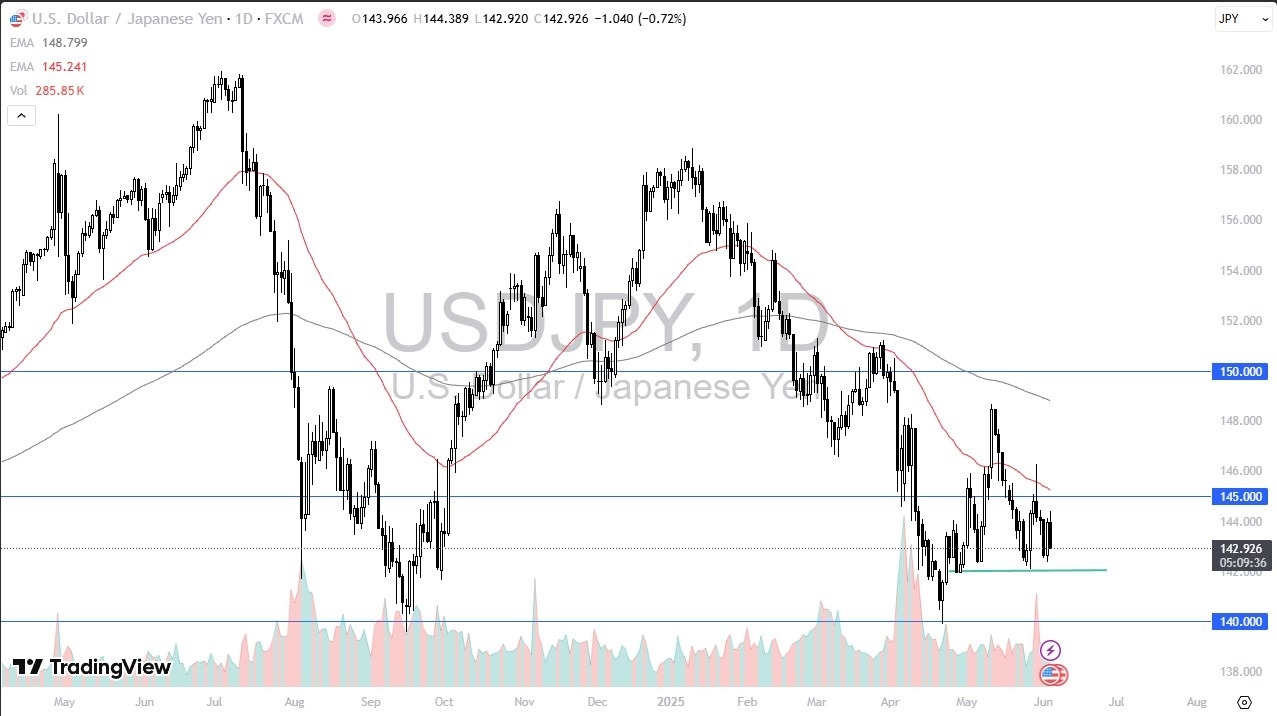

- The US dollar initially tried to rally against the Japanese yen, only to fall pretty significantly.

- This is a pattern that we have been in for some time, as the ¥142 level has been a major support level.

- With that being the case, the market is likely to continue to pay close attention to the ¥142 level where we have seen the market bounce multiple times, and I do think that could be an area that we may have to test.

If we can stay above that level, then I think it’s a very bullish sign, as even with the poor ADP Non-Farm Payroll numbers and the ISM Services PMI numbers coming out of 49.9, this would suggest that there is quite a bit of strength in the US dollar as it did not break down through support. That being said, the US dollar against the Japanese yen is a little bit different as far as currency markets are concerned.

Central Banks

Keep in mind that the Bank of Japan has a major issue on its hands, as people are not buying government bonds, with a couple of days where we’ve had absolutely no bid. This means that the Bank of Japan may very well be in a situation where they have to start quantitative easing again, stepping into the market to buy those very well bonds. However, it’s also worth noting that the data softening in the US might make people think that the Federal Reserve is likely to drop rates by the end of the year, but even if they do, the reality is that the interest rate differential between the United States and Japan is about a mile wide. In other words, the interest rate differential will attract traders sooner or later, and they will hold onto US dollars, collecting the swap along the way pad their trading accounts.

Want to trade our USD/JPY forex analysis and predictions? Here’s a list of forex brokers in Japan to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.