- It’s been a wild session during the trading session here on Wednesday as we tested the 1.3750 level, then turned around and sold off.

- If you want to know what the reason is, it’s the same reason that we see from time to time, a news report of something that President Trump said.

- On Wednesday, it was a suggestion, and then perhaps he would fire Jerome Powell. He walked back a little bit. This was a New York Times piece. They hit the wires and of course it just caused chaos.

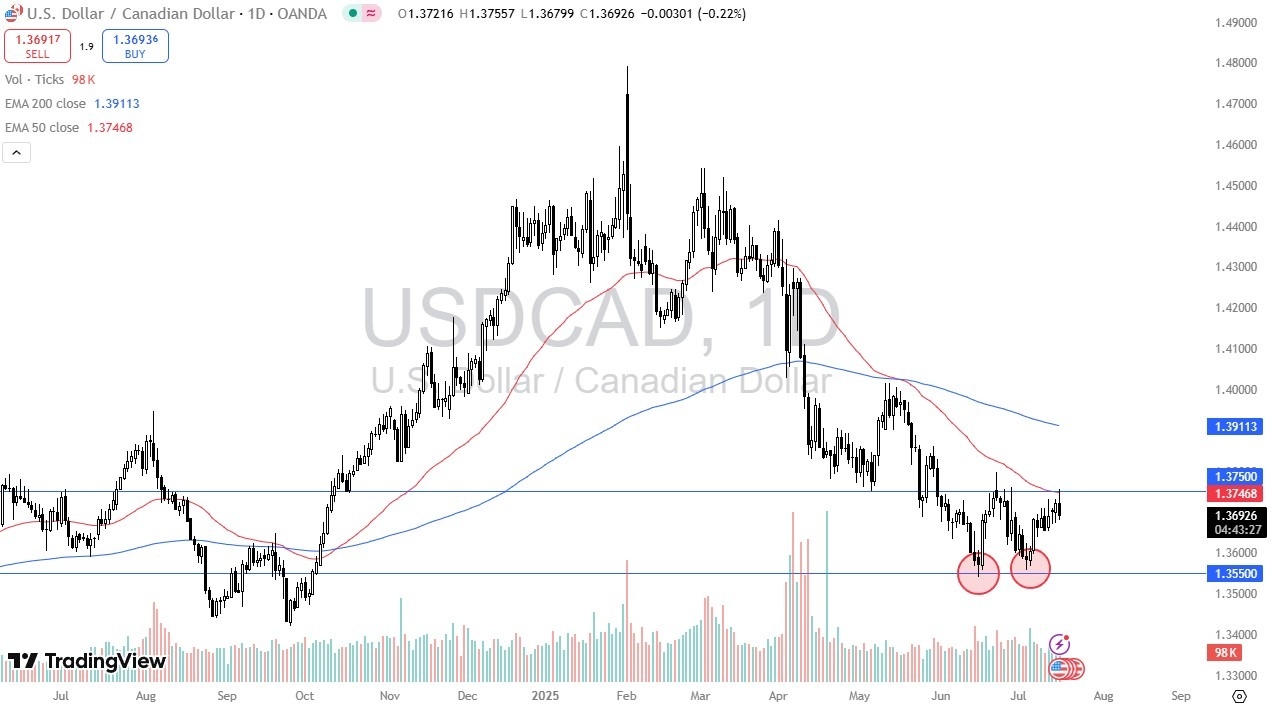

And now we have a situation where we are seeing buyers come back into this market. So, the analysis really hasn’t changed. And had you not paid attention to the market during the trading session, you really wouldn’t know too much. The 50 day EMA offered a significant amount of resistance right along with the 1.3750 level. So, I think you’ve got a situation here where it’s very likely that we will continue to press to the upside. And if we can clear the 1.3750 level on a daily close, I think that would be a huge victory for the greenback opening up the possibility of a move to the 200 day EMA at the 1.39 region.

Noise Will Continue

Ultimately, this is a market that I think will continue to be very noisy. Short-term pullbacks, I think, are still possibly opening for long positions as we just formed a pretty significant double bottom with the 1.3550 level offering massive support that extends down to the 1.35 level. All things being equal, this is a market that I think continues to be noisy.

I think it continues to be choppy, especially as headlines continue to come out of Canada and the United States as they do not have an agreement. And that is coupled with the idea of so much cross border traffic that this is a pair that will be very erratic and choppy. The interest rate differential between the two economies and currencies is about a mile wide. So, I still prefer to hold longs here, but I also recognize that short-term pullbacks are opportunities.

Ready to trade our Forex USD/CAD predictions? Here are the best Canadian online brokers to start trading with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.