I wrote on 16th March that the best trades for the week would be:

- Long of Gold, which rose by 1.19%.

- Short of USD/JPY following a daily close below ¥147.26. This did not set up.

- Long of Natural Gas futures following a daily close above $4.60. This did not set up.

- Long of Copper futures. This rose by 4.68%.

The overall result was a win of 5.87%, which is 1.47% per asset.

Last week saw several important data releases affecting the Forex market:

- US Federal Funds Rate, Rate Statement, and Economic Projections

- Bank of Japan Policy Rate & Monetary Policy Statement

- US Retail Sales

- Bank of England Official Bank Rate & Votes, Monetary Policy Summary

- SNB Policy Rate and Monetary Policy Assessment

- Canadian CPI (inflation)

- New Zealand GDP

- US Unemployment Claims

- Canada Retail Sales

- Australia Unemployment Rate

Last week’s key takeaways were:

- The big news of the week was the Fed’s slightly hawkish but reassuring statement, which revised inflation higher and growth lower, but which still left markets believing there will be two rate cuts of 0.25% later in 2025. This had the effect of boosting both the US Dollar and US stocks. The momentum here might continue into the coming week, until some other news halts it.

- The ongoing trade war between the USA on one side and Canada, Mexico, China and potentially the European Union on the other has no deal in sight and the new tariffs remain in place, causing economic harm everywhere. This leaves the US Dollar and stock markets.

- There were three other G7 central bank policy meetings last week, but there were no real surprises at any of them. The Swiss National Bank cut its interest rate by 0.25% to 0.25, as was widely expected.

- The clear trends in the markets are falling stock markets, especially in the USA, while two metals – Gold and Copper – have been breaking to new long-term highs.

- The remaining high-impact data last week had little effect, except the slightly worse than expected US Retail Sales data on Monday which did put a dampener on US stocks for a short while.

The coming week has a lighter schedule of important releases, so we are likely to see less volatility in the Forex market over the coming week.

This week’s important data points, in order of likely importance, are:

- US Core PCE Price Index

- US Final GDP

- UK CPI (inflation)

- Australian CPI (inflation)

- UK Annual Budget

- Canadian GDP

- Flash Services & Manufacturing PMI for USA, Germany, UK, France

- US Unemployment Claims

- UK Retail Sales

For March 2025, I made no forecast, as there were no clear trends at the start of this month.

Last week, I made no weekly forecast, as there were no unusually strong movements in any weekly currency crosses.

This week, I again make no forecast.

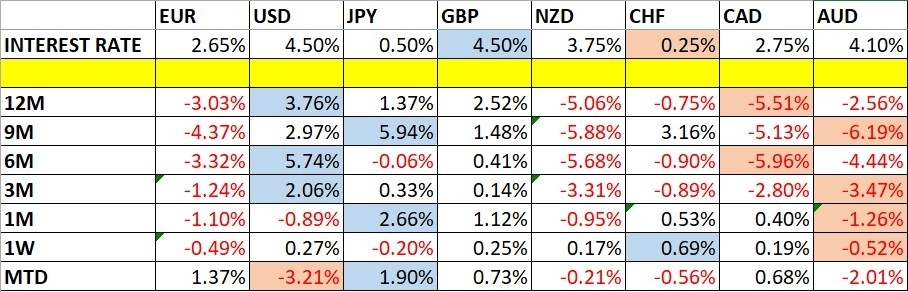

The Swiss Franc was the strongest major currency last week, while the Australian Dollar was the weakest. Volatility decreased last week, with only 4% of the most important Forex currency pairs and crosses changing in value by more than 1%. This is likely to remain low over the coming week, as there is a lighter agenda scheduled.

You can trade these forecasts in a real or demo Forex brokerage account.

Last week, the US Dollar Index printed a bullish outside engulfing candlestick. The candlestick is bullish, with a large lower wick, and closed very near the high of its range.

The price is well below its level of 3 months ago, invalidating its former long-term bullish trend. At one point, the price reached a new 4-month low. However, the long-term trend is mixed and unclear, as the price is still above its level from 6 months ago.

