The US dollar initially fell against the Japanese yen but has found enough support near the 140 level to turn things around and bounce quite significantly. It’s interesting, because the 140 level has been a major support level going back some time now, and it’s also worth noting that the 200 Week EMA sits there as well. By forming this massive hammer, and the fact that some of the rhetoric out there has gone off the rails, it’s starting to look more and more like the US dollar is in the process of bottoming. Furthermore, the Japanese yen looks like it is giving up some of that strength.

The US dollar initially fell during the course of the week to break down below the 0.81 level, only to turn around and bounce all the way toward the 0.83 level. The US dollar looks like it is ready to rally from here, but whether or not it can change the overall trend is a completely different question. If we can break above the 0.84 level, then I think we have a situation where we could rise as high as 0.8750 level. However, if we turn around a breakdown below the weekly candlestick, then we could drop to the 0.80 level eventually.

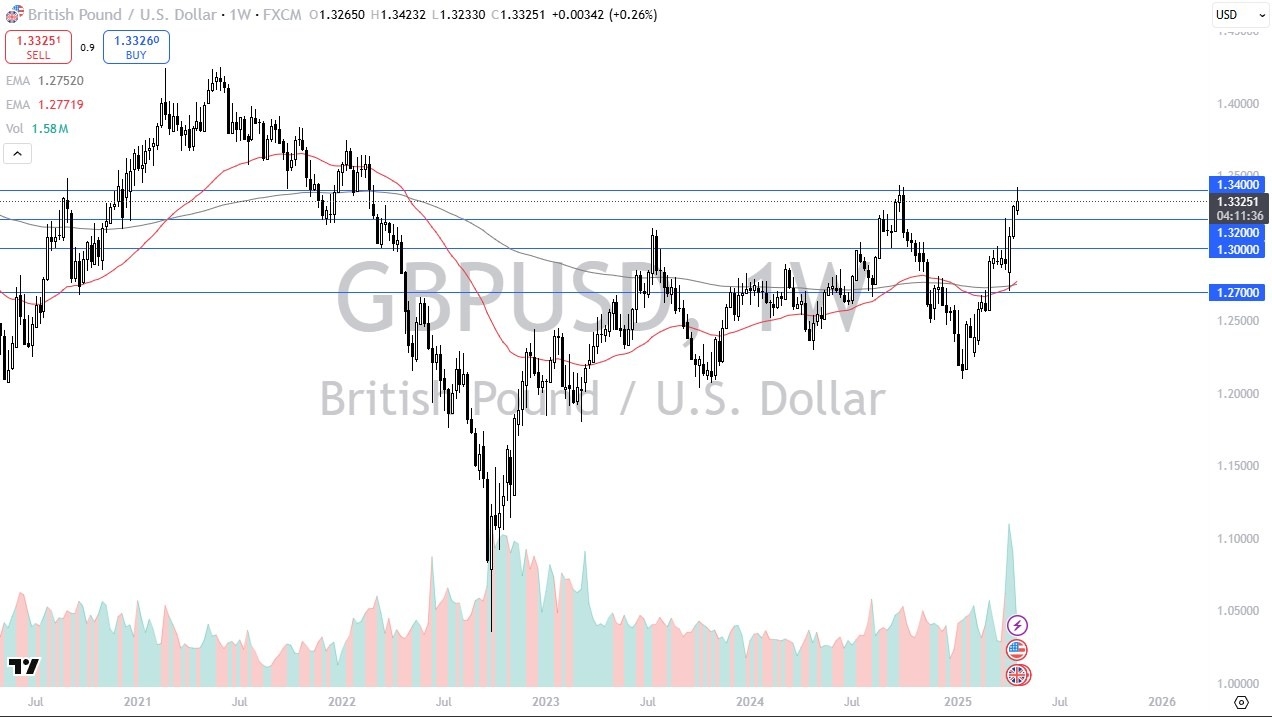

The British pound has rallied significantly during the course of the week, but it found the 1.34 level to be far too resistant to continue. By doing so, we ended up forming a bit of a shooting star. This is a market that is overbought, so a pullback makes quite a bit of sense at this point in time. In fact, I am seeing this across the board when it comes to the US dollar, so I think all things are leading to the same scenario, where the greenback is suddenly going to strengthen. That being said, it doesn’t necessarily mean that the British pound will fall apart, just that we have certainly gotten too far ahead of ourselves. However, if we were to break above the 1.34 level on a weekly close, we could really start to accelerate to the upside.

