- The US dollar has skyrocketed against the Swiss franc as word got out over the weekend that the United States and China were getting closer to coming together for an agreement.

- After all, both countries cut the tariffs quite drastically that they were planning on each other, and therefore the world breathed a significant sigh of relief.

- With this being the case, the market is likely to continue to see a lot of risk appetite influence, with the Swiss franc considered to be the “safest currency” out there. If people start to get scared again, this market will certainly fall.

Technical Analysis

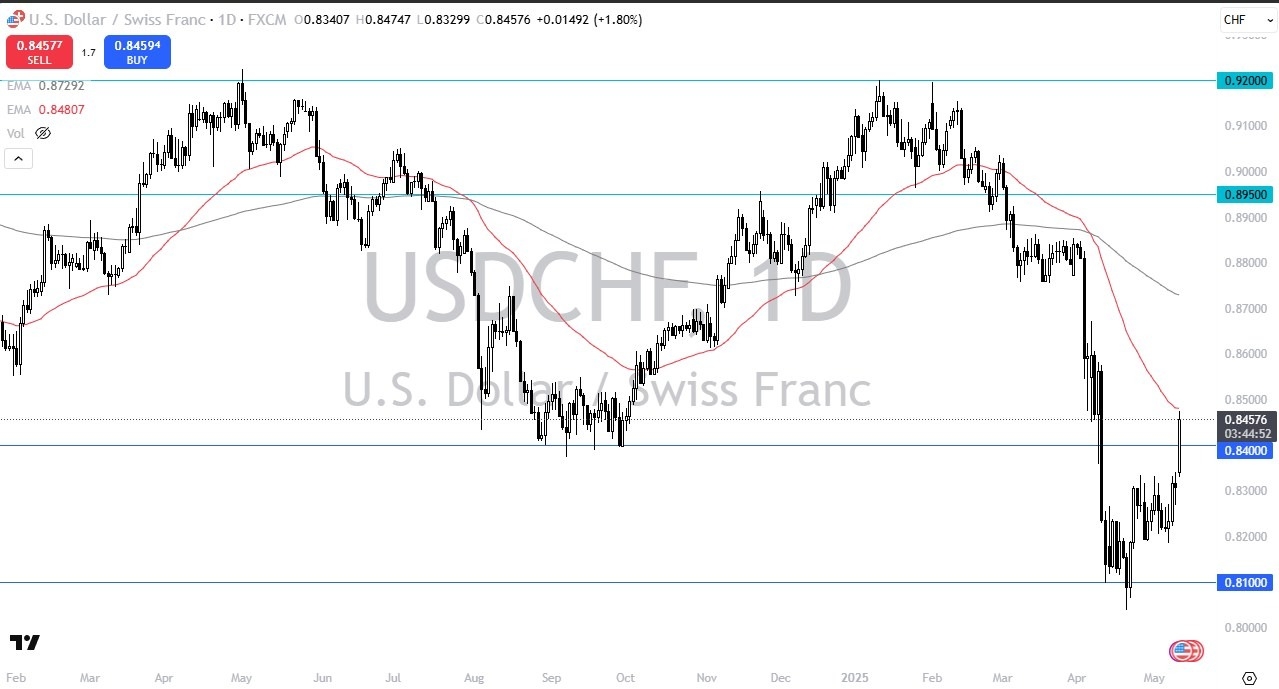

The technical analysis for this USD/CHF market is still negative overall, but I have to say that clearing the 0.84 level the way we did is of course a very bullish sign. All things being equal, this is a major breakout, and we are testing the crucial 50 Day EMA. The 50 Day EMA is sitting just below the 0.85 level which has a certain amount of resistance as well. If we can break above that level, then the 0.87 level could be the next target out the 200 Day EMA sits there.

Unfortunately, the markets are moving more on emotion than anything else right now, and I think you’ve got a situation where we could very well see a lot of volatility going forward based on the latest comment. While market participants will be happy that the Americans in the Chinese are at least coming to somewhat of a cooling off period, the reality is that there is still a long way to go, so I don’t think we have the “all clear” to start selling Swiss francs.

Nonetheless, I do recognize that there is an interest rate differential between these 2 currencies that is essentially a mile wide and therefore think you have got to pay close attention to the headlines to determine where we are going next. However, the size of the candlestick does tell us quite a bit of new volume has entered the market, but I do recognize that the area around the 0.86 level could be a little difficult to get beyond as there is a cluster of noise there.

Want to trade our daily forex analysis and predictions? Here’s a list of the best FX brokers in Switzerland to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.