Key points

- Buffett made no new stock picks in Q1 2025 but doubled his positions in Pool Corp (+145%) and Constellation Brands (+114%), signaling conviction in consumer-driven businesses with pricing power.

- Citigroup and Nu Holdings were exited entirely, while stakes in Bank of America and Capital One were trimmed further, extending a multi-quarter financials pullback.

- Cash holdings climbed to $348 billion, another all-time high, highlighting Buffett’s preference for patience and liquidity amid uncertain valuations

Warren Buffett’s Berkshire Hathaway has released its 13F filing for the first quarter of 2025, revealing a continuation of themes that have defined the firm’s recent positioning: cautious selling in financials, steady conviction in consumer-facing businesses, and little urgency to deploy its growing cash reserves.

There were no new stock initiations this quarter, but the firm made meaningful increases in a handful of existing positions, notably doubling its stakes in Pool Corporation and Constellation Brands. Meanwhile, it fully exited Citigroup and Nu Holdings, and trimmed other financial names like Bank of America and Capital One.

Despite elevated market volatility, Buffett left Berkshire’s largest holding—Apple—unchanged for a second consecutive quarter. At Berkshire’s annual meeting in early May, Buffett reaffirmed his admiration for Apple’s business model and its CEO, Tim Cook.

Berkshire also filed a confidential request with the SEC, indicating it is building a position in at least one undisclosed stock—likely in the commercial or industrial sector—estimated to be worth between $1 billion and $2 billion.

Key moves: What Buffett added, cut, and exited

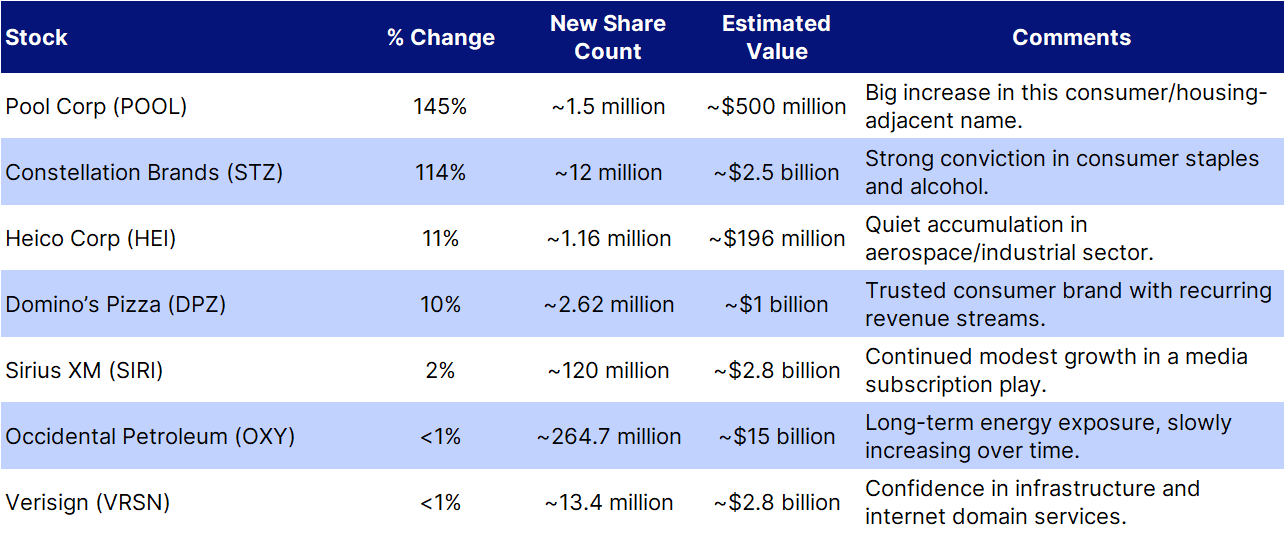

Additions and new positions:

Source: SEC, Saxo

Notable highlights

- Pool Corp and Constellation Brands saw the largest percentage increases, signaling renewed conviction in consumer and housing-adjacent names.

- Energy and tech infrastructure holdings (Occidental and Verisign) continued to inch higher, reinforcing long-term themes in the portfolio.