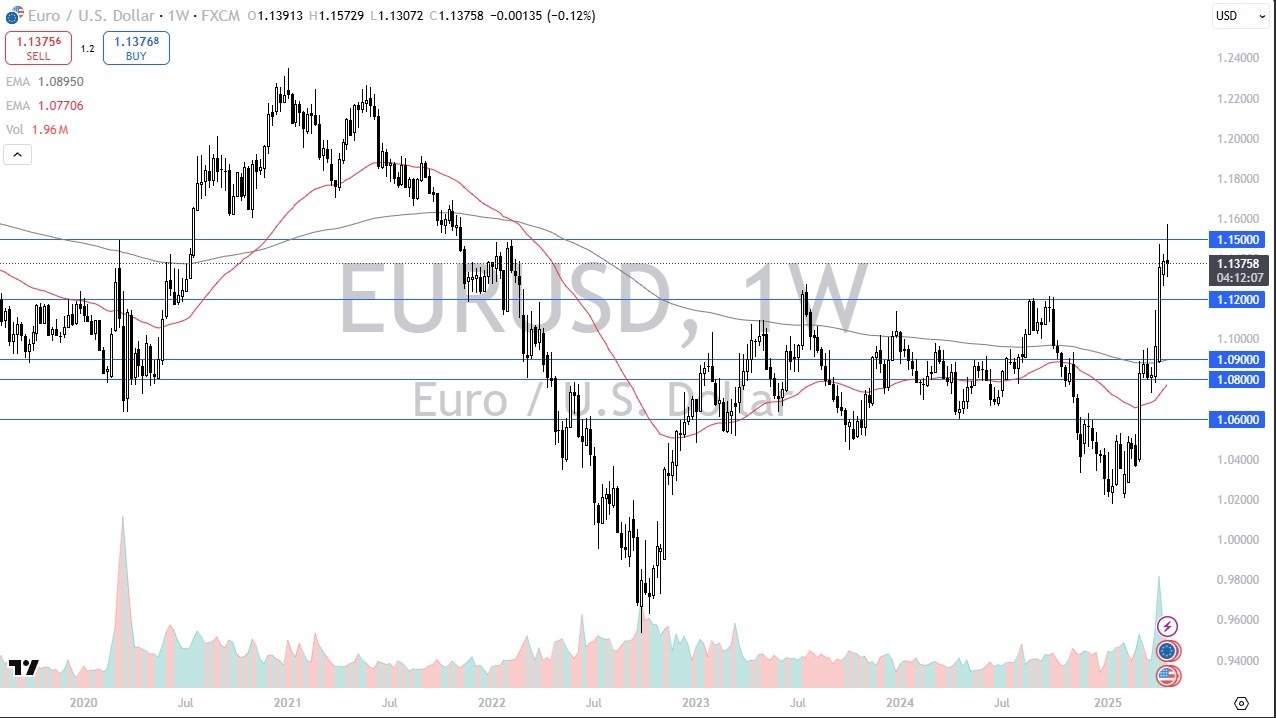

There are a few charts out there that suggest exhaustion in US dollars selling more than this one. I believe that the 1.15 level continues to be a large, round, psychologically significant figure, and an area where we have seen a lot of problems in the past. By forming a massive shooting star, it’s likely that we could drop from here and go down to the 1.12 level. If we were to break down below the 1.12 level, then we really start to see the US dollar pickup strength across the board.

