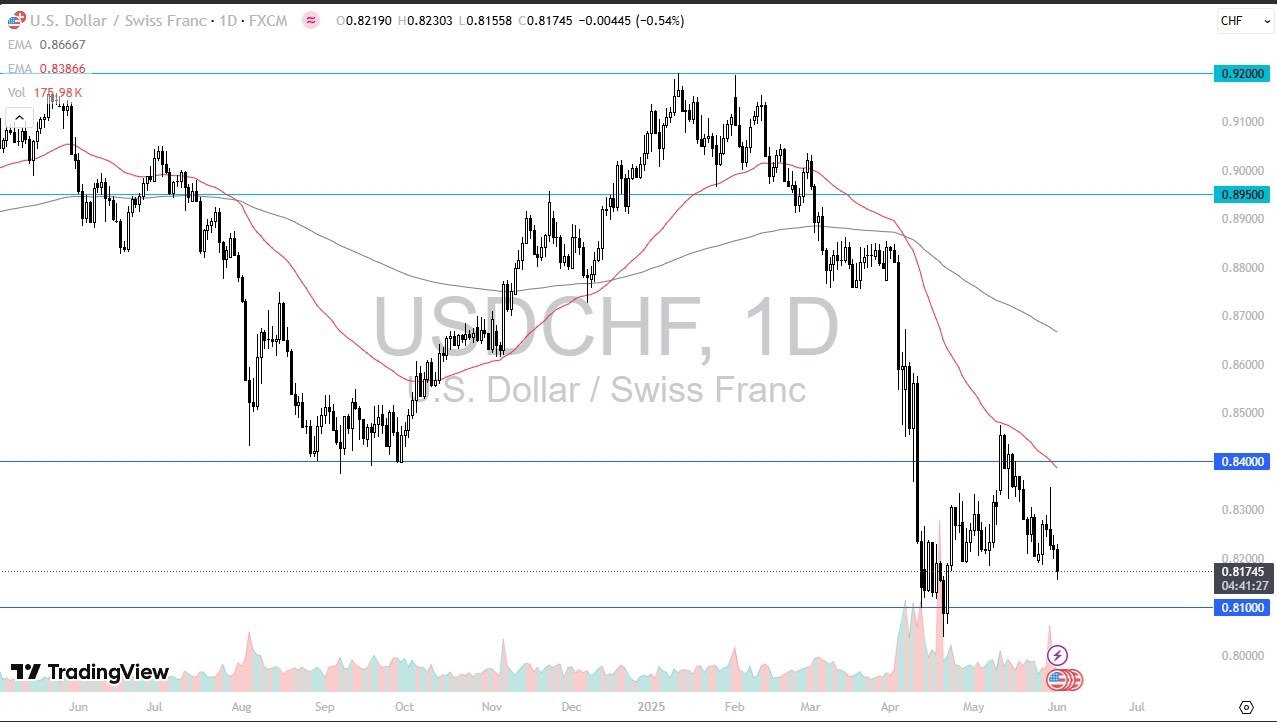

Potential signal:

- A move above 0.83 has me buying again, with a stop at 0.82 below.

- If we get above 0.84, then I will add.

The US dollar has fallen pretty significantly during the early hours of Monday against the Swiss franc as we continue to see a lot of noisy behavior. We are sitting just below the 0.82 level, and that is an area that I think we need to pay close attention to.

The market will continue to be a situation here where we are seeing whether or not the U S dollar can pick things up. The market right now is likely to see a lot of questions asked about the U S dollar as the interest rate situation may be a little bit murky with the manufacturing PMI numbers coming out a little bit weaker than anticipated and a bit of a contractionary number.

So, people start to wonder about the Federal Reserve and what they can actually do. Now, the reality is the interest rate differential still pays you quite handsomely to hold this pair. And I think that is something that you need to keep in the back of your mind as traders will continue to look at this as a market that is a little bit overdone. And I think we are trying to find out whether or not there is plenty of support between here and 0.81. If we were to break down below the 0.81 level, then it would be extraordinarily bearish for the US dollar.

The Most Likely Move

But more likely than not, you would see the US dollar crumbling against most things. If we turn around and break above the 0.83 level, I think that’s very bullish for the dollar. But the real test is the 0.84 level, clearing that would, at least in theory, send this market racing higher. Now, for what it’s worth, the US dollar has been strengthening later in the day or at least stabilizing against most currencies. So, we’ll have to watch this. Certainly, we are extended to the downside. So, what I’m looking for is upward momentum. The question is, will we get it?

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.