Signals for the Lira Against the US Dollar Today

Risk 0.50%.

Bullish Entry Points:

- Open a buy order at 36.35.

- Set a stop-loss order below 36.15.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 36.77.

Bearish Entry Points:

- Place a sell order for 36.75.

- Set a stop-loss order at or above 36.90.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 36.30.

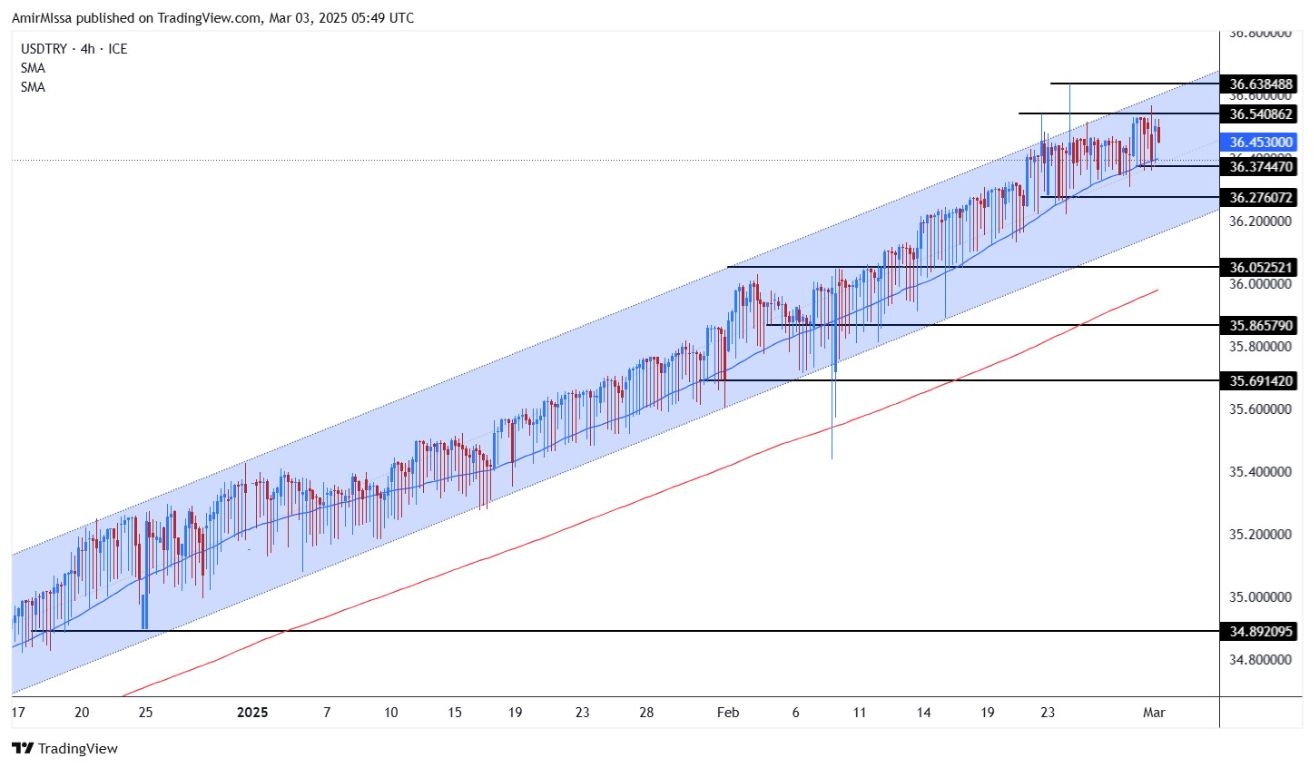

Turkish lira Analysis:

The USD/TRY pair opened with mixed trading during Asian trading on Monday. The dollar traded against 36.50 Lira near its all-time highs recorded by the pair last Monday. The slowdown in the Turkish Lira’s decline (the Turkish currency has lost about 3.5 percent of its value since the beginning of the current year) reflects a kind of control by the monetary and financial authorities in Turkey amidst the Central Bank’s efforts to regulate the economic rhythm by adjusting reserve criteria related to loan growth, amidst rising inflation and increasing market pressures.

Investors followed a report published at the end of last month via Bloomberg, which included positive expectations that Turkey’s economy would emerge from recession in the last quarter of last year (the country’s GDP had recorded a decline for two consecutive quarters). Expectations indicate stronger economic growth during the current year, supported by a shift in the monetary policy that the Turkish Central Bank may pursue during 2025. Expectations indicate that the country’s economy will record growth of 1.5 percent, or the equivalent of 1.3 trillion dollars, during the first quarter of the current year.

The Central Bank began stimulating monetary policy during December 2024 and January 2025, when it cut interest rates after eight meetings of maintaining interest rates at 45%, compared to 50%, while expectations indicate that interest rates will reach 30% by the end of the current year. The bank is expected to continue its interest rate cut policy throughout the remaining meetings of 2025. This is despite the consumer price index recording an increase last month, recording 42%, after a series of consecutive declines during the past year, when inflation fell from levels of 75%.

TRYUSD Technical Analysis and Expectations Today:

Technically, the USD/TRY pair’s trading stabilized, recording mixed trading within a narrow range, with the pair continuing to stabilize within an ascending price channel in which the price has been trading for the past months. The overall upward trend dominating the pair’s movements continues, supported by the ascending price channel as well as by the 50 moving averages on the four-hour time frame. Meanwhile, Turkish Lira price forecasts indicate that the dollar will continue to rise against the Lira. Moreover, any decline in the pair to the mentioned moving average represents an opportunity to re-buy. The pair is targeting 36.75 Lira and 36.99 Lira, respectively.

Ready to trade our Forex daily analysis and predictions? Here are the best Turkish brokers to choose from