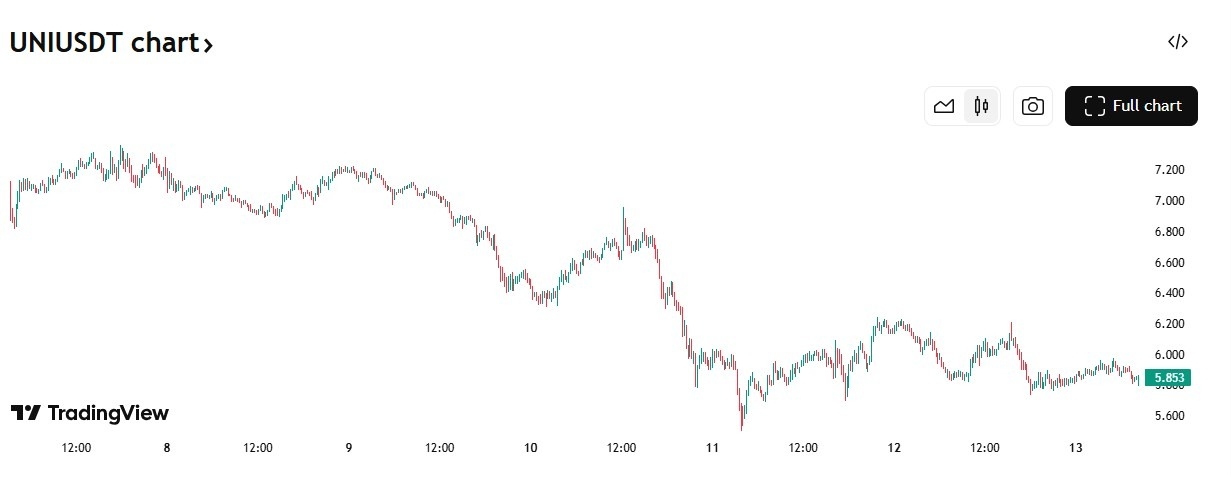

Uniswap (UNI) is facing increasing bearish pressure after a steep decline that pushed the price below key support levels. With UNI now trading around $5.5, down 22% in 7 days, traders are closely watching for a possible technical rebound.

UNI Flashes Bearish Signals on the Charts

Uniswap’s recent price action has been discouraging for bulls. The token has plunged over 35% in the past month, struggling to reclaim key moving averages.

From a technical standpoint, Uniswap displays a downtrend pattern, with lower highs and lower lows. The Relative Strength Index (RSI) is hovering near the oversold region at 30, which could indicate a potential relief bounce.

From a technical standpoint, Uniswap displays a downtrend pattern, with lower highs and lower lows. The Relative Strength Index (RSI) is hovering near the oversold region at 30, which could indicate a potential relief bounce.

However, the Moving Average Convergence Divergence (MACD) remains deeply negative, showing no clear signs of bullish momentum.

Adding to these concerns, UNI has failed to hold above its 50-day moving average (currently near $9.37) and is now significantly below both its 20-day and 200-day moving averages. This confirms the bearish bias, with resistance levels forming in the $6.50 and $7.00 regions.

Increased Selling Pressure and Whale Activity

Recent on-chain data reveals a troubling sign for Uniswap bulls as large investors move their holdings into exchanges.

Sentiment data showed UNI’s Exchange Flow Balance flipping positive by over 2.23 million tokens in one day (after being negative just prior). In other words, a large net amount of UNI was deposited to exchange wallets, presumably to be sold.

Correspondingly, the supply of UNI on exchanges jumped by about 2.67% in that short span, a bearish development indicating more tokens available on exchanges.

A recent surge in UNI inflows to centralized exchanges suggests rising sell-side pressure. Notably, a single whale transferred 2.25 million UNI (worth ~$13.7M) to Kraken, a move typically associated with liquidation.

Meanwhile, Uniswap’s active address count has steadily declined, which reflects waning user engagement with the protocol. Historically, dips in network activity have correlated with price declines, adding to the bearish sentiment.

Support and Resistance Levels to Watch

Uniswap’s current price action indicates it is testing a critical support zone around $5.74. If this level fails to hold, the next significant support at $5.57 should be watched, followed by the stronger support at $5.36.

On the upside, immediate resistance is observed at $6.30. A successful breach of this level could shift short-term sentiment to bullish sentiment, potentially targeting the next resistance at $7.30.

However, until UNI reclaims its 20-day moving average, currently near $9.24, any upward movement might be viewed as a temporary relief rally within a broader bearish trend.

Ready to trade our Uniswap analysis? Here’s our list of the best MT4 crypto brokers worth checking out.