s likely that silver will just simply scream to the upside. Ultimately, I expect to see a lot of noisy behavior, but it’s obvious that the buyers are in control overall.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.