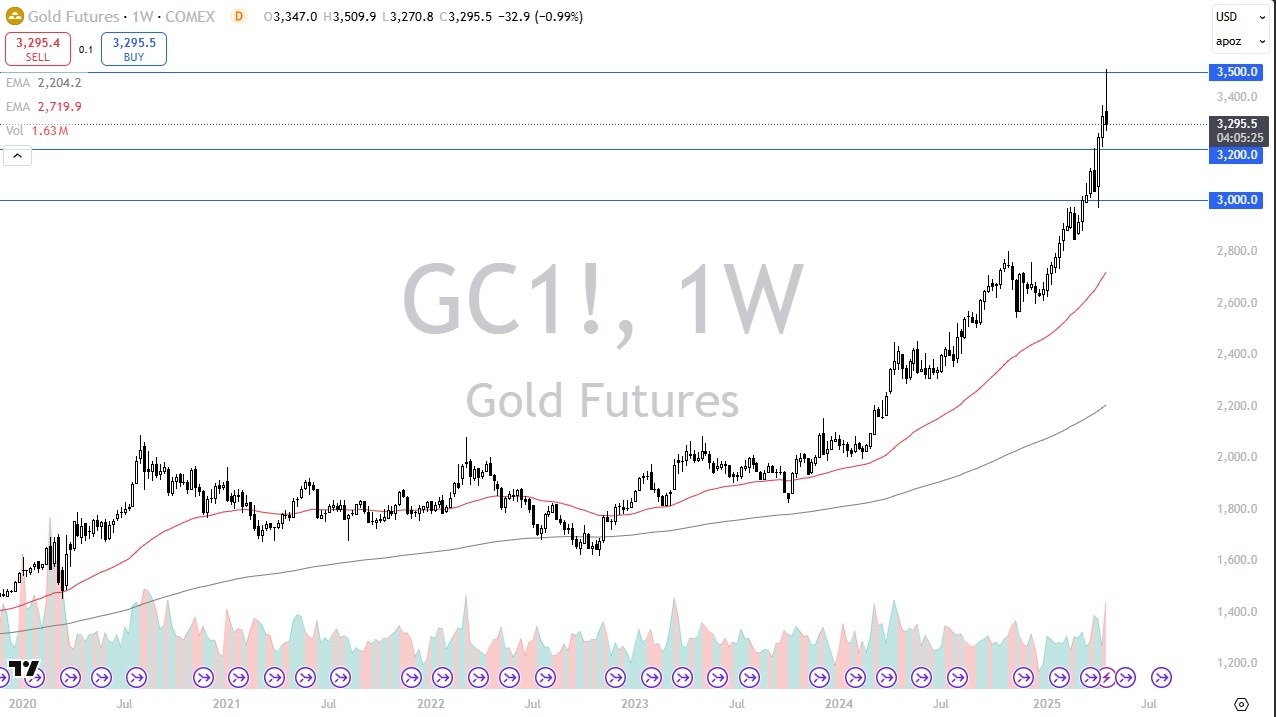

Gold markets initially launched higher during the trading week, but during the Asian session we managed to hit the $3500 level. The $3500 level of course has a lot of psychology attached to it, and we ended up forming a shooting star, which of course is a well-known exhaustion candlestick, and therefore it would not surprise me at all to see the gold market drop toward the $3200 level. After that, we could drop all the way to the $3000 level. That being said, the market is also going to be paying close attention to the US dollar, and gold only shows the same things that the previously mentioned charts show, that the US dollar is oversold.

Gold markets initially launched higher during the trading week, but during the Asian session we managed to hit the $3500 level. The $3500 level of course has a lot of psychology attached to it, and we ended up forming a shooting star, which of course is a well-known exhaustion candlestick, and therefore it would not surprise me at all to see the gold market drop toward the $3200 level. After that, we could drop all the way to the $3000 level. That being said, the market is also going to be paying close attention to the US dollar, and gold only shows the same things that the previously mentioned charts show, that the US dollar is oversold.

