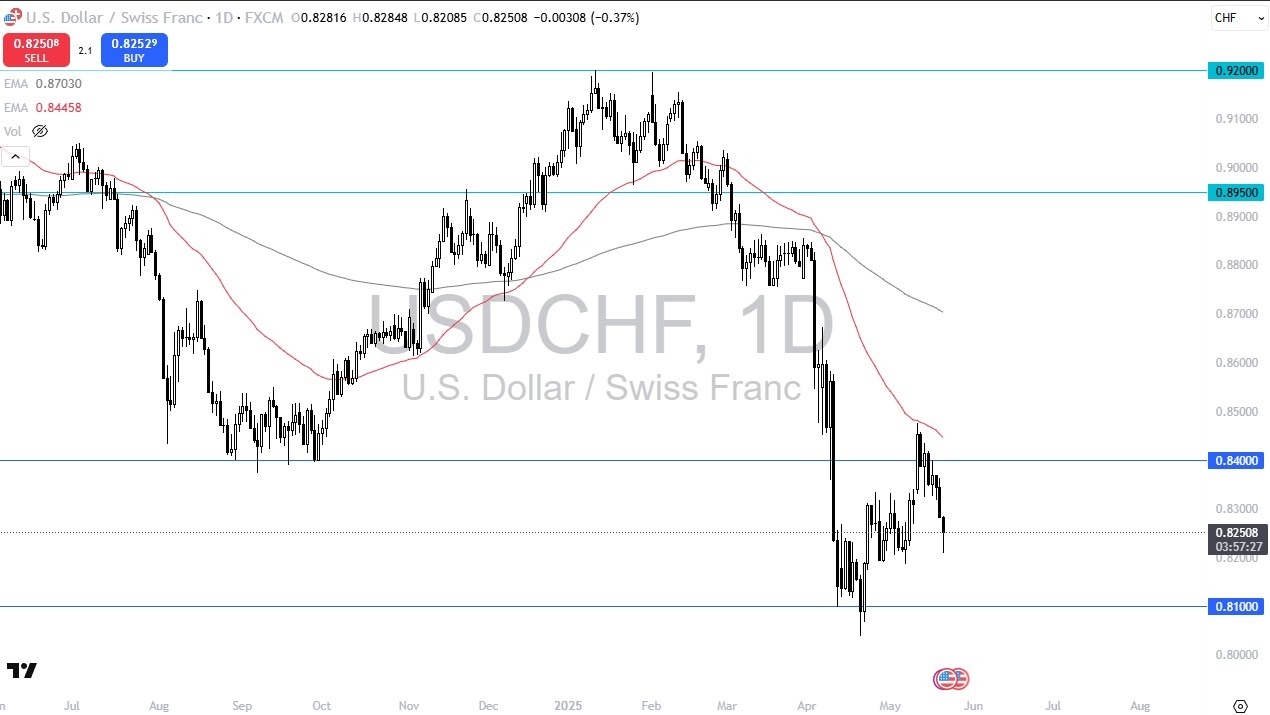

- The US dollar has fallen pretty significantly during the trading session on Wednesday, but it does look like we are at least trying to fight back. Now, keep in mind, this is a market that is highly sensitive to risk appetite.

- And we got a horrific 20 year auction in the bond markets of America during the day. This is a bad sign, and at that point in time, we could see ‘contagion’ in a lot of markets far beyond the bond markets.

The 0.82 level has offered a little bit of support. So now the question is, can we bounce? That will determine what happens next. But if we do in fact bounce from here, the 0.83 level is an area I’d watch. And then target possibly 0.84. Anything above there, things get very interesting because it could be a bottoming pattern. We have a lot of really noisy behavior right now and multiple markets around the world. And it should be noted that a lot of the problems stem from the bond market.

Bond markets selling off the way they have in the United States, Japan, several other countries is causing chaos.

That being said, this is an area that was massive support in the form of the 0.84 level. Now you have to ask, was this a throwover? Only time will tell, but if we recapture that 0.84, maybe the 0.8450 level, then it could end up being massive, long. At this point though, I’m looking more for stability, maybe buying the dip for short-term trades, but that’s about it. However, I think that it is a market that could be very important and profitable, but we need to see a bit of momentum appear before we start taking that position.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.