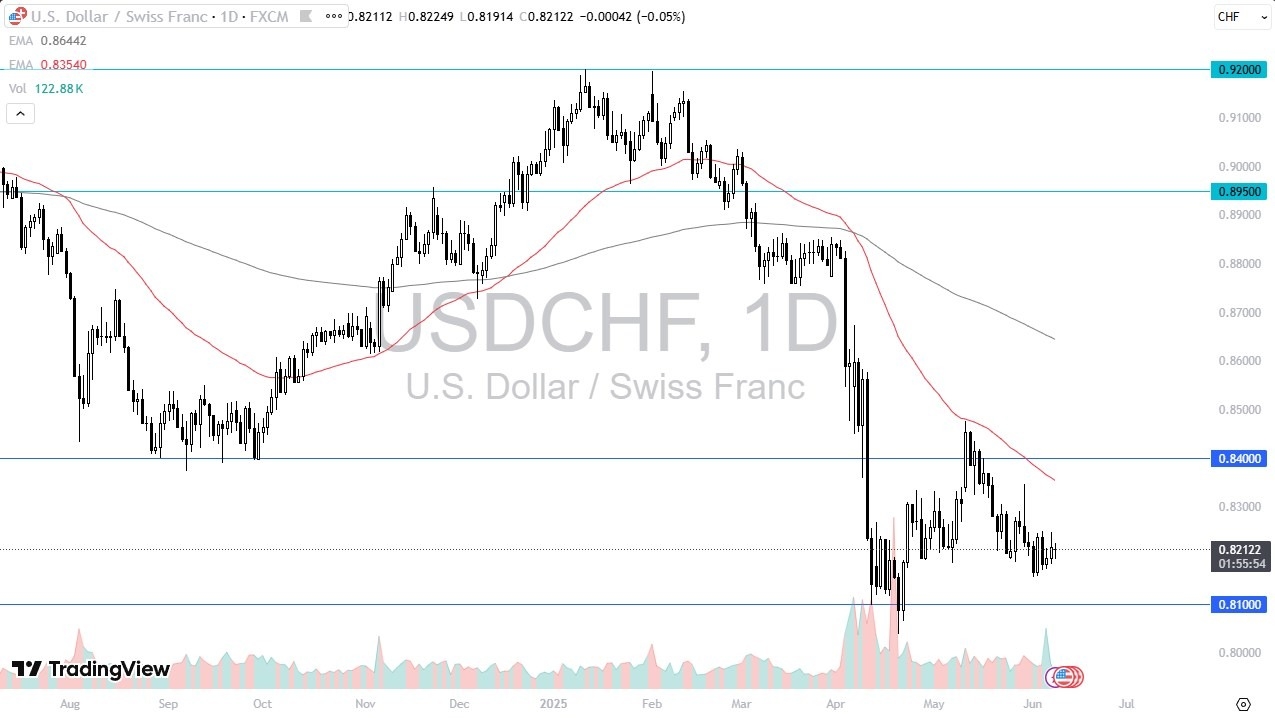

- The US dollar went back and forth during the trading session on Monday, as we continue to try to build some type of basing pattern and what has been a significant sell off that is now stalling.

- Because of this, I think you have a situation where you could see a certain amount of resiliency built into this pair, and I think that the 0.83 level is an area that a lot of people will be paying attention to.

- That being said, this is not the easiest trade to take, and you will have to be very cautious, as well as patient in order to take advantage of it.

Technical Analysis

The technical analysis for this USD/CHF pair is fairly poor, but I can also make an argument that we are in the midst of finding some type of bottom. The 0.82 level is an area that’s been important multiple times over the last several weeks, but we did break down below there to reach the 0.81 level. The 0.81 level of course is an area that has been very important as well, so I think there is a “zone of support” in this overall region. If we can bounce from here, then I think you have a real chance to turn things around.

That being said, if we were to break down below the 0.81 level, then we could see the US dollar fall down to the 0.80 level, which of course is a large, round, psychologically significant figure that people will be paying close attention to. That being said, I don’t think it’s going to be the easiest thing in the world to get short of this market at the moment, despite the fact that it had been so negative previously.

If we turn around and break above the 0.83 level, then it opens up the possibility of the market going higher, perhaps to the 50 Day EMA, followed by the 0.84 level after that. Anything above there probably changes the overall attitude of this market and probably has the US dollar rallying against almost everything, including the Swiss franc.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.