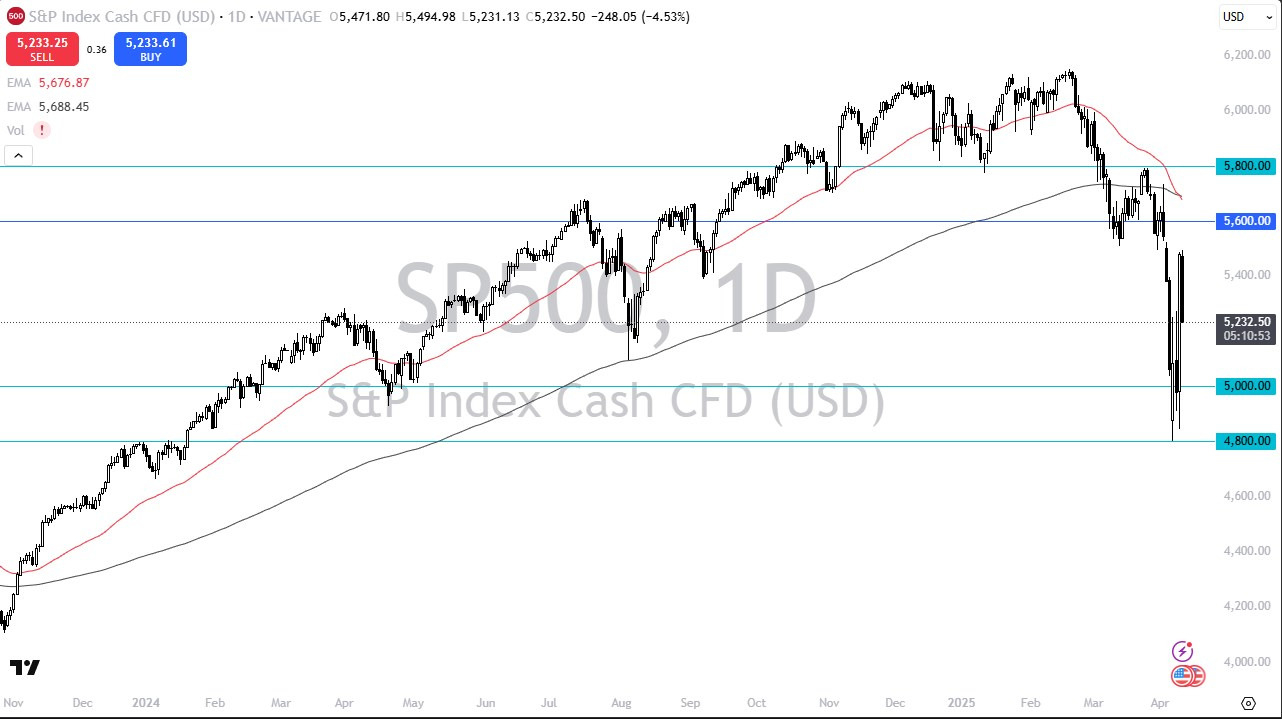

- It’s been a brutal day in the S&P 500 after the CPI numbers came out weaker than anticipated and you know, let’s be honest here, the market got way ahead of itself during the previous session.

- So that being said, it does make sense that we get back at least half of the candlestick and that’s essentially what we’ve done now.

- The question is whether or not we can form some type of basing pattern to turn things back around.

The 5,000 level underneath is a large round psychologically significant figure and I think it’s an area where we could see a major floor in the market. Now that only assumes that things do stabilize. If they don’t, then we could find ourselves back at the 4,800 level. All things being equal, this is a market that is trying to figure out what to do next, and it does make a certain amount of sense that some of what we had seen during the previous session was probably short covering. We just kicked off the so-called death cross, but that’s an indicator that is always late. It’s when the 50 day EMA breaks below the 200 day EMA kicking off a downtrend, which would have been much more interesting if you knew that 1000 points ago.

Death Cross? Who Cares? Not I.

So, it’s not really something I watch and in fact, quite often, you’ll see it happen, and then the market will take off. So, I am at this point thinking there’s probably more risks to the upside than down. But that doesn’t mean I want to jump in and buy this market. What I would need to see is a few days of stability and then maybe a positive candlestick that breaks out of a short term range. Right now, it’s almost impossible to trade in this market unless you’re willing to go short, which is fine for some. But if you understand the structure of the S&P 500, it’s not made to fall for very long, it is not an equal weighted index and that is something that makes it behave a little suspicious at times. I do think there are buyers underneath, but you’re probably going to be better off to take a day or two before you try to put any money to work.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.