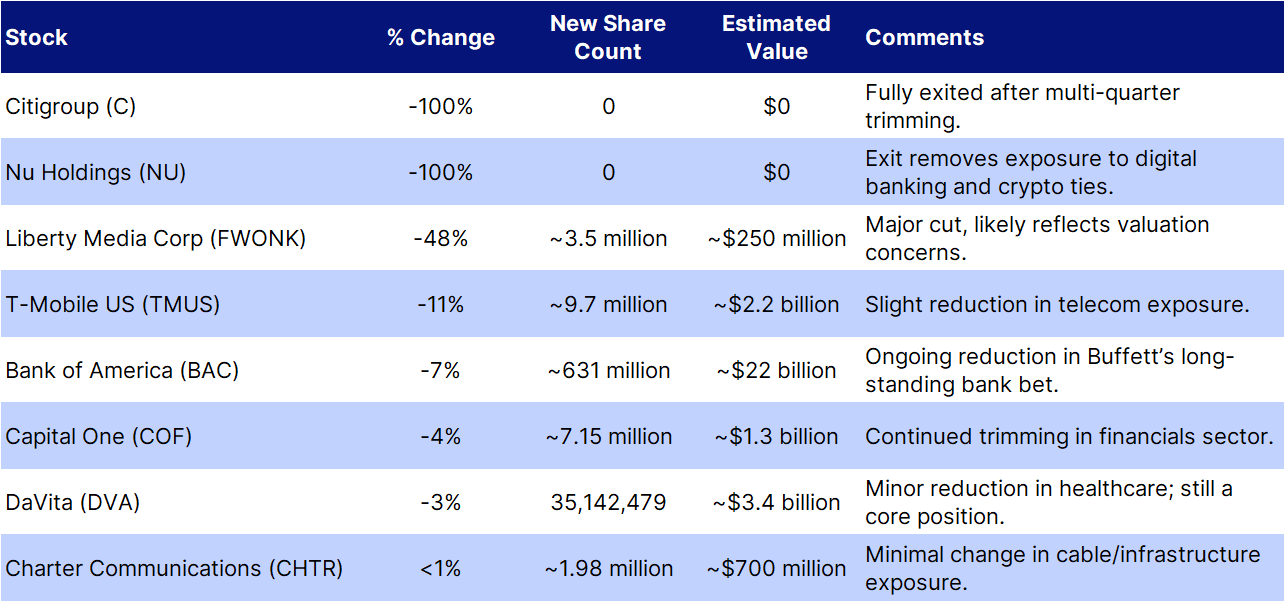

Reductions and exits

Source: SEC, Saxo

Notable highlights

- Citigroup and Nu Holdings were fully sold, extending the retreat from financials and risk-heavy emerging market bets.

- Bank of America, a long-held top position, was cut by another 7%, following larger reductions in 2024.

Key takeaways from Q1 2025

Cash pile hits a record $348 billion

Berkshire’s cash and Treasury bill holdings rose again, reaching $348 billion, underscoring Buffett’s reluctance to chase assets in a richly valued market. With Treasury yields remaining elevated, Berkshire is collecting significant passive income while keeping liquidity ready for future opportunities.

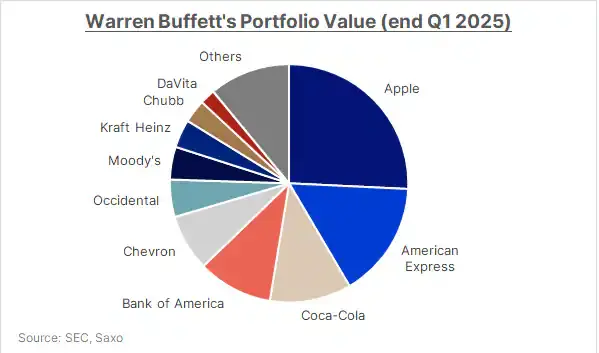

Apple position remains unchanged

Berkshire maintained its 300 million shares in Apple, now valued at $66.6 billion. At Berkshire’s May 2 annual meeting, Buffett praised Apple CEO Tim Cook and reiterated that Apple is “a better business than any we own.” The stake remains the portfolio’s largest single holding.

Doubling down on pool and constellation brands

Berkshire dramatically increased its Pool Corp stake by 145% and Constellation Brands by 114%, doubling down on consumer and housing-linked names with durable demand and pricing power. These moves reflect confidence in selective pockets of growth even as broader market valuations stay elevated.

Financials see continued pullback

The firm exited Citigroup and Nu Holdings, and trimmed several other financial holdings. The message is clear: Berkshire is growing more cautious about the sector, especially names tied to credit, economic cycles, and macro risk.

Confidential stock filing suggests a new target

Berkshire filed a confidential request with the SEC to withhold at least one equity position from public view. Based on Q1 10-Q estimates, the stake is likely between $1–$2 billion and may fall into Berkshire’s “commercial and industrial” segment. This approach mirrors its past strategy when it built a hidden position in Chubb.

Final takeaways: Buffett’s market outlook for 2025

Patience is key: With cash at $348 billion, Buffett continues to wait for compelling, large-scale opportunities rather than chase stretched valuations.

- Selective buying: The firm’s increases in Pool, Constellation Brands, and Domino’s Pizza suggest Buffett is still willing to add—but only in high-conviction names.

- Ongoing financial sector caution: Berkshire is gradually reducing its banking exposure, indicating greater concern about risk/reward dynamics in that space.

- Commitment to quality: Apple remains the portfolio cornerstone, and dividend-paying, cash-generating businesses dominate Berkshire’s top holdings.

Read the original analysis: Warren Buffett’s Q1 portfolio shifts: Financials trimmed further, Apple held, and cash hits $348 billion