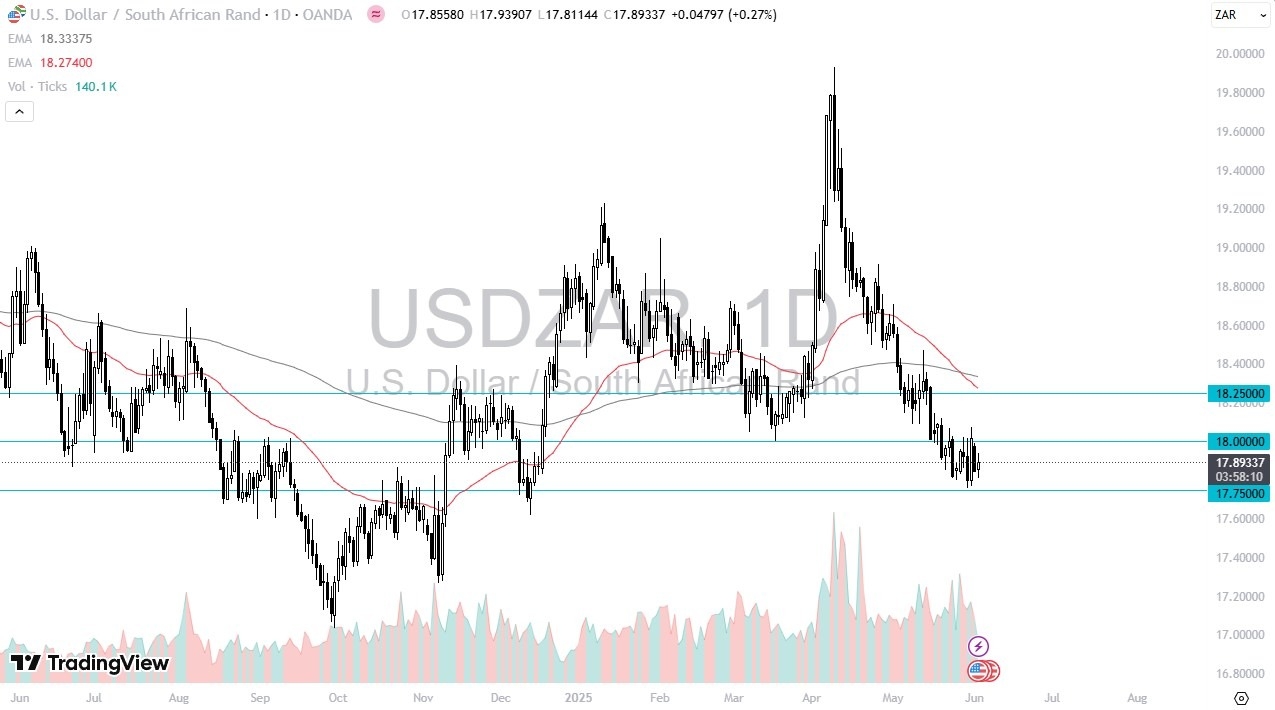

- The US dollar has gone back and forth against the South African Rand during the trading session on Tuesday, as we continue to see the USD/ZAR pair bounce around in a short-term consolidation area.

- The 17.75 ZAR level in the bottom offering support, and the 18 ZAR level above offering significant resistance.

- With this being the case, I think it makes perfect sense that we see what is essentially a neutral candlestick for the session.

Technical Analysis

If we were to break above the 18 ZAR level on a daily close, then I think we have a real shot at the US dollar rallying against the South African Rand. The South African Rand is overdone in its buying, and I think it’s probably a scenario where we will see this market bounce sooner or later. However, we don’t really have a significant catalyst at the moment, but it is worth noting that the United States and South Africa are further apart than they have been for years, and it’s also worth noting that Donald Trump may or may not continue to fund South Africa with US donations, as it is a huge part of the money that flies into that country.

On the downside, if we were to break down below the 17.75 ZAR number, then we could see the US dollar drop down to the 17.50 ZAR level, which is a level that we could see a certain amount of support based upon historical trading. This is a pair that tends to move on the 0.25 level, time and time again. It’s a very methodical grinding type of pair, but it should be noted also that the interest rate differential favors the South African Rand, so that is part of what we have seen here. Once we break out of this 0.25 ZAR level, then I think we know where the next 0.25 ZAR is going to be found.

Ready to trade our daily Forex forecast? Here’s some of the best trading platforms in South Africa to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.