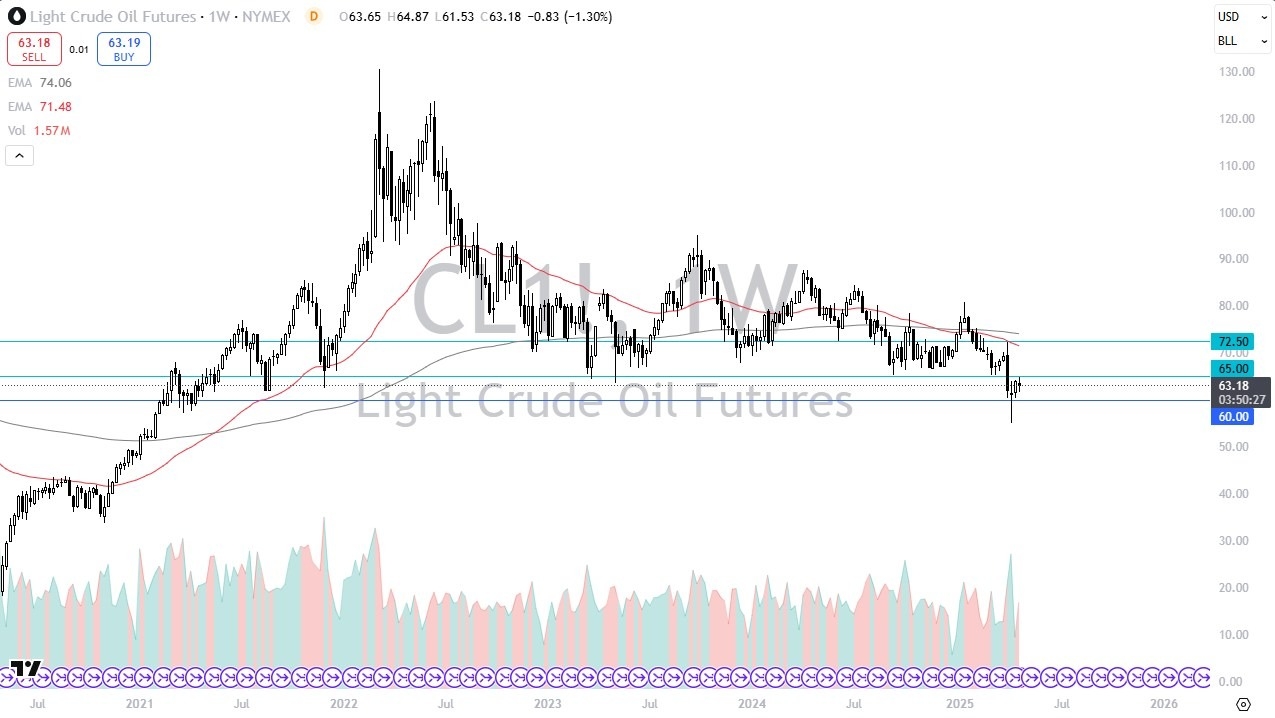

The CL contract has been back and forth during the week, as we continue to build some type of basing pattern. At this point, it does make a certain amount of sense that we are still in a somewhat sideways market, but the key to seeing more gains in the crude oil market will be the $65 level. If we can break above there, then we might see more FOMO entering this market. One thing that could be a major boon for the oil market is if we do in fact see some type of resolution to the tariff situation around the world.

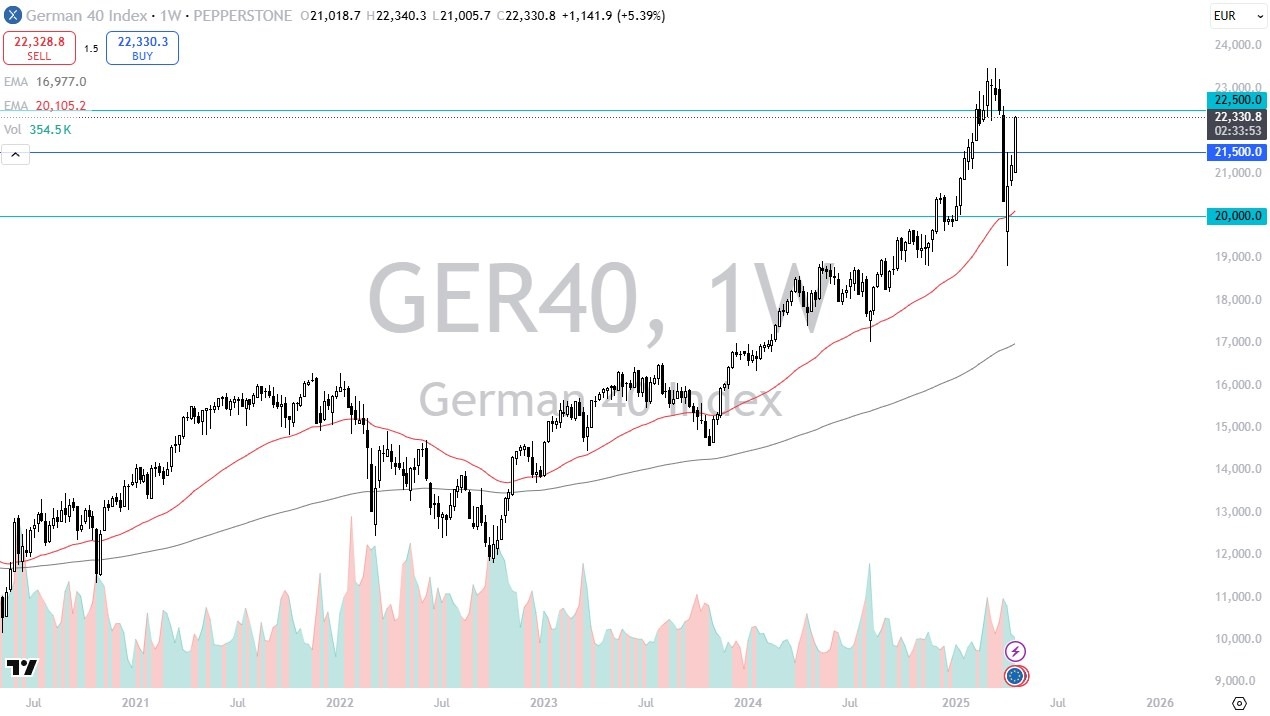

The German index shot straight up in the air like a rocket over the last week, as we have seen a lot of positivity in stocks around the world. The tax now faces the challenge of the €22,500 level, but with the massive amount of momentum that we have seen to the upside, it would not surprise me at all to see this market pull back a bit in order to find enough value to eventually continue higher as Germany has been extraordinarily bullish.

The NASDAQ 100 has seen itself launched during the previous week, but we are also testing a previous uptrend line. Furthermore, the 50 Week EMA sits just above, so I think that probably comes into the picture as well. Regardless, the price action cannot be ignored and at this point in time it looks like Wall Street is expecting some type of trade deal. Short-term pullbacks should continue to attract attention in a potential “buy on the dip” market.

The NASDAQ 100 has seen itself launched during the previous week, but we are also testing a previous uptrend line. Furthermore, the 50 Week EMA sits just above, so I think that probably comes into the picture as well. Regardless, the price action cannot be ignored and at this point in time it looks like Wall Street is expecting some type of trade deal. Short-term pullbacks should continue to attract attention in a potential “buy on the dip” market.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.