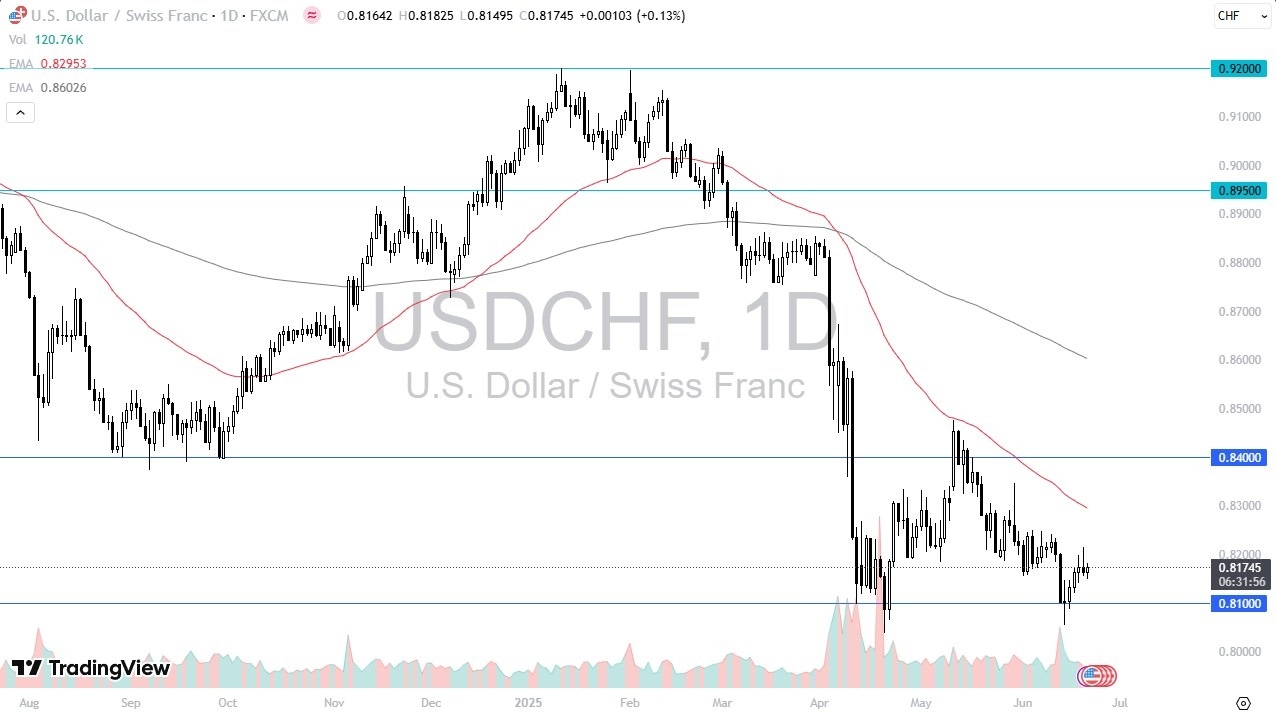

- The US dollar initially pulled back just a bit during the early hours on Friday but turned around to show signs of strength again against the Swiss franc.

- This is a very interesting currency pair at the moment, because the 0.81 level is a massive floor, and could potentially end up being a bit of a “double bottom” in this pair.

- The 0.81 level being broken to the downside would be a very negative sign, opening up the possibility of a move down to the 0.80 level, but so far, it looks like the support is in fact holding.

Interest Rate Differential

The interest rate differential course continues to favor the US dollar, so therefore a certain amount of “carry traders” would be in this market. The 0.82 level has offered short-term resistance, but if we can break above the shooting star from the Thursday session, then it’s possible that the US dollar could accelerate to the upside, but I don’t think this is necessarily going to be a very explosive pair. It typically is at, so more of a slow upward grind is what I would be looking for.

That being said, it’s worth noting that the Swiss franc is the ultimate “safety currency”, and therefore if we see things get worse in the Middle East, it is possible that the Swiss franc could pick up a bit of a bid, but ultimately at this point in time I think the US dollar is oversold against almost everything you can measure it against, so I think at this point in time a bounce makes a certain amount of sense ultimately, but that doesn’t necessarily mean this is going to be an easy to trade. Ultimately, I expect this to be a very noisy and choppy market, but the 0.81 level is an area I am watching very closely to see if the US dollar can defend it.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.