The Japanese Yen attracts safe-haven flows amid trade uncertainties and rising geopolitical tensions. The divergent BoJ-Fed policy expectations undermine the USD/JPY pair amid a broadly…

USD/INR falls below 85.50 at open, while the US Dollar steadies after the US and China reach a framework on a trade deal. The US…

I wrote on 1st June that the best trades for the week would be: Long of Bitcoin following a daily (New York) close above $111,743.…

Speculators last week in WTI Crude Oil got rather solid price range from Monday until mid-Friday. A price realm between 61.600 and 63.300 dominated most…

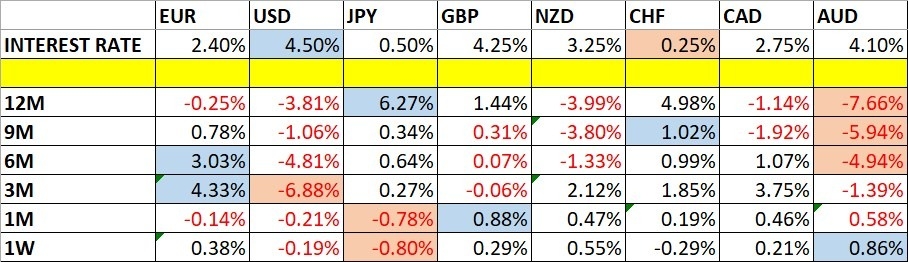

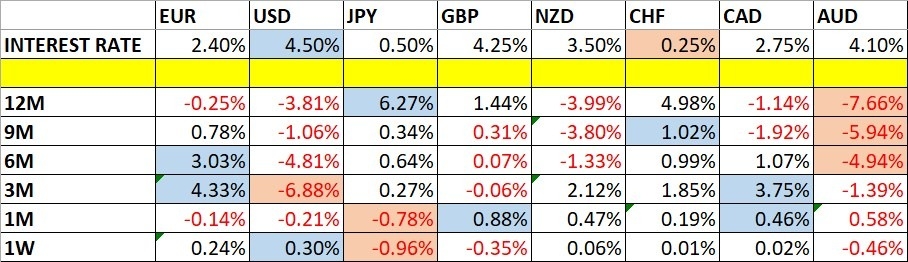

As expected this past Thursday the ECB lowered its Main Refinancing Rate by another 25 basis points to an interest rate of 2.25%. The European…

Gold markets initially rallied during the week, but we have given back quite a bit of the gains. We are currently in the middle of…

USD/JPY climbs 0.87% to 144.83, nearing breakout above the Ichimoku Cloud. Strong US jobs report and higher Treasury yields fuel Greenback’s rally. Bulls eye 146.00…

XAU/USD falls after strong NFP data cuts rate cut hopes, but holds weekly gain above 1.30%. US adds 139K jobs in May; Unemployment Rate steady…

Initial Jobless Claims in the US rose by 8,000 in the week ending May 31. The US Dollar Index declines toward 98.50 after the data.…

I wrote on 25th May that the best trades for the week would be: Long of Bitcoin following a daily (New York) close above $111,743.…