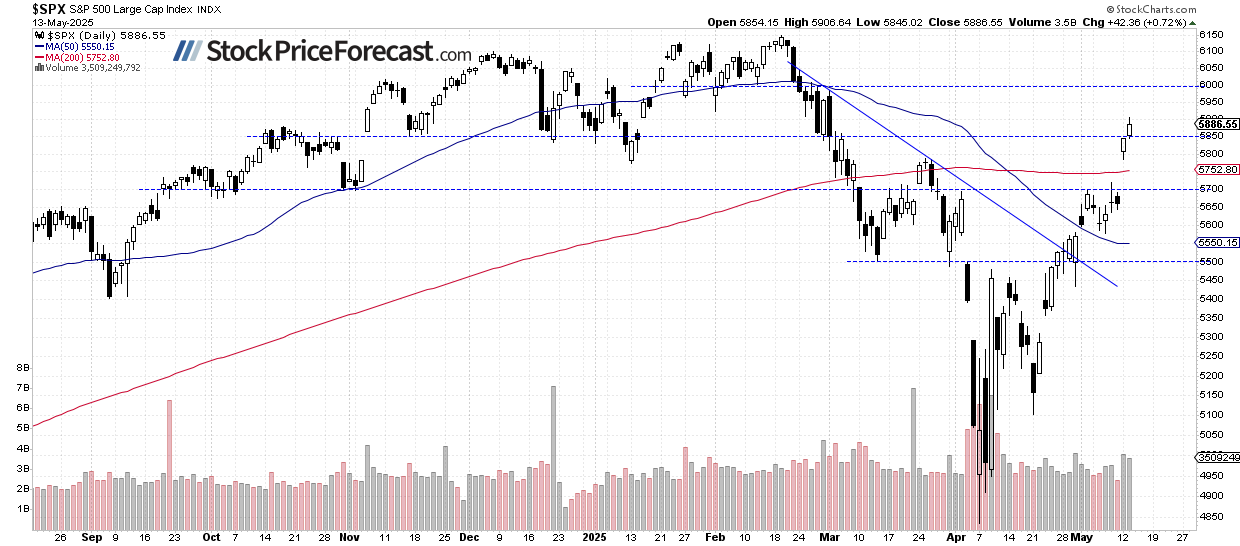

The S&P 500 extended its uptrend on Tuesday, but is the market becoming too overbought?

The S&P 500 gained 0.72% on Tuesday, extending its short-term uptrend following the U.S.-China trade deal announced over the weekend and U.S.-Saudi Arabia AI investment plans. The index breached the 5,900 level, reaching its highest since March 3.

While the market is becoming increasingly overbought, there are currently no negative signals. The S&P 500 is expected to open 0.1% higher today, and I think a period of consolidation is likely following the recent gains.

Investor sentiment has recently improved, as reflected in last Wednesday’s AAII Investor Sentiment Survey, which reported that 29.4% of individual investors are bullish, while 51.5% are bearish.

The S&P 500 index is set to open near the 5,900 level, likely pausing its rally. Key resistance remains at the 5,900-6,000 level.

Nasdaq 100: Tech leadership continues

The tech-heavy Nasdaq continues to outperform, with the index jumping 1.6% on Tuesday. Tech stocks remain in the spotlight, particularly with Nvidia posting strong gains after announcing the sale of 18,000 AI chips to Saudi Arabian company Humain for its data center.

Cisco Systems earnings will be highlighted today, with analysts watching closely to see how the technology equipment firm views the impact from U.S. duties on its finances.

