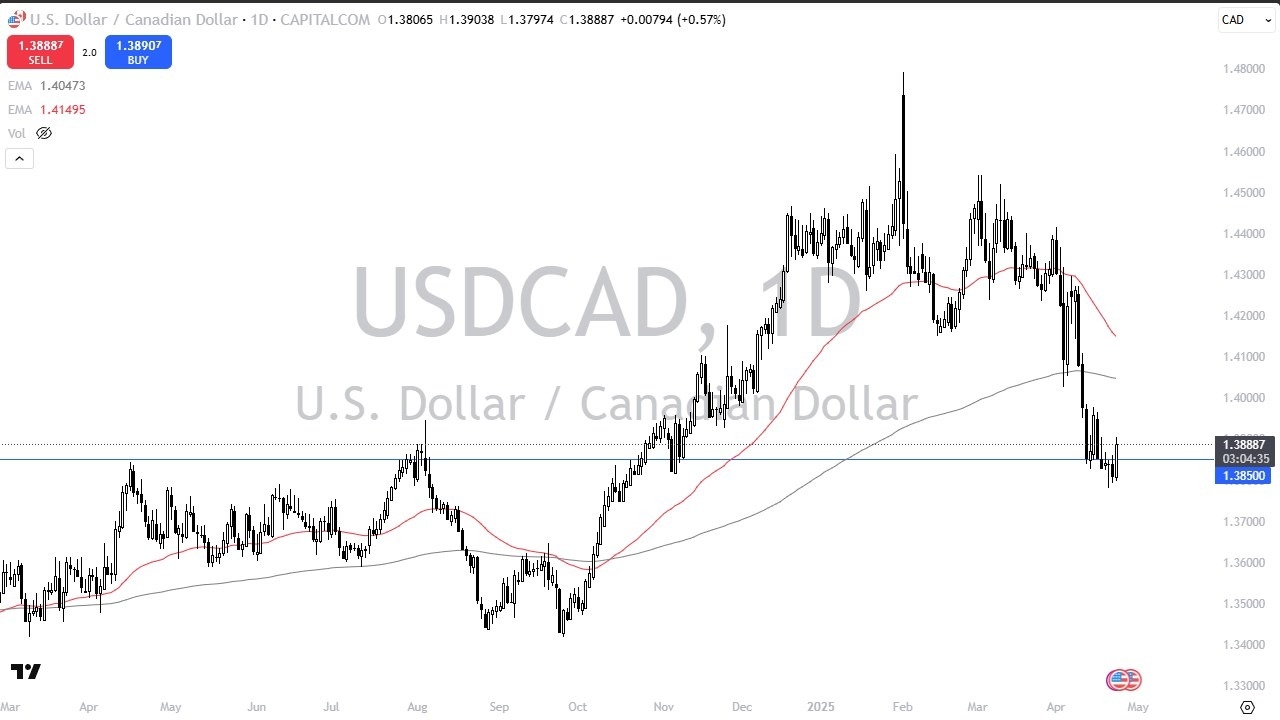

- The US dollar has rallied rather significantly against the Canadian dollar during the trading session on Wednesday, as the 1.3850 level continues to be very important.

- Because of this, the market is likely to continue to see a lot of volatility in this area, as it was previous resistance, and a certain amount of “market memory” will most certainly come into play here.

Keep in mind that the tariff situation continues to be a major driver of what happens next, and I recognize that this is a scenario where traders will be watching very closely, as the tariff spat between these 2 countries continues going forward. After all, Canada has a major election in a few days, so that will also have a major impact on what happens with the Canadian dollar. All things being equal though, we have gotten oversold, and it does make a certain amount of sense that the US dollar might do a little bit of a bounce at this point.

Technical Analysis

If the market were to break out to the upside, the 1.40 level would be the next target. After that, then we would be looking at the 200 Day EMA near the 1.4050 level, followed by the 50 Day EMA near the 1.4150 level. On the downside, if we break down below the 1.38 level, it opens up a move down to the 1.37 level underneath there. That being said, you should also keep in mind that from a longer-term standpoint, the 1.45 level is a massive barrier that has been important for several years. Because of this, the upside might be somewhat limited unless of course something drastic happens between the Americans in the Canadians.

A little bit of a bounce makes quite a bit of sense, but I also think that we are getting fairly close to getting back into a choppy situation, which quite frankly is the norm for this pair. Long protracted moves in the USD/CAD pair normally have a specific reason behind them as there is so much cross-border traffic.

Ready to trade our USD/CAD daily analysis and predictions? Check out the best currency exchange broker Canada for you.