Global stock markets are looking weak as markets focus on today’s official imposition of US tariffs, sending most indices lower.

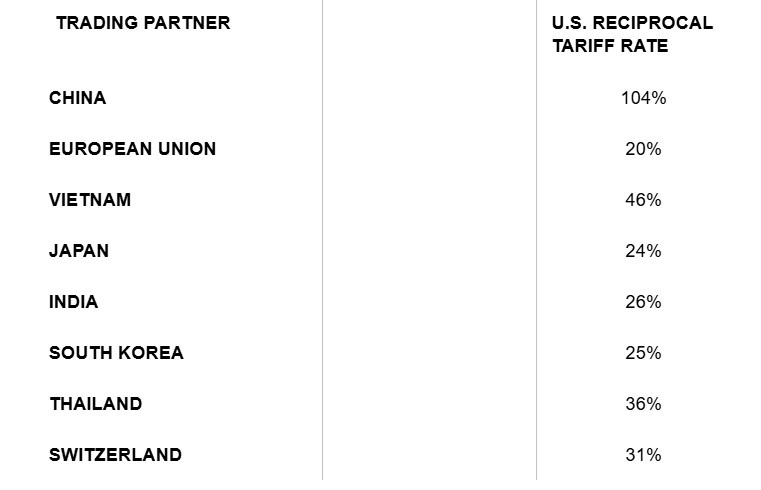

Following yesterday’s partial recovery, global stock markets are mostly falling again, as today sees the official start of the application of the high new US tariffs announced by President Trump one week ago. These are the tariffs that have been imposed on key US trading partners:

- Although some negotiations are going on behind the scenes, President Trump’s rhetoric remains very tough. US equity index futures are trading firmly lower, with the S&P 500 Index, the NASDAQ 100 Index, and the Dow Jones Industrial Average all close to retesting 1-year+ lows which were printed on Monday. Markets are very bearish, and the mood is extremely risk-off. Asian and European markets are also lower, with the Japanese Nikkei 225 Index standing out as it looks like closing more than 4% lower.

- Commodities are almost all falling sharply, with WTI Crude Oil standing out as it falls to a new 4-year low price below $57.50 per barrel. As well as energies, soft commodities and industrial metals are all firmly lower.

- Interestingly, US Treasury Yields, which typically fall in a crisis bear market such as this, are holding their recent rebound gains. This is probably because the effect of the tariffs, if they are not negotiated lower, will be to stoke US inflation, so the Fed will probably feel like it cannot cut rates. However, the CME FedWatch tool shows markets are expecting 4 rate cuts over 2025 totaling 1%.

- Bitcoin is looking weak near $75,000 and is behaving like other risky assets.

- Gold is gaining again, but is still well off its recent high.

- Market players will be putting primary importance on trying to accurately forecast how tariff negotiations will play out. We can expect market volatility, rumours, and occasional dramatic announcements over the weeks ahead. Beginner and less sophisticated traders will likely do best following the price and trading relatively small position sizes, always using hard stop losses.

- In the Forex market, price movements are less dramatic, but there continues to be plenty of activity in the market, with the strongest major currency since today’s Tokyo open the Euro, while the US Dollar is the weakest major currency, putting the EUR/USD currency pair in focus.

- The Reserve Bank of New Zealand cut its Official Cash Rate as expected from 3.75% to 3.50% earlier and indicated that it is on a path to further rate cuts. The New Zealand Dollar is relatively weak.