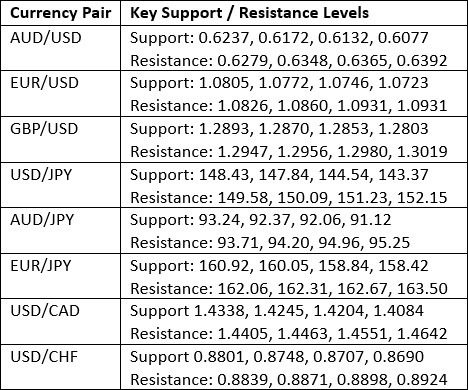

The lack of decisive direction in the greenback suggests that the Forex market is likely to be best traded by playing ranges over the coming week, which would mean looking for reversals from the support and resistance levels given above. I would not pay much attention to what the US Dollar is doing over the coming week.

The short-term momentum might be bullish, at least during the early part of this coming week.

Gold rose again week to reach a new record high above the half number at $3,050. However, the precious metal gave up some of its earlier gains later in the week.

The price closed at a new all-time high as a weekly closing price, but the weekly candlestick does have a significant upper wick.

Some analysts think that Gold is being boosted by safe-haven flow, with the Japanese Yen less attractive due to high volatility, while the US Dollar is unattractive due to of the ongoing US-centered trade war.

I see Gold as a buy right now. This has been a good run – for a bullish trend, and now it is well established above the big round number at $3,000.

The EUR/USD currency pair fell over the past week, rising on the first two days but then making a strong and sustained downwards move for the last three days of the week.

I have no strong belief that this is likely to happen, but if the price makes a strong bullish move and goes on to make a new high as a daily (New York close) above the resistance level at $1.0951, that will represent a valid bullish breakout entry within a valid long-term bullish trend, and I would take it.

Although the Greenback made some progress last week after a bearish period, it could well turn bearish again due to the ongoing trade war which has no resolution in sight, and this could see funds flowing into the Euro and out of the Dollar again.

The USD/JPY currency pair rose over the past week, making a relatively small but significant rise. The Yen is looking to strengthen as the Bank of Japan looks to implement a more hawkish monetary policy including rate hikes, but this is taking longer than expected to play out.

So I have no strong belief that the price is likely to make a significant fall again any time soon, but if the price makes a strong bearish move and goes on to make a new low as a daily (New York close) below ¥147.26, that will represent a valid bearish breakdown entry within a valid long-term bearish trend, and I would take it.

Although the Japanese Yen looks less likely to strengthen, the US Dollar remains vulnerable due to the ongoing trade war which has no resolution in sight, and this could see funds flowing into the Yen and out of the Dollar again.

The S&P 500 Index made a recovery over the past week, continuing to advance from its recent multi-month low. However, the rise has been a bit muted and choppy, and we continue to see the price trade below the 200-day simple moving average, which is typically a bearish sign for this stock market index.

The main reason for the strong drop in most global stock markets, and the major US indices in particular, is of course the large tariffs President Trump has imposed on US imports from Canada and Mexico, and the fact that neither country seems close to capitulating or to make the kind of deal President Trump would want to call off the tariffs. The US tariffs are just negotiation by another means.

Personally, as a trend trader, I will not be entering any new long trades until we see the price make a new record high, and that might not happen for quite a long time.

Short trades are possible but dangerous for beginners. The best opportunity I can see which might set up is if the price tests the area of resistance confluent with the 200-day moving average which I have marked out within the price chart below, between 5713 and 5786. A bearish reversal within that zone, especially if it rejects the moving average, could be an excellent short trade entry signal.

Copper futures again reached a new 9-month high last week, including on Friday, before turning bearish on Thursday and trading lower over the final two days of the week.

Most commodities are not performing very well, but Copper is one of the few exceptions, as is another metal, Gold.

So, what is driving Copper higher? To some extent there are issues with supply, but it is accelerating demand that is a much more important factor. The boom in renewable energy, electric vehicles, and the AI sector are increasing demand for Copper, which pushes up the price.

I see Copper as a buy but only after the price makes a new daily high closing price with a bullish candlestick above $910.20. The downwards move looks a little impulsive so it is maybe better to be on the safe side here with a new entry long.

I see the best trades this week as:

- Long of Gold.

- Long of EUR/USD following a daily close above $1.0951.

- Short of USD/JPY following a daily close below ¥147.26.

- Long of Copper futures following a daily close above $910.20.

Ready to trade our Forex weekly forecast? Check out our list of the top 10 Forex brokers in the world.