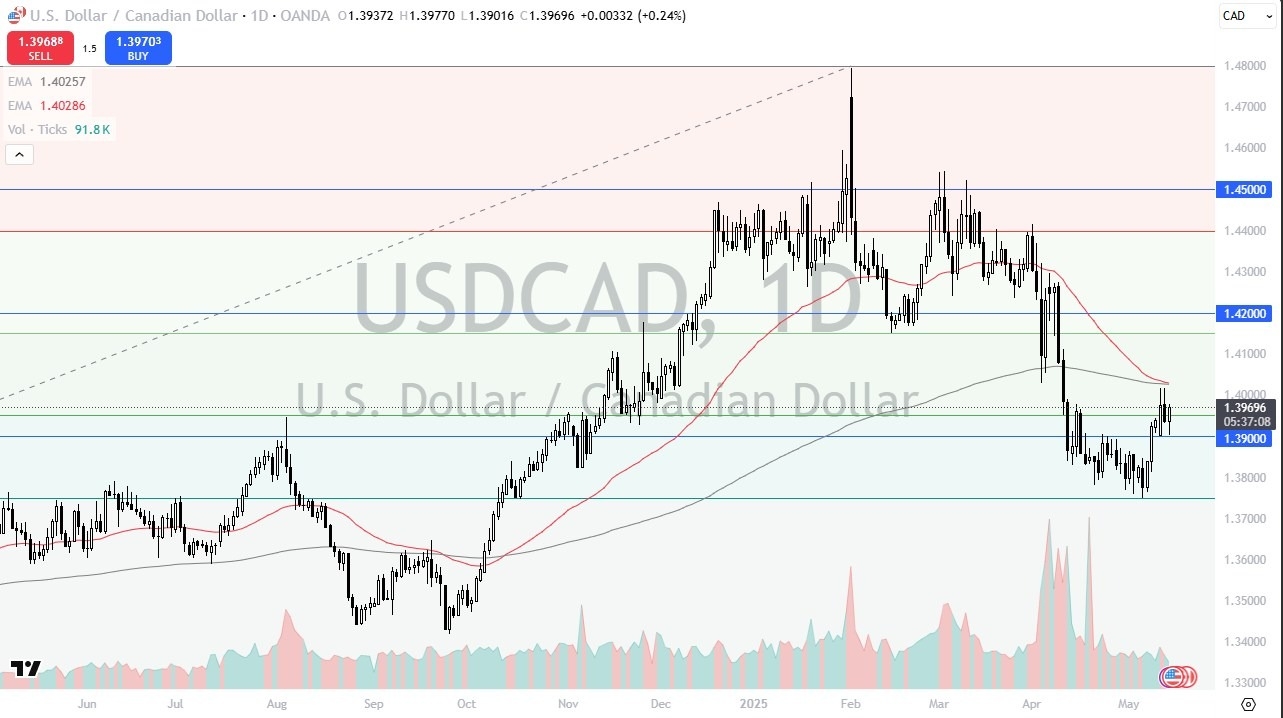

- The US dollar initially pulled back just a bit against the Canadian dollar during the trading session on Wednesday, testing the 1.39 level, but we have seen buyers come back in this area, which has a certain amount of market memory attached to it.

- So, a bounce from here makes quite a bit of sense.

- Ultimately, if we can rally from here, pay close attention to the 1.4010 area where the moving averages are the 50 day EMA and the 200 day EMA, but also the high of both Monday and Tuesday.

Breaking above that should open up more buying pressure to the upside. On the downside, the 1.39 level should remain important, but if we were to break down below there, the 1.3750 level is the next major support level that I see on the charts.

US/Canada Talks?

The situation in the trade talks between the United States and Canada are essentially null and void. And as long as that’s the case, I would be a bit cautious about pumping a bunch of money into the Canadian economy. As a trader, the US dollar has been oversold for several weeks. So, it does make sense that we would correct a bit here as well.

You see the US dollar do fairly well against the multitude of currencies at the moment. And as long as that’s going to be the case, it makes sense that the Canadian dollar will not be a beneficiary of anything until we get a trade deal in North America. Furthermore, keep in mind that although the Canadian dollar is highly levered to the oil market, it is not levered to the oil market against the U.S. dollar as the U.S. is basically energy independent at this point in time. So, I’m looking for a bounce. I’ll be watching these moving averages. If we can get above there, then I’ll be targeting the 1.42 level.

Ready to trade our Forex USD/CAD predictions? Here are the best Canadian online brokers to start trading with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.