Goldman Sachs (GS) reports on the heels of JP Morgan’s (JPM) solid results that saw its shares rally by 12.3% and recapture its 200-day moving average.

Watch the trading revenue numbers as added volatility should help their bottom line exceed expectations. The implied one day move for earnings day is +/- 7.7% and if the market is moving that morning then expect a possible bigger move.

Technically, shares have been put through the ringer. Price has broken many key trendlines and support levels along the way. Maybe, just maybe, we have found a floor.

Like most stocks in this current environment, the swings have been wild. Lines in the sand have been drawn and maybe GS can follow JPM’s lead as the charts are quite similar.

Things have been extremely volatile; the range between support and resistance is wide. The $440/$450 area looks to be a strong area of support for now. However, the trend has changed and there has been much technical damage done. There are levels of resistance above, but it seems more likely that they may get tested faster to the upside than any retest of the lows.

On a rally watch the $520 level from which it broke down after breaching its 200-day moving average. If shares eclipse that, it is likely we will experience a run back to that $540 area at its 200-day. That would also take shares back to its new downtrend line and should be met with much selling pressure.

Johnson & Johnson (JNJ) has experienced some of the wildest swings since making a new high back in early March. Shares have fallen over 16% and look to get back to its winning ways when they report on Tuesday.

Year-to-date, shares are up 5% and in one of the strongest sectors for those playing defense. Like all companies reporting, focus will be on management’s commentary on future earnings guidance and potential impacts from global economic conditions.

Technically, shares are in a bit of a no-man’s land. Price action has been streaky and now they report in the middle of this recent wide range.

The bear case to be made is that shares have yet to reach oversold levels and major support so more of a downside could be reached before jumping into the stock.

The bull case at worst is a reversion back to the 200-day moving average just above current levels. The best case is that it has little tariff exposure and remains a safer haven in tough times and may run back towards old highs.

Overall, outside a safe 3.3% dividend, the case to jump in for a trade is tough to make given recent price action.

Technically, shares are in a bit of a no-man’s land. Price action has been streaky and now they report in the middle of this recent wide range.

The bear case to be made is that shares have yet to reach oversold levels and major support so more of a downside could be reached before jumping into the stock.

The bull case at worst is a reversion back to the 200-day moving average just above current levels. The best case is that it has little tariff exposure and remains a safer haven in tough times and may run back towards old highs.

Overall, outside a safe 3.3% dividend, the case to jump in for a trade is tough to make given recent price action.

Technically, there are several more positives than negatives.

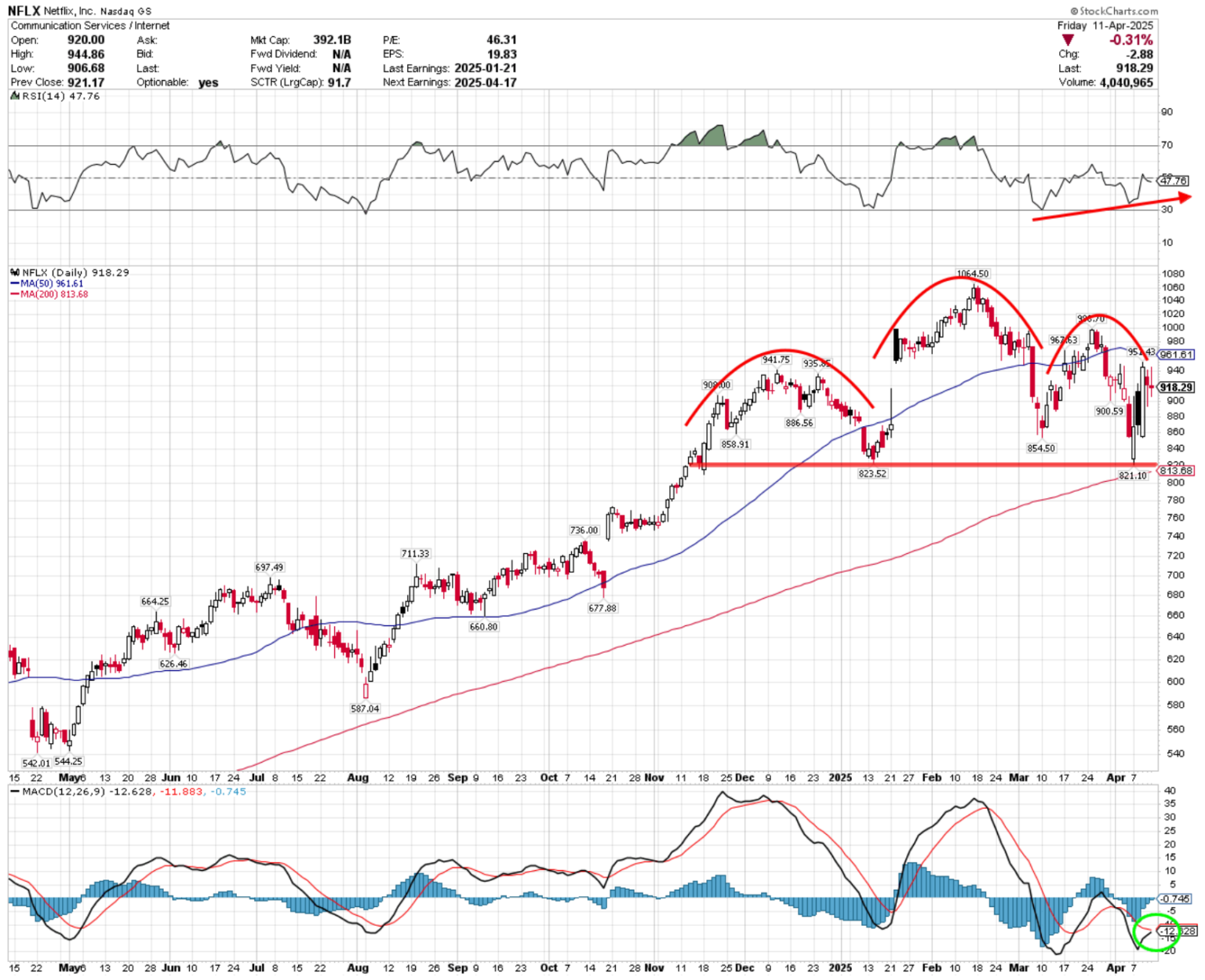

Shares had formed a head-and-shoulders top but failed to break its neckline at the $820 level and bounced. That was one positive development, but the pattern still hangs over the stock for now.

Secondly, we see a bullish divergence in its RSI when comparing that to recent price action. As price made new lows the RSI did not. That tells us something has changed and this recent sell-off was not as strong as its predecessor and that a reversal may be coming.

Lastly, we may be experiencing a bullish crossover in its MACD. We have seen this lead to a rally in price more often than not and could be telling us that we are about to see an upward move. Let’s see if we get price action to confirm this during the week.

We have a history of gaps after earnings so watch that gap and price action immediately afterwards. If we experience a gap higher and above the 50-day moving average, one can use that as a stop to manage risk. To the downside, watch to see if the $820 level holds. If it doesn’t it could lead to an accelerated move to the downside.