- Nvidia skyrocketed during the trading session on Tuesday, despite the fact that the overall markets were only so-so as far as momentum is concerned.

- Quite frankly, the market is reacting to the fact that Nvidia is getting the green light from the trough administration to sell certain AI chips to China.

- This opens up one of the world’s largest markets, so it’s no huge surprise to see that Nvidia rallied roughly 5% midday.

Technical Analysis

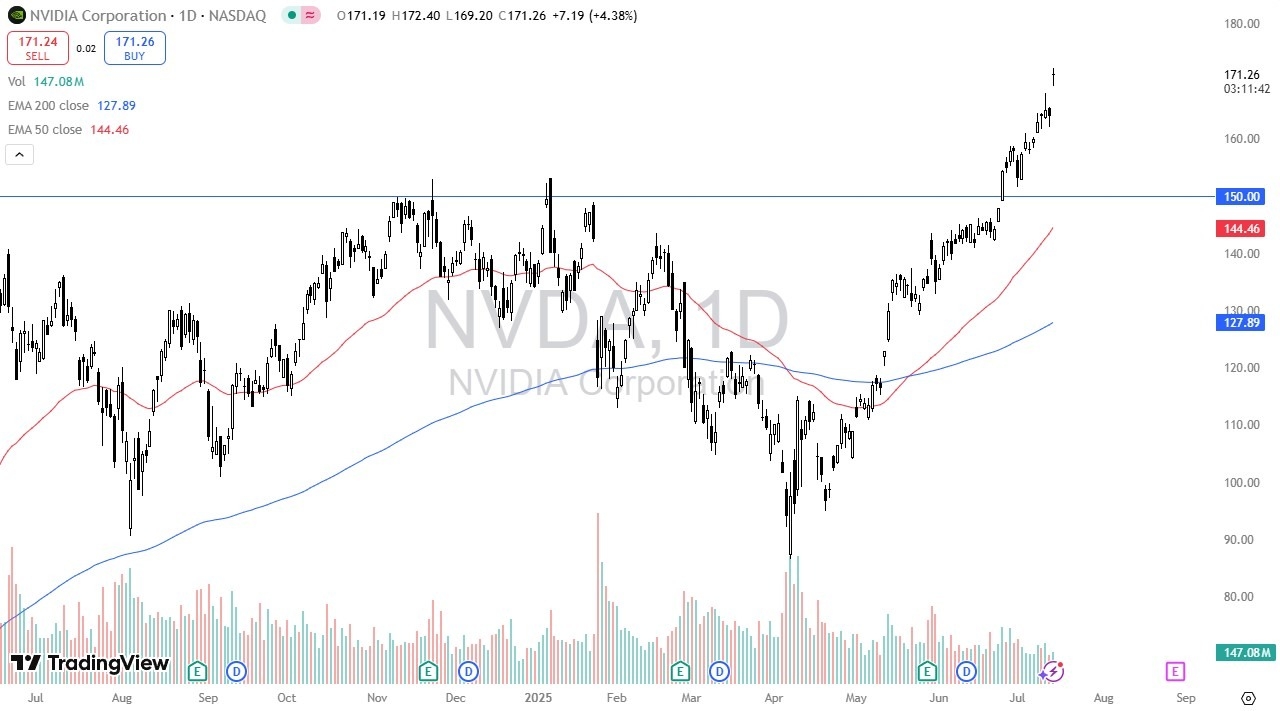

The technical analysis for Nvidia is obviously very bullish, and quite frankly it has been for some time. That being said, we are a little bit stretched, so I would like to see some type of pullback toward the $165 level to get long. The 50 day EMA is near the $145 level and is rising, perhaps trying to get to the $150 level. I find that interesting, because the $150 level at this point in time probably defines the entire trend. Anything below opens up the possibility of a complete turnaround, but I don’t think that happens anytime soon. To the upside, I believe that the $175 level probably offers at least a little bit of psychological resistance.

Keep in mind that Nvidia is a mainstay of most institutional traders and funds, including retirement accounts. It’s a play on the idea that AI is going to be a mainstay of our lives going forward, and therefore a lot of longer-term traders or to simply buying and holding. I think there will be a considerable bid in Nvidia because of this, and therefore I have no interest in shorting this market anytime soon. Quite frankly, Nvidia will continue to be a major leader in the stock market, despite the fact that we are a little overbought. I would love to see a $15 drop in the stock, but the likelihood that might be a little bleak at this point. I would settle on a move down to fill the gap from the open today. A break of the top of the candlestick for the session means that we are probably going to enter a new impulsive bullish phase, and I will be part of that as well.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.