The S&P 500’s support on the 6,366 pivot sets the tone for next week’s trading. Meanwhile, SPY August 11 $637 calls are building momentum for a potential surge, with both instruments aligned in a bullish MacroStructure setup.

SPX: Bulls defend 6,366 central pivot

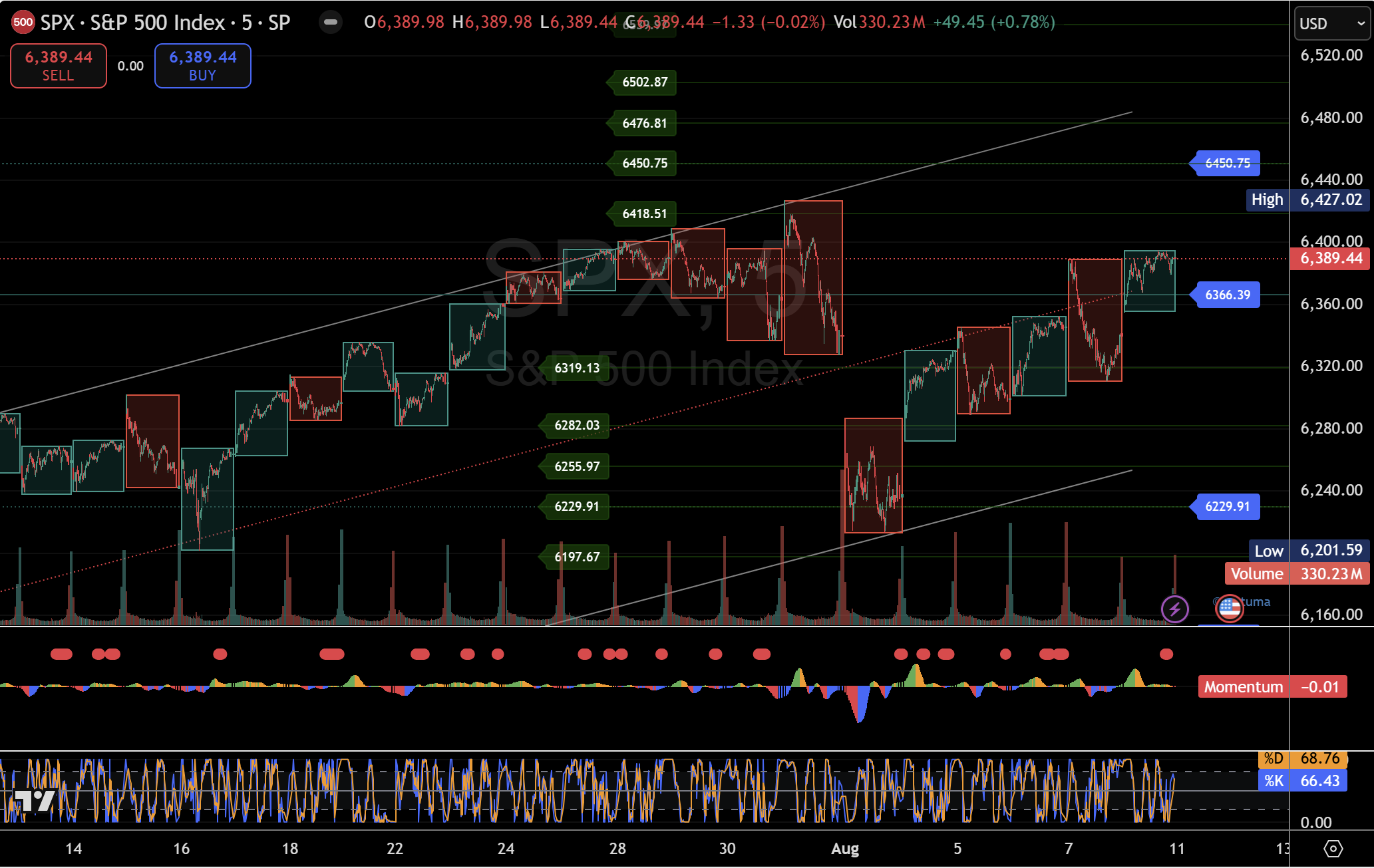

As of Friday, August 8, 2025, the S&P 500 Index (SPX) closed at 6,389.44, holding firmly above the critical 6,366 pivot. This level has emerged as the central battleground for market direction heading into the new week.

For the past two weeks, SPX has traded within the 6,145 to 6,366 pivot range, carving out a progressive upward price channel. This structure has repeatedly triggered the MacroStructure signature long setup — buying at micro 1–2 and targeting micro 3–5, which has delivered multiple clean upside moves.

Last week’s action saw SPX break through micro 5 at 6,319 and secure the upper critical pivot at 6,366, setting the stage for a potentially decisive move.

Key technical scenarios:

- Bullish breakout: Hold above 6,366 → test micro 1 at 6,418, then target 6,450–6,539, with an extended move to 6,587.

- Bearish reversal: Lose 6,366 → retest 6,319. Break below could see 6,282–6,197.

SPX continues to respect MacroStructure’s disciplined framework — long entries at micro 1–2, shorts at micro 5–4, and avoiding mid-channel chases — with each move supported by institutional-grade volume patterns.

S&P 500 price chart end of trades Friday, August 8

SPY August 11 $637 calls: Momentum points higher

The SPDR S&P 500 ETF Trust (SPY) August 11 $637 call options staged an impressive recovery in Friday’s session, rebounding 379% from Thursday’s steep drop of $2.85 to $0.48.

From the opening bell on Friday, August 8, 2025, price action held firmly above the $0.48–$0.78 VWAP lower band zone, setting a progressive upward price channel. Every pullback was met with aggressive buying, with $1.25 emerging as intraday floor support and $2.22 acting as resistance.

Key technical scenarios:

- Bullish continuation: Hold above $2.02–$2.22 → target $2.96, extended to $3.73.

- Bearish reversal: Reject $2.22 → retest $2.02–$1.54, then $1.25 VWAP lower band.

This recovery reflects the MacroStructure momentum setup — reclaiming VWAP support early, holding structure, and building toward an upside pivot break — with volume confirming active positioning by short-term momentum traders and possible institutional desks.

SPY August 11 $637 Calls price chart end of trades Friday, August 8

MacroStructure outlook: Index and options in sync

With SPX holding its 6,366 pivot and SPY calls coiling for a breakout above $2.22, both the index and its derivative instruments are aligned in bullish setups.

A coordinated breakout early next week could accelerate flows toward 6,587 on SPX and $3.73 on SPY calls, reinforcing each other’s momentum. Conversely, failure at these pivots could trigger fast reversals, putting lower support zones back in play.

This analysis is for informational purposes only and does not constitute investment advice. Trading involves risk, and past performance is not indicative of future results.