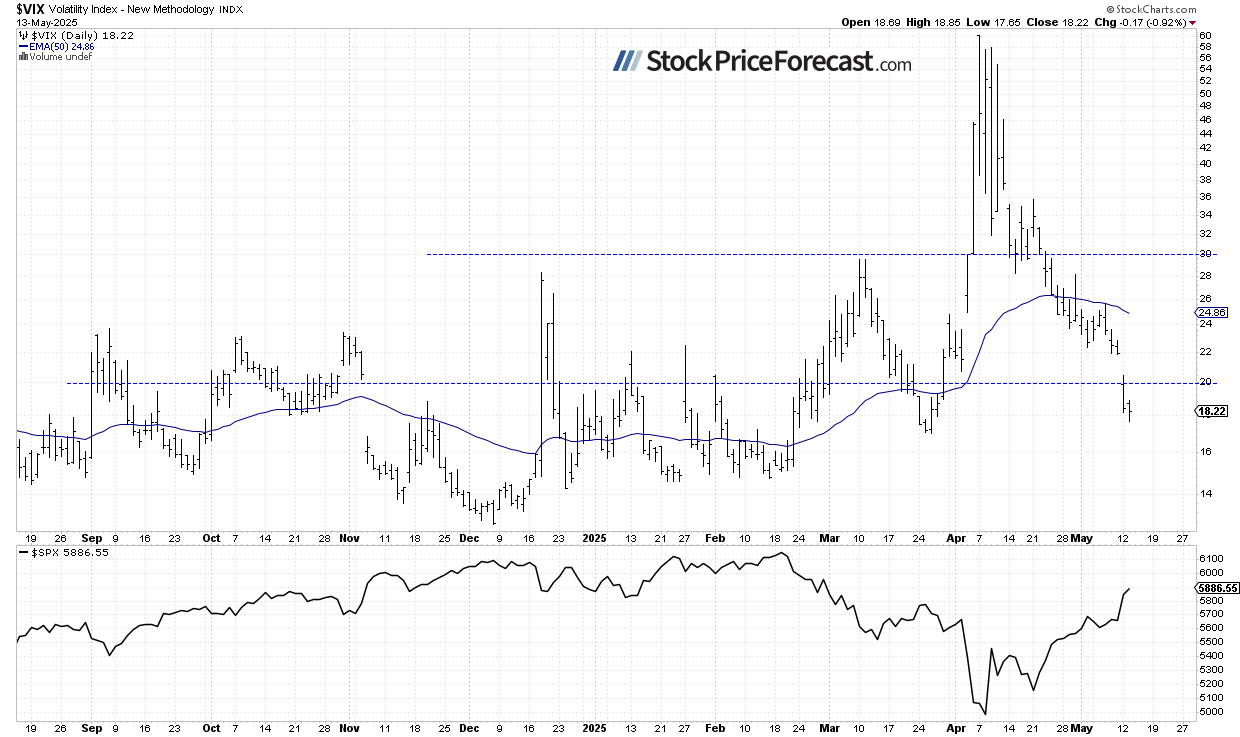

VIX showing investor confidence

The volatility index continues to trend lower as stock prices extend their gains. It dipped to a local low of 17.65 yesterday.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

