There is an air of capitulation in financial markets ahead of the April 2nd reciprocal tariff announcement from the US. Global stocks are all in the red, the Eurostoxx 50 index is down by 1.7%, and all sectors are in the red. The biggest decline is for industrial stocks and consumer discretionary, followed by the financial sector. Reciprocal tariff fears are infecting the whole stock market, even defensive sectors like energy and utilities are lower at the start of the week, which is a sign that investors are cutting their positions sharply and choosing to pause ahead of this week’s tariff announcements.

US stocks have also plunged at the open on Monday and the S&P 500 is now in correction territory, dipping 10% from its peak in mid- February. Tarif fears have deepened over the weekend, there has been no let up from President Trump who said that no country would be able to avoid his reciprocal tariffs. This dashed any hopes for a last-minute reprieve. There is no where to hide in the stock market, as equities get caught up in the tariff headwinds, which is not helped by the fact that it is the last trading day of Q1.

Is Gold telling us that stocks have gone too far?

It is worth noting that as the US trading session gets under way, the gold price is giving back some earlier gains. Although gold remains above $3,100 per ounce, it is giving back earlier gains. This could be a sign that the sell off is overdone. We will be watching to see if this is a sign that risk sentiment is recovering now that the S&P 500 has reached correction territory.

A secular shift away from US equities

Although today’s sell off appears to be indiscriminate, there could be some divergences in stock market performance in the coming weeks. The CFTC positioning data last week was enlightening about investor trends. There were further declines in the net long positions in the S&P 500 and the Nasdaq last week, as investors further cut their exposure to the US. President Trump may be labeling April 2nd as liberation day; however, a protectionist US could find itself increasingly isolated on the world stage with few friends. This existential threat is causing investors to trim their exposures to the US. The $5 trillion that has been wiped off of the S&P 500 so far this year, could be a sign of a secular shift away from the US that may seep into Q2. This means that US stocks may continue to underperform European indices as we move through the year.

The case for continued European outperformance

For now, the selloff in European stocks has spared no one. German arms manufacturer Rheinmetall is one of the weakest performers on the Dax so far on Monday. There is no fundamental reason for Rheinmetall to sell off, as it is less exposed to US tariffs compared to other German companies. However, the fact that it has also joined in with the sell off suggests that the move in markets on Monday is partly down to stock traders reducing their exposure to risk ahead of Q2. It could also be a sign of panic in the markets, whereby stocks are being sold indiscriminately. We think that this is only a mild panic. We would look for a relief bounce if tariffs announced on Wednesday are not as bad as feared. However, because reciprocal tariffs are a big ‘known unknown’ risk for financial markets, we do not expect any recovery rally in risk assets until it is clear what the reciprocal tariffs are, and what products and countries will be impacted.

