After surrendering 6,306 and slicing through 6,302 / 6,297, E-mini S and P Futures hit 6,276 and now chop between 6,288 and 6,274; a breach below 6,274 risks a slide to 6,265 / 6,255 while reclaiming 6,288 → 6,306 is needed to reignite upside.

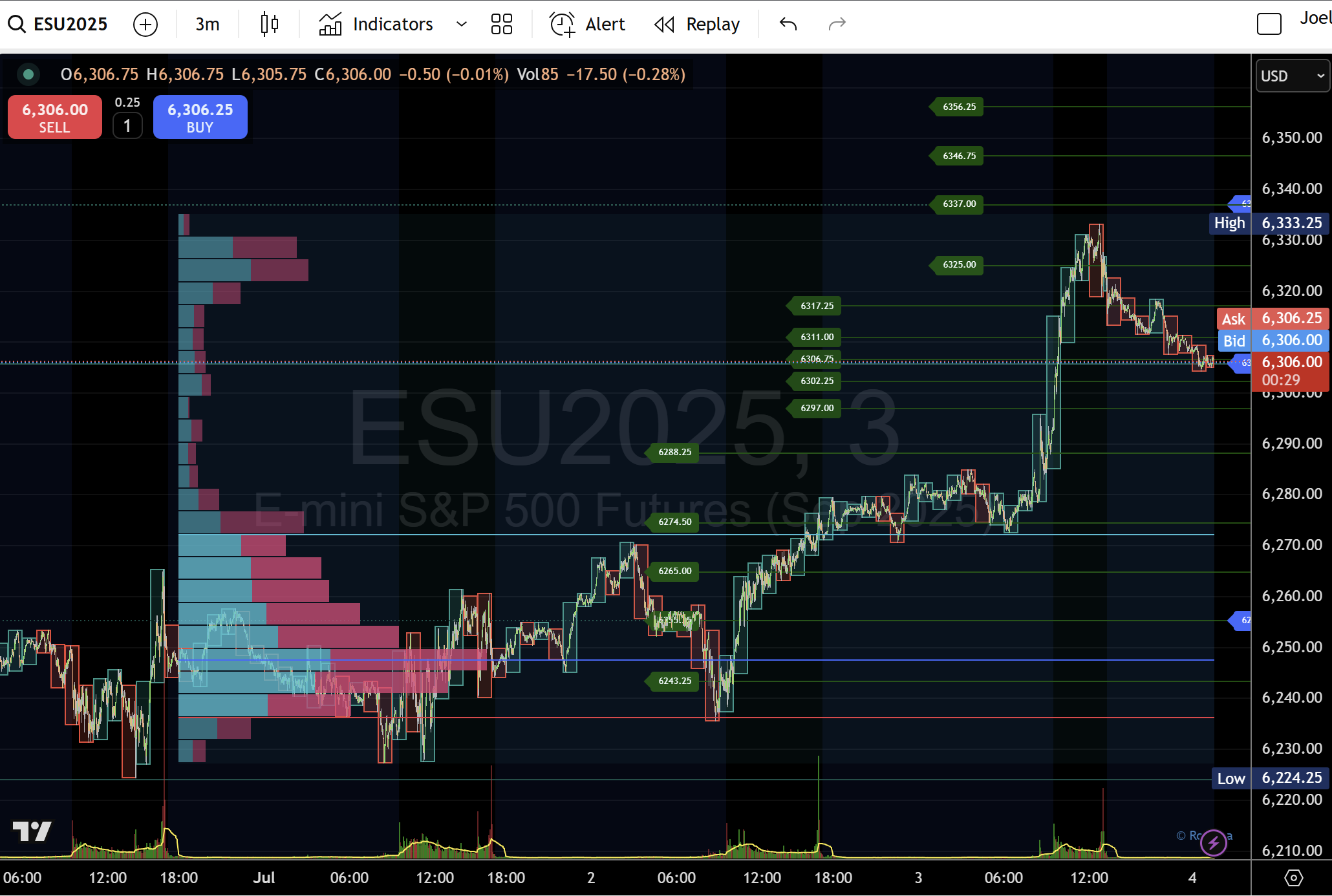

Session overview

- Pivot loss: During the London overlap, ESU2025 gave up the 6,306 pivot and slipped below the 6,302 / 6,297 defences.

- Target hit: The move carried through 6,288 (first target) and reached a low near 6,276, just above our secondary target at 6,274.

