- During the trading session on Monday, we have a national election Ian the Canada that will of course capture a lot of headlines, and this might be part of why the market really hasn’t done anything in this pair during the session.

- After all, depending on who is leading Canada could have a major impact on what happens next between the United States and Canada.

- This is a situation that sooner or later needs to be resolved, otherwise it will destroy the Canadian economy.

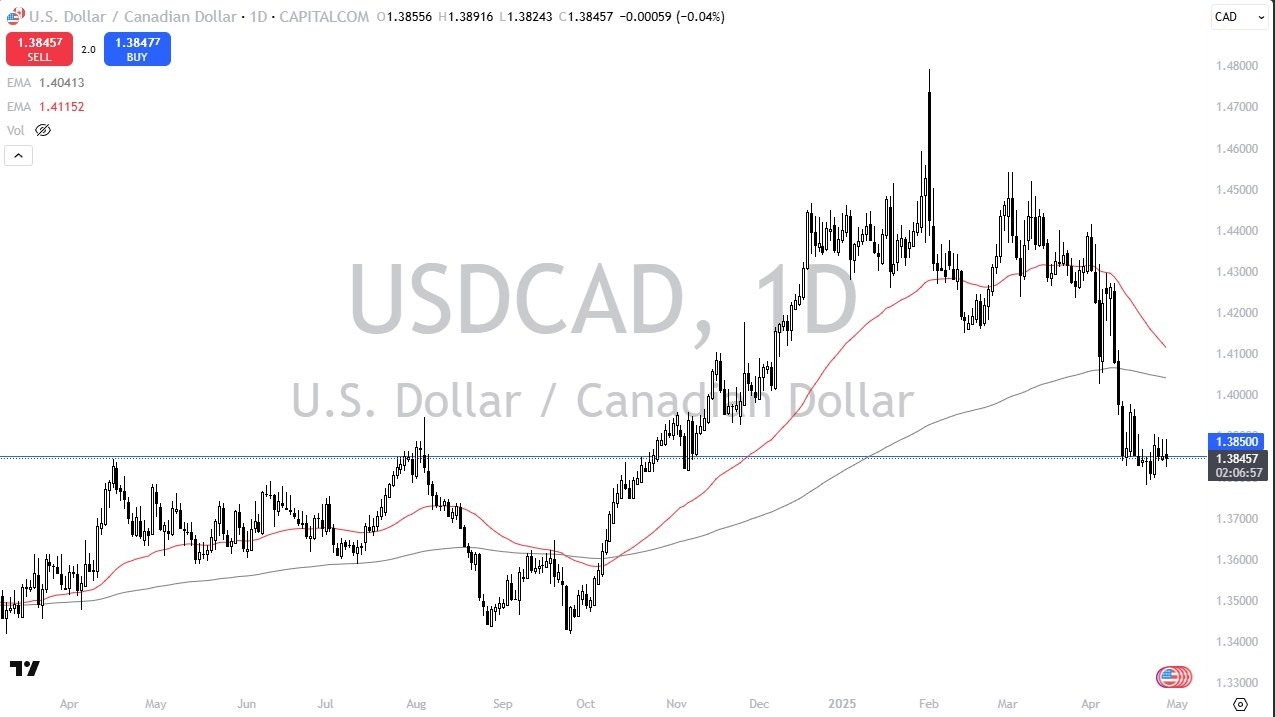

That being said, there is a lot of transactions between these 2 countries, so it’s not as if the United States won’t feel pain either. However, I still think at this point in time you have a situation where traders are looking to try to find a bottom in this USD/CAD pair, right around the 1.3850 level. This is an area that’s been important multiple times, and I think it does make a certain amount of sense that we continue to see a lot of volatility, but ultimately, I do think that there are certain buyers out there willing to pick up little bits and pieces.

Impulsive Candle Needed

At this point, I need to see some type of impulsive candlestick, one that shows a definitive close higher or lower from the range that we have been in for about 10 days. If we get that, then it’s very likely that we will continue to see momentum in whichever direction that is. To the upside, it would make a certain amount of sense that we go looking to the 1.4050 level, which is basically where the 200 Day EMA resides.

On the downside, if we break down below the 1.38 level on a daily close, then we could begin to see the Canadian dollar strengthen overall. At this point, I think this is an extraordinarily neutral market, but over the longer term we have seen the US dollar climbed steadily against the Canadian dollar of the last couple of years, so this is something that should probably not be forgotten.

Ready to trade our USD/CAD daily analysis and forecasts? Here’s a list of the best Forex Trading platform in Canada to choose from.