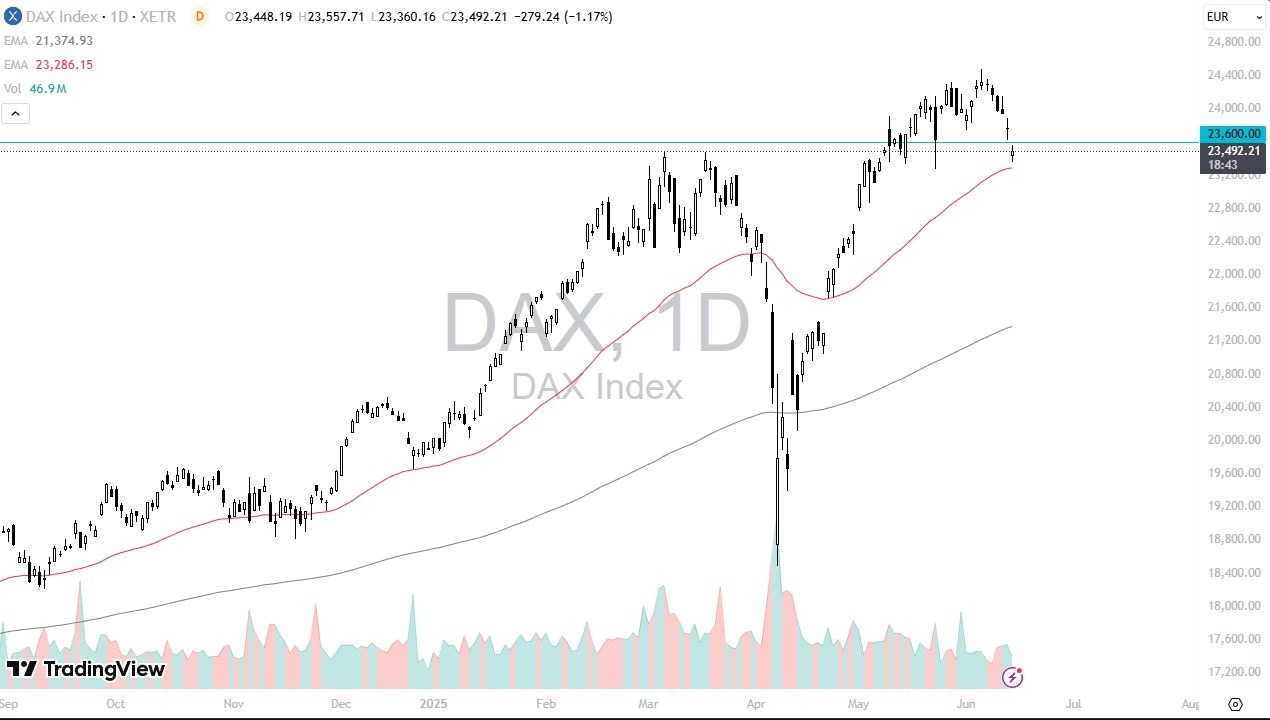

- During the trading session on Friday, we’ve seen the DAX in Germany gapped lower, which makes sense considering that the entire world is on edge after the Israeli airstrikes on the Iranians.

- That being said, we are looking at a market that’s been very strong for some time, and we are getting close to the bottom of the overall consolidation area that looks like it’s trying to form after what has been such a massive move to the upside.

Furthermore, we are right around the 50 Day EMA, and it’s probably worth noting that the Americans are trying to turn things around, so it’s very possible, at least as things stand right now, we could very well see the DAX rally quite nicely on Monday. That being said, we had a long weekend as traders worried about whether or not the military actions in the Middle East will expand and perhaps kick off something a bit more major in terms of dangerous action.

Technical Analysis

The 50 Day EMA is very crucial, right along with the €23,000 level. Because of this, I think that we would probably have buyers jumping into this market and trying to get to the €24,000 level, which is an area that’s basically in the middle of the overall consolidation that I see. Anything above could open up a fresh attempt at the all-time high level, opening up the possibility of a move to the €25,000 level, which I do think is the ultimate target given enough time. I would anticipate a lot of volatility, but this is a market that is still very bullish overall.

Ready to trade daily forex analysis? Here are the best CFD brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.