- The DXY climbs above 107.00 amid geopolitical tensions.

- Russia sees no reason for a Trump-Putin meeting as demands remain unresolved.

- Empire State Manufacturing Index surprises with a return to positive territory.

The US Dollar Index (DXY), which tracks the US Dollar’s (USD) performance against six major currencies, rises on Tuesday as traders react to discouraging headlines from the United States (US)-Russia talks in Riyadh. Despite efforts to negotiate a ceasefire or peace deal for Ukraine, Russia has dismissed the need for a Trump-Putin meeting this month, citing ongoing demands. At the time of writing, the DXY hovers above 107.00, fueled by geopolitical uncertainties.

Daily digest market movers: US Dollar rises as Russia dismisses Trump-Putin meeting

- Geopolitical risks support the US Dollar as US-Russia talks in Riyadh show no progress.

- Russia states that a Trump-Putin meeting is unnecessary due to unresolved demands and the previous sparks of hope of a hypothetical ceasefire seem to be fading away.

- On the Ukrainian side, President Volodymyr Zelensky commented that “fair” negotiations to end the war with Russia must involve Ukraine and Europe, also contributing to a negative market environment.

- On the data front, the New York Empire State Manufacturing Index for February jumped to positive territory after months of contraction but had little impact on the USD.

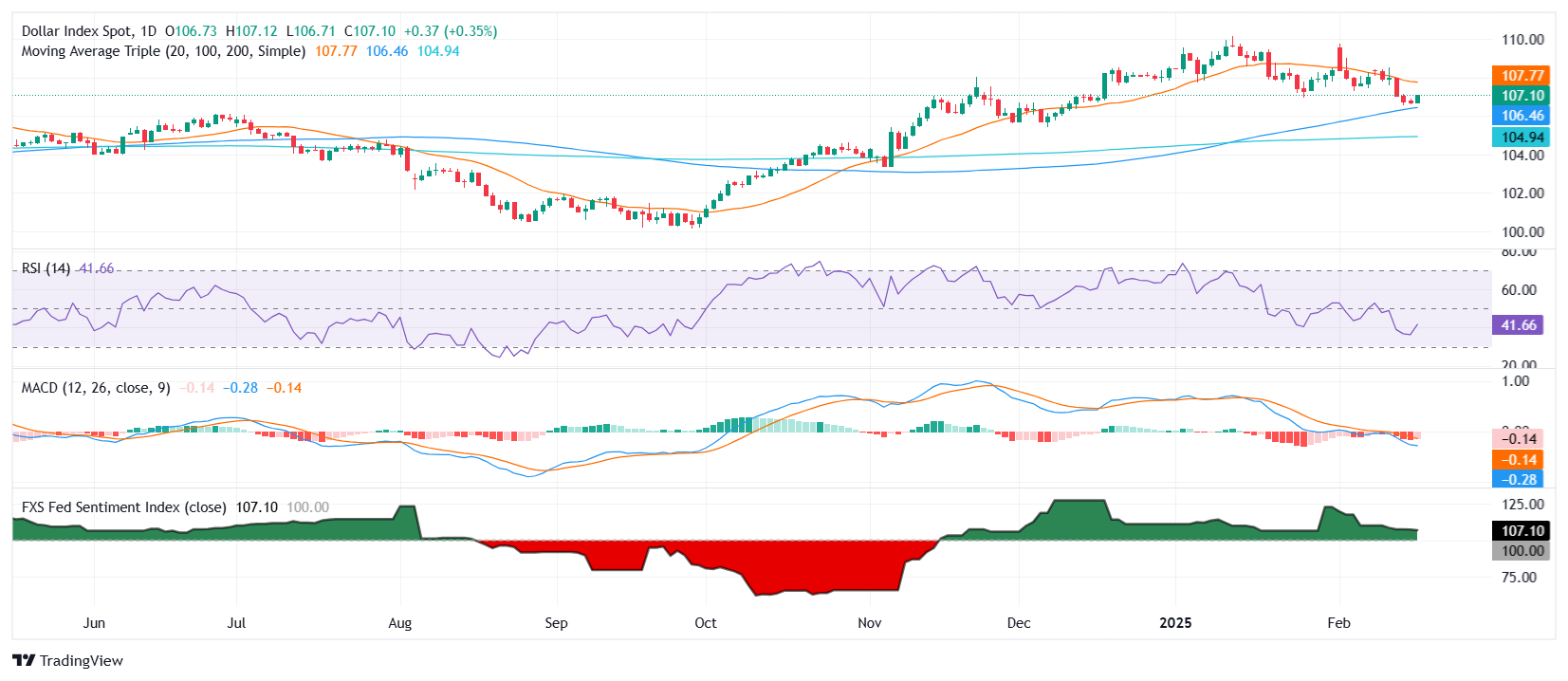

- Federal Reserve officials continue to assess the impact of holding interest rates steady and maintain a cautious stance. In fact, the Fed’s sentiment index on the daily chart continues to be stuck in hawkish terrain.

DXY technical outlook: Key resistance at 107.50, but downside risks persist

The US Dollar Index struggles to sustain gains after reclaiming the 107.00 level. Despite this mild rebound, the 20-day Simple Moving Average (SMA) remains a key resistance after being lost last week. The Relative Strength Index (RSI) is entrenched in negative territory, while the Moving Average Convergence Divergence (MACD) signals steady bearish momentum. Immediate support is seen at the 100-day SMA at 106.30, and a break below this level could confirm a short-term bearish outlook. Bulls need stronger momentum to challenge 107.50.