Potential signal:

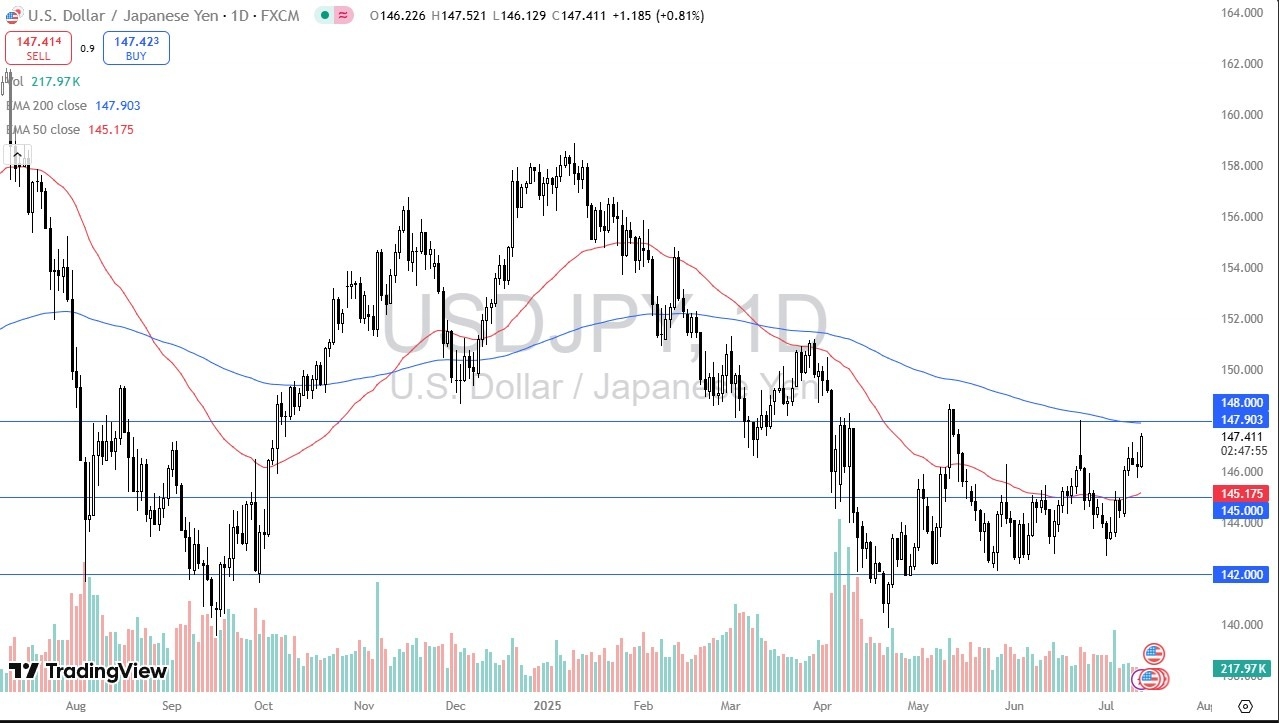

- At this point, I am buying the USD/JPY pair on a move above the obvious 148 level, with a stop loss at 147, aiming for 151 above.

The US dollar has rallied significantly during the trading session here on Friday, as we are looking towards the 200 day EMA, which is at the crucial 148 yen level. The 148 yen level of course is an area that I think a lot of people will watch closely. And with that being the case, if we do break above there, I think you’ll see more FOMO trading, more people jumping in to try to take advantage of the momentum. Short-term pullbacks, I do think are buying opportunities and the 50-day EMA sitting near the 145.17 level offers short-term support right along with the 145 yen level. If we break down below there, then the 142 yen level is a massive floor.

Bonds in Japan

Keep in mind that the Bank of Japan now has to deal with the idea that the bond markets aren’t being subscribed to as much as they are in the past. And if there are no bidders out there, that means the Bank of Japan will eventually have to start quantitative easing. The interest rate differential continues to favor the US dollar. That is something that I don’t see going anytime soon. So, I still like this as a buy on the dip market, but it’s also worth noting that we are near the top of an obvious consolidation region.

So, with all of that being said, I think you need to look at this through the prism of a market that maybe you see a little bit of value underneath that you can take advantage of, or you take advantage of the breakout. On the breakout, you’ll be looking at a move to 151 yen followed by 154 yen. I have no interest in shorting this market anytime soon. With this being said, I remain bullish.

Want to trade our USD/JPY forex analysis and predictions? Here’s a list of forex brokers in Japan to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.