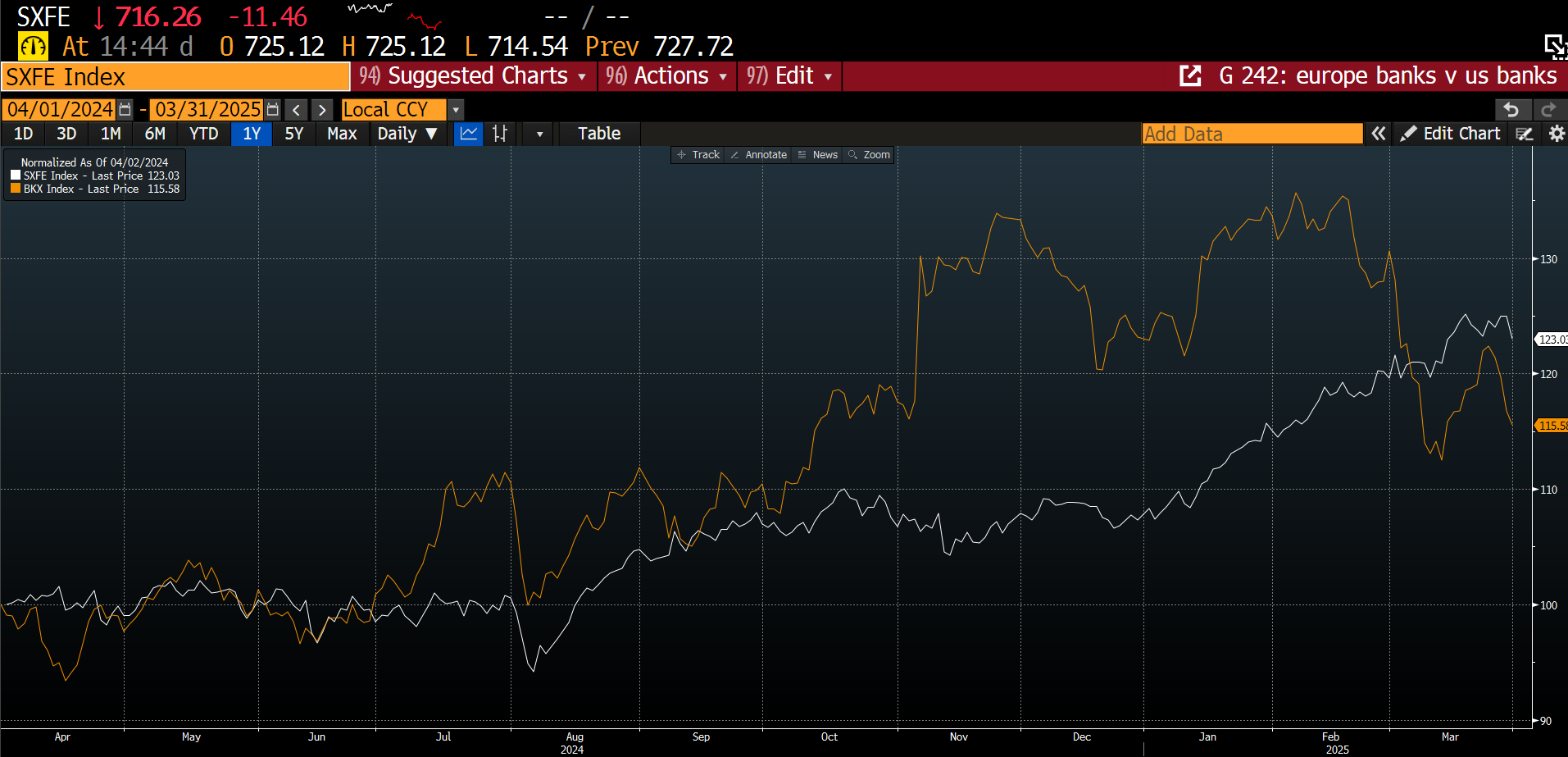

European banks and finance stocks are taking a knock on Monday, however, this sector still rallied to a record high this year and has outperformed the US banking index for the first time in 12m months, as you can see below. This could be a sign that key European sectors will continue to outperform their US peers for the medium term.

Chart 1: Eurostoxx finance index and the KBW US banks index, normalised to show how they move together over the past 12 months.

Source: XTB and Bloomberg

The tech sector

The sell off in US stocks has been led by the tech sector. Netflix, Tesla, Meta and CrowdStrike are some of the weakest performers on the S&P 500 so far on Monday. Nvidia is down 5%, as it is exposed to tariffs on chip exports, particularly any tariffs that are applied to Taiwan, where TSMC, the manufacturer of Nvidia’s chips is based. Although TSMC has pledged hundreds of billions of investments into the US, at this stage it is not clear that is enough to get a tariff exemption from President Trump. If TSMC is excluded from tariffs later this week, then we could see a sharp reversal in Nvidia’s share price. For now, the tech sector is coming under intense pressure and is the second weakest sector on the S&P 500 at the start of the week. Although the US stock market sell off has lost some momentum as we move through Monday, without the tech sector, it is hard to see the S&P 500 bounce even after the sharp sell off in recent weeks.