Will stock prices correct their recent gains amid uncertainty over earnings and tariff developments?

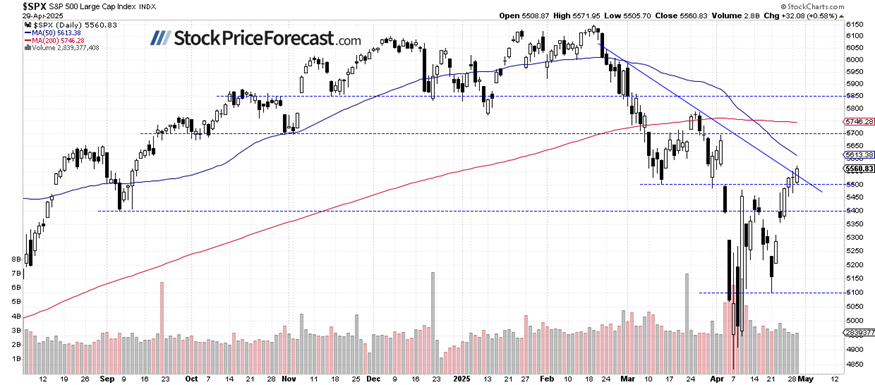

The S&P 500 closed 0.58% higher on Tuesday, extending its short-term uptrend and closing above the 5,550 level. The market is now facing potential consolidation as investors await key earnings releases from major tech companies – Microsoft and Meta today after session close, followed by Amazon and Apple on Thursday. This morning, futures suggest the S&P 500 will open approximately 1.4% lower.

Economic data have been worsening, with today’s ADP report coming in lower than expected at +62,000 and the Advance GDP report coming in at -0.3% quarter-over-quarter (vs. the expectations of +0.2%).

Recently, investor sentiment has worsened, as shown in last Wednesday’s AAII Investor Sentiment Survey, which reported that only 21.9% of individual investors are bullish, while 55.6% are bearish.

The S&P 500 extended its gains above the 5,500 level, as we can see on the daily chart.

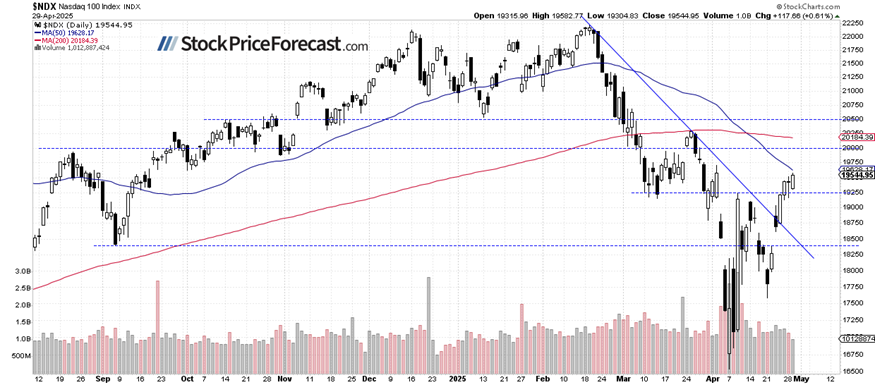

Nasdaq 100 awaits key earnings

The tech sector is consolidating ahead of crucial earnings reports that could set the tone for market direction. Executives from major tech companies will likely address their AI investments and potential impacts from Trump policies. Investors are particularly focused on guidance regarding the effects of tariff developments on future business plans.

Microsoft and Meta will report today after market close, with Amazon and Apple scheduled tomorrow. These “Magnificent Seven” stocks have been key market drivers in recent years, though they have largely underperformed so far in 2025.

Potential resistance for the Nasdaq 100 is around 19,700, marked by the previous local high, while support is at 19,000-19,200.

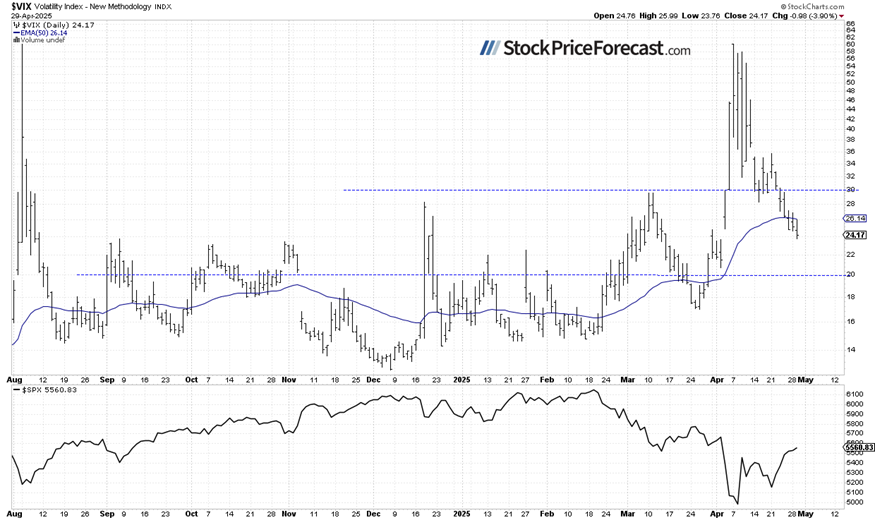

VIX: Lower again

The volatility index has been stabilizing at lower levels, suggesting some growing investor confidence despite concerns about trade policies and economic growth. Yesterday, the VIX was as low as 23.76.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

S&P 500 futures contract: Pointing lower

This morning, the S&P 500 futures contract is trading lower, pulling back from its recent highs near the 5,600 level. The support level is around 5,400, marked by some recent lows. The market is taking a breather after weak economic data.

Conclusion

The S&P 500 is likely to correct some of its recent advance following worse-than-expected economic data. It’s expected to open 1.4% lower, pulling back below the 5,500 level. For now, it appears to be just a correction of the uptrend.

Last week, the market advanced on several positive catalysts, including easing tariff fears, potential peace developments in Ukraine, and anticipated quarterly earnings releases. That said, it remains uncertain whether this is a new uptrend or merely a correction within the downtrend.

Here’s the breakdown:

-

S&P 500 closed 0.58% higher on Tuesday, but today, it is poised to open much lower following weak economic data.

-

The market is awaiting earnings releases from Microsoft and Meta today after the session closes.

-

Trade policy developments remain in focus.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!