Signals for the Lira Against the US Dollar Today

Risk 0.50%.

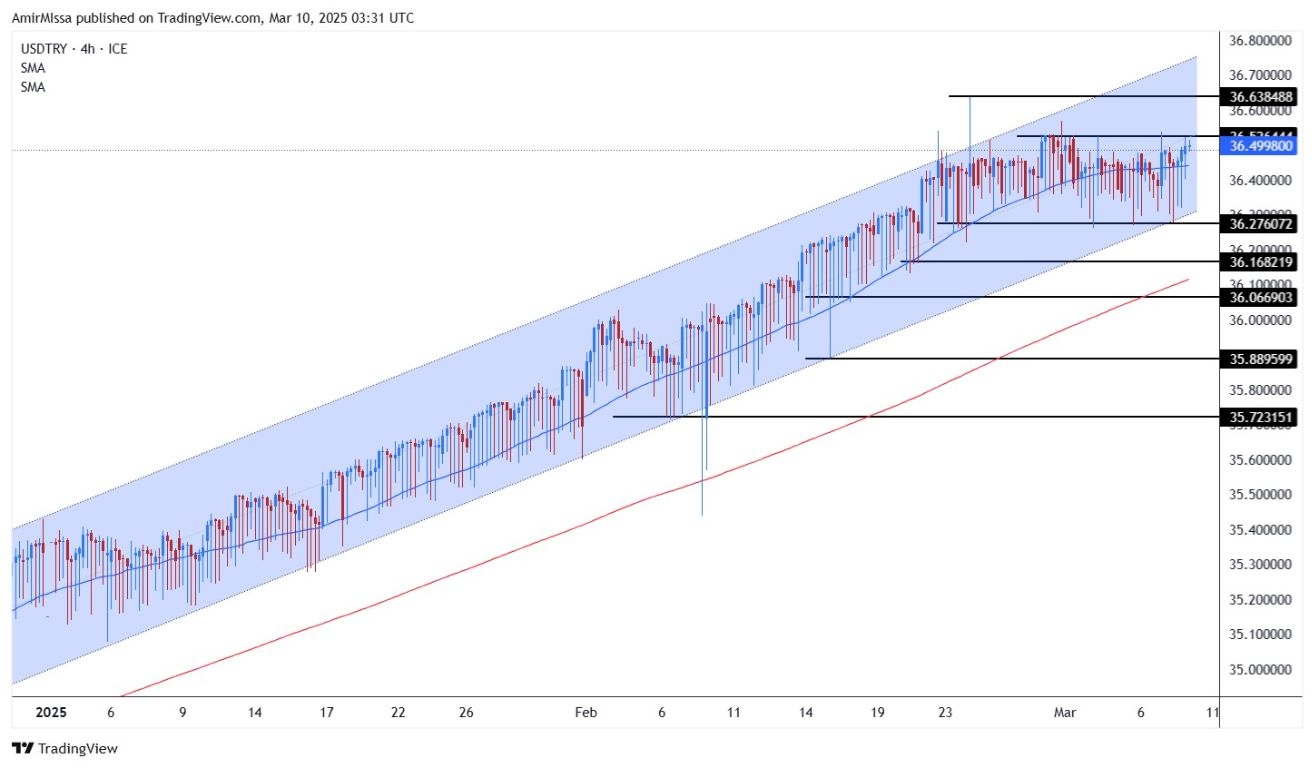

Bullish Entry Points:

- Open a buy order at 36.35.

- Set a stop-loss order below 36.15.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 36.77.

Bearish Entry Points:

- Place a sell order for 36.75.

- Set a stop-loss order at or above 36.90.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 36.30.

Turkish lira Analysis:

The USD/TRY pair maintained its stability at the beginning of this week’s trading, after trading within a limited range around 36.50 Lira last week. The Lira’s price was not negatively affected by the interest rate cut approved by the Turkish Central Bank last week, reflecting the strong control by the country’s monetary and financial authorities.

The Turkish Central Bank cut the interest rate by 250 basis points during its meeting last Thursday, for the third consecutive time, after similar reductions in December and January. The interest rate was reduced from 50% in November to 42.5%. The Turkish Central Bank’s monetary policy stimulus continues in conjunction with the slowdown in inflation to levels below 40% last January, for the first time in more than two years, with inflation reaching 39.05%.

The Turkish President praised the Turkish Central Bank’s decision to cut interest rates, stressing that it is a decision in the right direction. The Turkish President is known for his strong opposition to high interest rates, which supported interest rate cuts over previous years before the 2023 elections. At the same time, the President announced a decision to raise the credit limit allocated to traders and craftsmen, emphasizing the vital role this sector plays in supporting the economy. The Turkish President stressed that this category represents one of the most prominent pillars of the Turkish economy, indicating that this step comes within the framework of government efforts to enhance economic stability and provide the necessary support for productive sectors. The Turkish President’s decision comes at a time when concerns are growing about the decline in interest rates and the increase in credit on inflation rates.

In other news, data issued by the World Gold Council revealed that the country’s gold reserves recorded about 615 tons, which represents about 35.7% of the bank’s total reserves, making it the tenth globally in gold reserves.

TRYUSD Technical Analysis and Expectations Today:

Technically, the USD/TRY pair’s trading did not witness changes at the beginning of weekly trading. The pair stabilized in trading around the 50-moving average on the four-hour time frame. At the same time, the price continued to trade within an ascending price channel, which reflects the overall upward trend. Despite the current relative stability, Turkish Lira price forecasts indicate that the dollar will continue to rise with every decline in the pair, targeting 36.75 Lira and 36.99 Lira, respectively.

Ready to trade our Forex daily analysis and predictions? Here are the best Turkish brokers to choose from