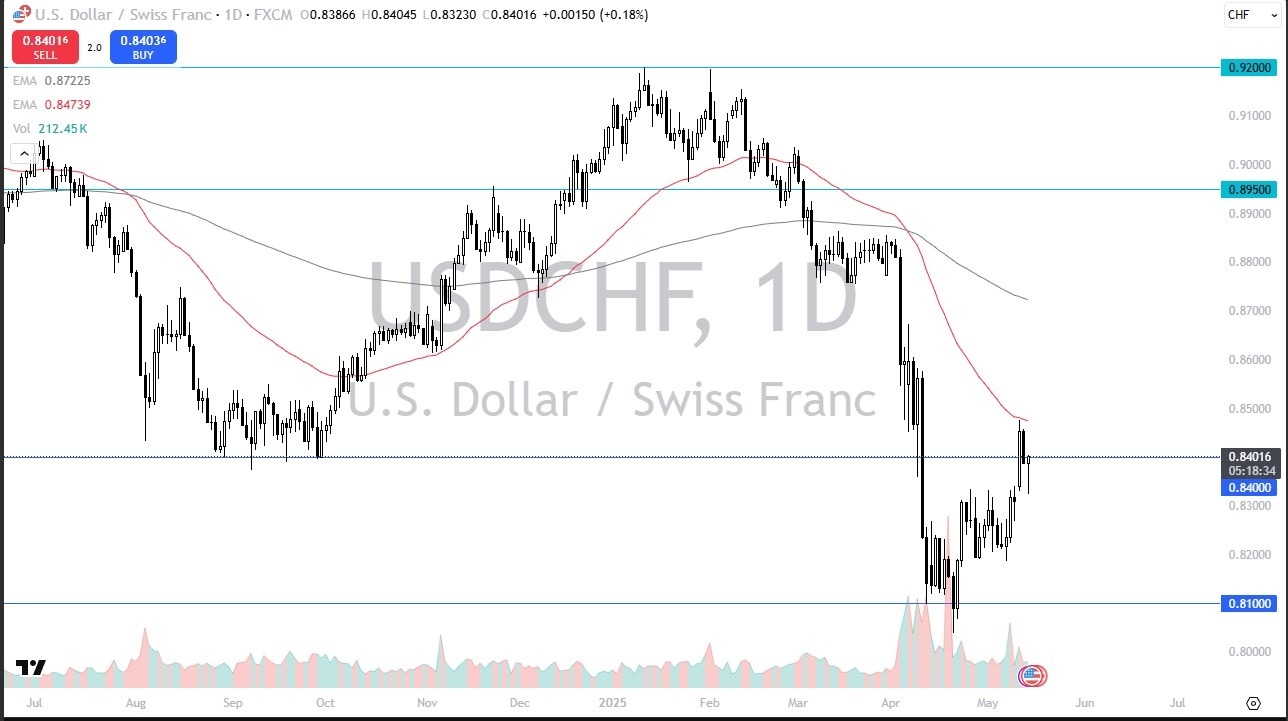

- The US dollar initially fell during the session here on Wednesday but looks as if it is recovering quite nicely.

- At this point, I think we’ve got a situation where traders are starting to look at this through the prism of a market that could go much higher.

Keep in mind that the 0.84 level where we presently sit is an area that has been important multiple times in the past. Therefore, I think you have to look at this as a market that probably continues to see significant action here. But I also recognize that we have a scenario where traders will look at this as a barrier if you are trying to get long.

Keep an eye on the 50 day EMA, it is just below the crucial 0.85 level and dropping I think we are entering an area that’s going to be very noisy. But it should be noted that we do in fact, have a lot of movement into the US dollar as rates climb. The other thing to think about is that the Swiss franc just offers nothing in return as far as swap. So, at the end of the day, as long as things don’t fall apart on the trade front, I suspect this is a pair that could do quite well over the longer term.

Below the 0.83 Level

If we were to break down below the 0.83 level though, I think not only does that invalidate this candlestick, but it could send us towards the lows. On a move to the upside, I recognize that we have a lot of work to do to get to the upside, but this is a market that tends to grind anyways. So, you just get paid to hang on to it at the end of every day. And you think of it more as a swing trade or possibly even an investment.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.