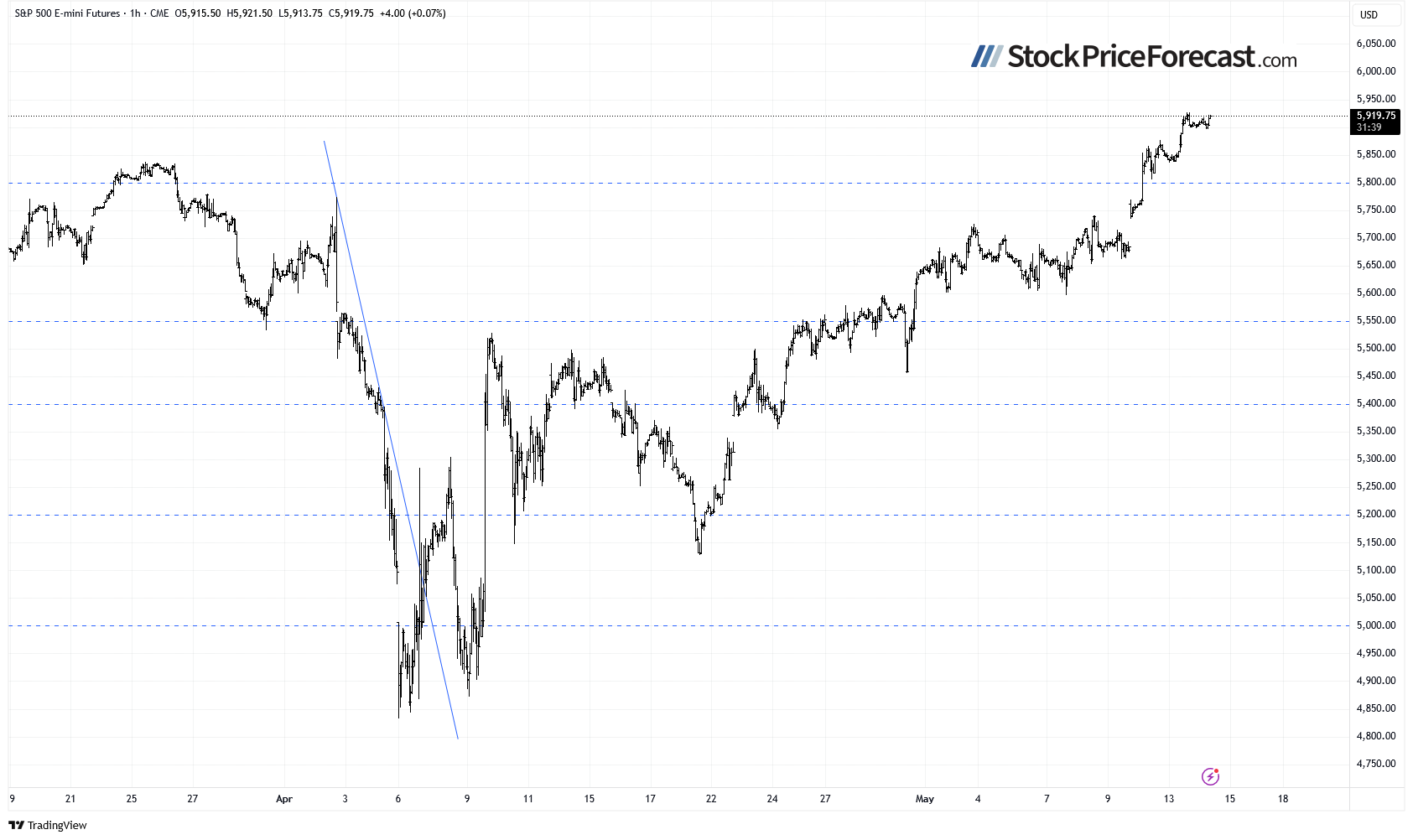

S&P 500 futures contract: Above 5,900

This morning, the S&P 500 futures contract is trading above the 5,900 level, moving sideways after gaining significantly since the beginning of the week.

On Monday, I noted “This technical breakout, fueled by the weekend’s trade agreement, opens the door to potential moves toward 5,900-6,000.” This proved correct.

However, some profit-taking could follow the initial surge. Support is currently near 5,850, marked by recent consolidation.

Conclusion

The S&P 500 is set to open near the 5,900 level, and I think the likely scenario is a short-term consolidation following recent rally. Today’s economic calendar is relatively light, but several Fed officials are set to speak. Investors will follow their comments as they attempt to gauge the future path of interest rates this year, especially after monthly inflation figures were lower than expected on Tuesday.

Here’s the breakdown

- S&P 500 reached the highest since March 3, breaching the 5,900 level and extending gains for those who bought based on my Volatility Breakout System.

- The market is getting more overbought, but no negative signals are evident yet.

- Today, the S&P 500 is expected to open 0.1% higher, with consolidation the most likely scenario.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!