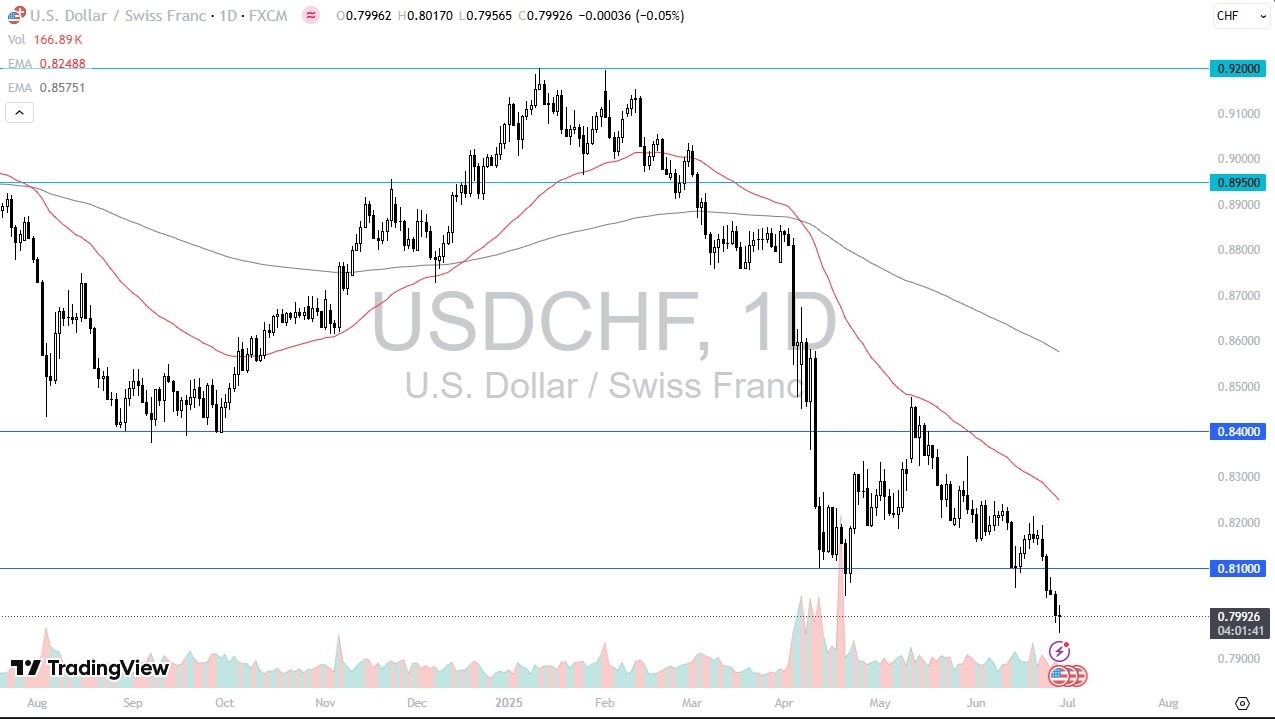

- The US dollar has fallen pretty significantly during the early hours on Friday, but it does look like it’s catching a bit just around the 0.80 level.

- 0.80, of course, will have a certain amount of psychology attached to it.

- So, I find that interesting that traders weren’t really going to push it much lower than that, at least in the short term.

When you zoom out, you can see just how low we are, especially when you look at the monthly charts. We are near a major swing low back in 2011. So, the question then becomes, are we setting up for a decade long buying opportunity. don’t know, but I do recognize that we are in extraordinarily low levels and the Swiss National Bank will get involved sooner or later.

Watching Closely Here

So, while I’m not necessarily willing to throw a bunch of money into this market, I think that if we break above the 0.81 level, you have to start to think about the possibility of going higher. I also recognize that this is a market that if we get more risk on, it may actually benefit the dollar as this is one of those backward type of markets where the dollar is actually considered to be riskier of the two. And we are seeing equities really break out.

So, it’ll be interesting to see how this plays out because the Federal Reserve is expected to cut rates by a 95% odds in September. So, I think a lot of traders are getting a little ahead of themselves because even if the Fed were to cut a couple of different times, the interest rate differential still favors owning the dollar over the Swiss franc. The Swiss National Bank is the perennial funding currency type of central bank with extraordinarily low interest rates, and I just don’t see that behavior changing. Now, you should keep in mind that you really need to look at how the euro trades against the Swiss franc to get an idea as to how quickly the Swiss National Bank might get involved because most of their exports head into Europe. They’re not as concerned about the franc against the dollar, but if it gets out of hand, they may step in as well.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.