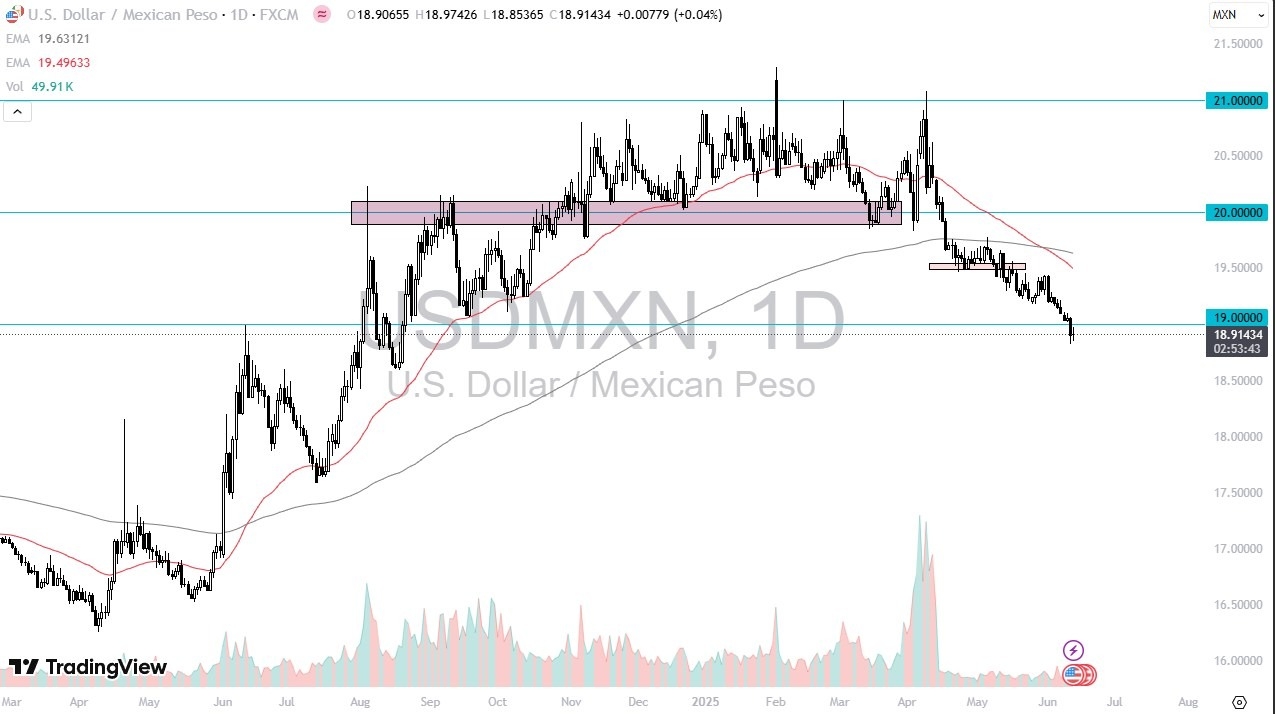

- You can see that the US dollar has gone back and forth against the peso during the session here on Thursday as we’re just sitting right here just below the crucial 19 Mexican peso level.

- Ultimately, I think this is a market that you’ll be watching very closely due to the interest rate differential, which does favor Mexico, not the United States.

- It’s one of the few places where the carry trade actually works in reverse.

That being said, if we were to break above the 19 peso level, then you’re probably looking at 19.25 as your next potential target. If we break down from here, then I’d be looking towards the 18.6 Mexican peso region as your potential target for shorts. This is the most likely of scenarios eventually, and this is what I am looking towards later.

US Economy is Vital for Mexico

All things being equal, as goes to the US economy, so goes Mexico’s economy. So, the US economy doing fairly well helps Mexico and it strengthens the peso because Americans buy more Mexican goods. However, we’ve also seen inflation cool a little bit in the United States, both CPI and PPI. And that does seem to have an effect on the greenback overall. So, keep that in the back of your mind.

That’s part of the reason why the greenback is failing with this. I do believe it’s probably only a matter of time before we see, um, some type of bounce, that bounce with any signs of exhaustion at that point in time should be selling opportunities. I don’t have any interest in buying, at least not until we break back above the 200-day EMA where the 19.60 level sits. This is an area that I think will continue to be important and should continue to be so.

Ready to trade our Forex daily analysis and predictions? Here are the best forex brokers in Mexico to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.