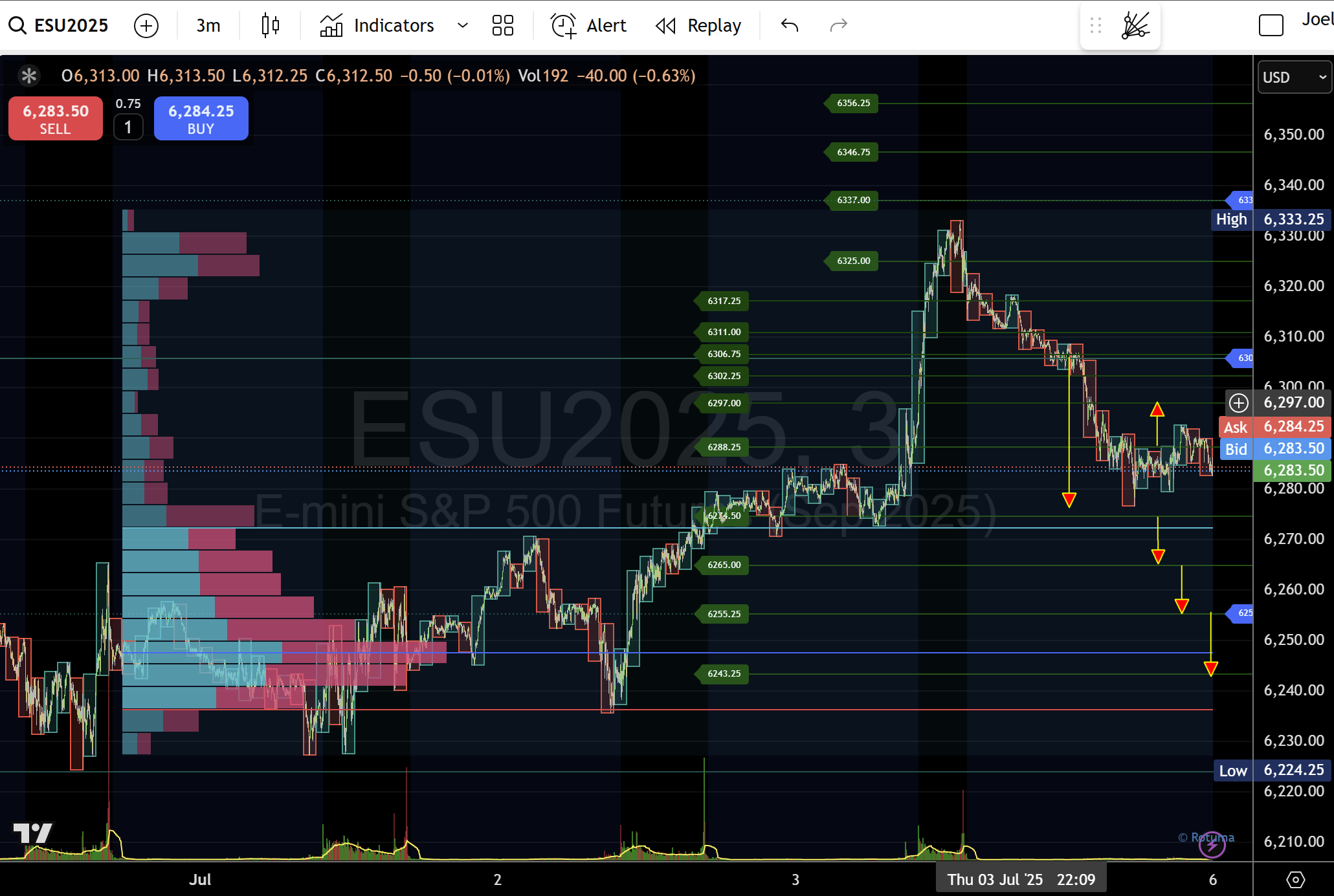

- Holiday consolidation: In the thin-volume New York Holiday session, price has chopped between 6,288 and 6,274, forming a tight range with little conviction.

Updated levels and stakes

Key support: 6,274 – Yesterday’s VAH breakout pivot; last bull line

Secondary support: 6,265 – Overnight node low—break risks a deeper slide

Tertiary defence: 6,255 – Multi-day pivot; next stop before POC

POC region: 6,243–6,247 – High-volume area; strong magnet on continued selloff

Reclaim thresholds: 6,288 – Hurdle to upside; reclaim for bull re-entry

Bullish triggers: 6,297 / 6,302 – Reclaims to confirm momentum toward 6,306+

London pre-opening session

London session overlaps with the New York holiday session

Updated playbook

- Bearish continuation (

- Entry: Clean close under 6,274 on H1.

- Targets: 6,265 (overnight node), 6,255 (session pivot), 6,247–6,243 (POC region)

- Stop: Above 6,288

- Defensive hold (6,274 – 6,288):

- Setup: Look for 3 min/H1 reversal bars in this zone.

- Re-entry targets: 6,297 (session swing), 6,302 (node high), 6,306 (pivot)

- Stop: Below 6,274

- Bullish reclaim (> 6,288):

- Entry: Break and hold above 6,288 on H1.

- Targets: 6,297 → 6,302 → 6,306

- Stop: Below 6,274

This analysis is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Futures trading carries a high level of risk and may not be suitable for all investors. Always conduct your due diligence and consult a qualified financial professional before making any trading decisions.