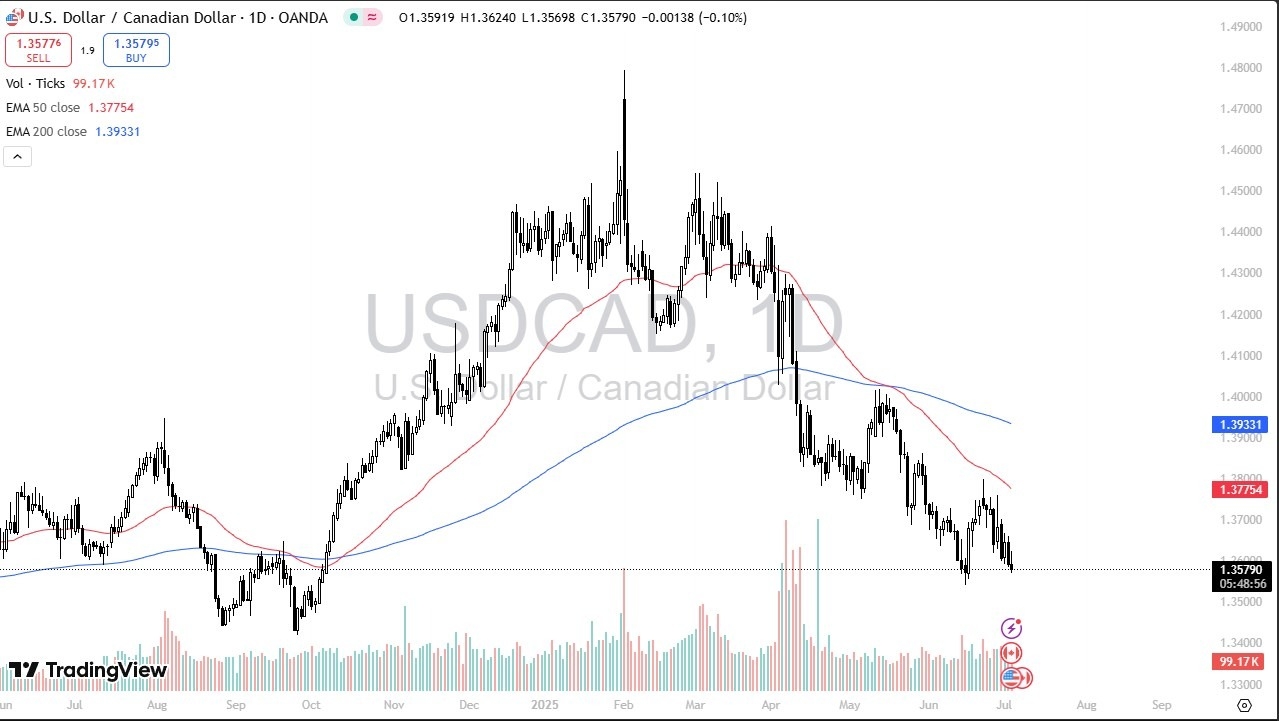

- The US dollar initially rallied a bit during the trading session here on Thursday but then fell pretty hard as we continue to see a lot of noisy and negative trading.

- That being said, this is a market that’s been in a negative trend for quite some time.

- I think we have to look at this as a market that anytime we rally, we should see some type of exhaustion that we can get involved with.

However, we are approaching the 1.35 level and that of course is an area that a lot of people will be paying close attention to. It is a large round psychologically significant figure and it’s right in the middle of the cluster that we had traded in for two excruciating years. This is a market that quite often does nothing and quite frankly, that’s more the common action in this market than anything else. We don’t get big moves very often. When we do they tend to be grinding like we’ve seen on the way up and on the way down. I think that continues to be the way going forward. And with this, we’ll be paying close attention to that area between 1.35 and 1.34.

The Interest Rate Differential

The interest rate differential does favor the US dollar at least for now, and people now are trying to sell the US dollar in hopes that the Federal Reserve is going to come out and cut. The problem, of course, is various Federal Reserve speakers aren’t willing to admit that yet. It wasn’t a big day in this pair and not a huge surprise considering that it is Independence Day on Friday.

That will have a major influence on liquidity, especially in this pair, because as a general it is mainly traded in the North American part of the world and with the Americans gone that obviously affects things. That being said though, it looks like a fade the rally type of situation.

Ready to trade our Forex USD/CAD predictions? Here are the best Canadian online brokers to start trading with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.