- The US dollar rallied pretty significantly during the trading session on Tuesday.

- It does look like we have a situation where we are trying to recover from an oversold condition.

- The question is whether or not the US dollar can continue to do so.

I certainly think that we are in a scenario where the dollar being oversold doesn’t necessarily mean that things change, but from a longer term trajectory, it does make quite a bit of sense that the Canadian dollar may continue to shrink as the Canadian economy has been soft and it doesn’t really look like the new government is willing to do much about it other than pay lip service to internal tariffs.

Fed Likely to Stay Tight

So, with that being said, the fact that the US dollar is oversold while the Federal Reserve is likely to stay tight, the move higher makes sense, but it’s been so noisy at this point that it’s very difficult to hang on to the position. Keep in mind that there also was a little bit of positivity for the Canadian dollar due to the fact that they dropped some of the reciprocal tariffs against the Americans, which helps keep them out of a massive recession, but quite frankly doesn’t do much to strengthen the currency long term.

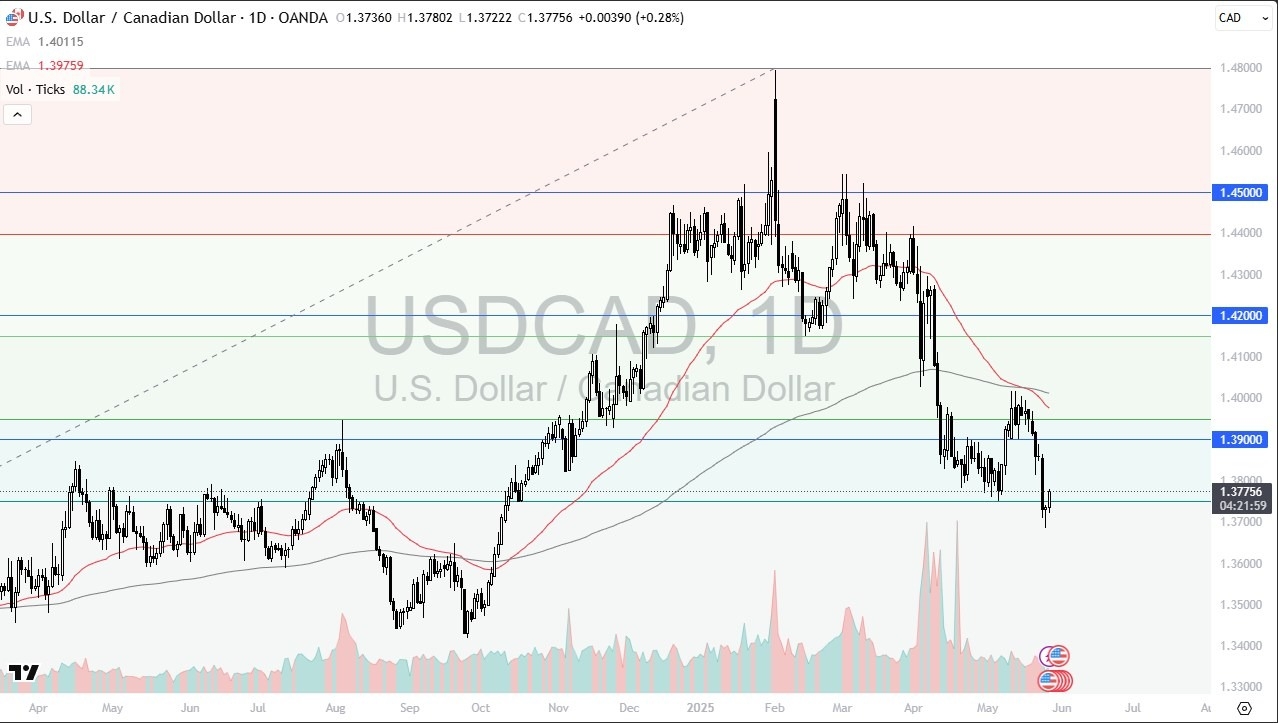

With that being the case, I am watching this very closely because we are in an area right now where we are at the top of the previous consolidation area, so we have to ask did we break out and pulled back, getting ready to bounce again or are we finally going to head back into the previous consolidation which was basically between 1.39 and 1.32. I do think we are at an inflection point here and you need to watch very closely.

If we break below the hammer from the Monday session, it’s very possible that we continue down to the 1.34 level. If we rally from here, I believe that the 1.39 level could be the target, but I also think it’s very difficult to get above. We would need a catalyst to get that going. If and when we get that going, then we could see a move all the way back to the 1.42 level and then the 1.45 level. I think it’s a difficult trade to take, but most of them are that pay over the longer term. Position sizing will be crucial because clearly you are trying to swim upstream if you do follow the bullish setup. So, expect a lot of difficulties. The one caveat of course that helps for long trading in this pair is that you get paid at the end of every day via swap.

Ready to trade our USD/CAD daily analysis and forecasts? Here’s a list of the best Forex Trading platform in Canada to choose from

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.