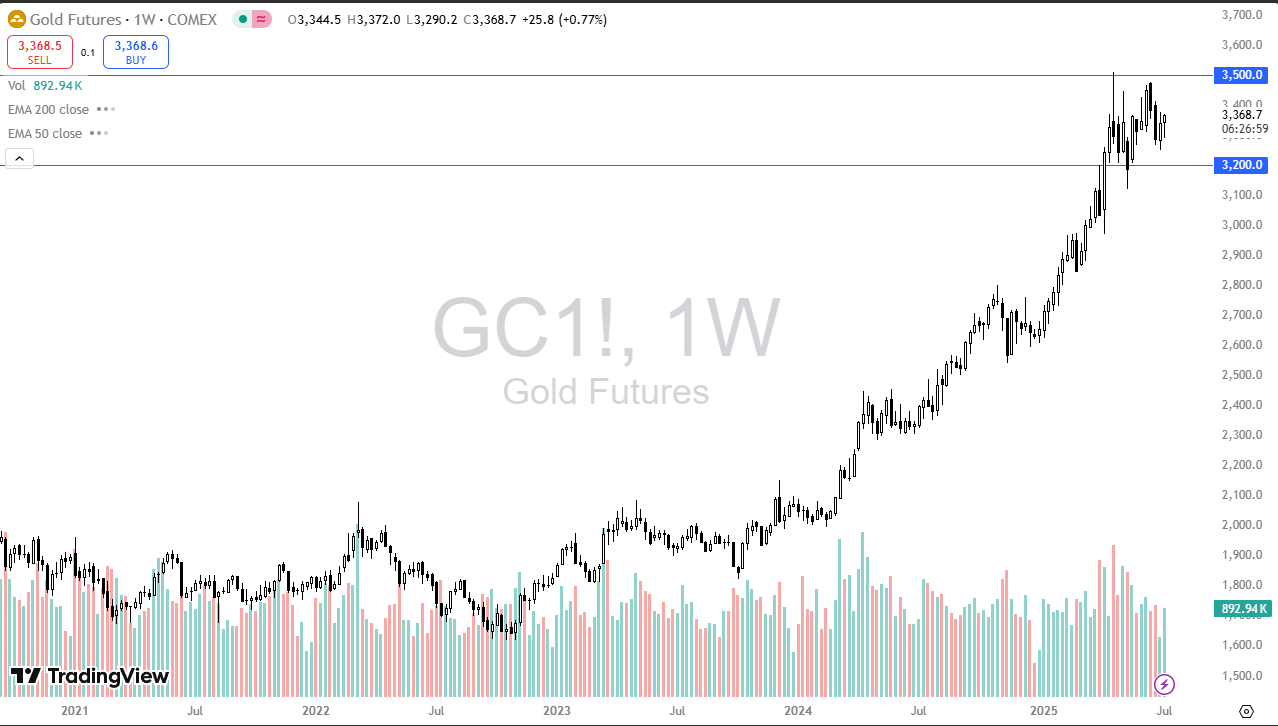

Gold markets initially fell during the course of the week but then turned around to show signs of strength. Quite frankly, we still have a lot of noise out there when it comes to tariff wars, and when you look at the longer-term charts, it’s obvious that we have seen so much in the way of upward momentum that it only can go sideways for a while, working off some of the excess froth. Currently, we are trading in the middle of the overall consolidation range between $3200 on the bottom, and the $3500 level at the top.

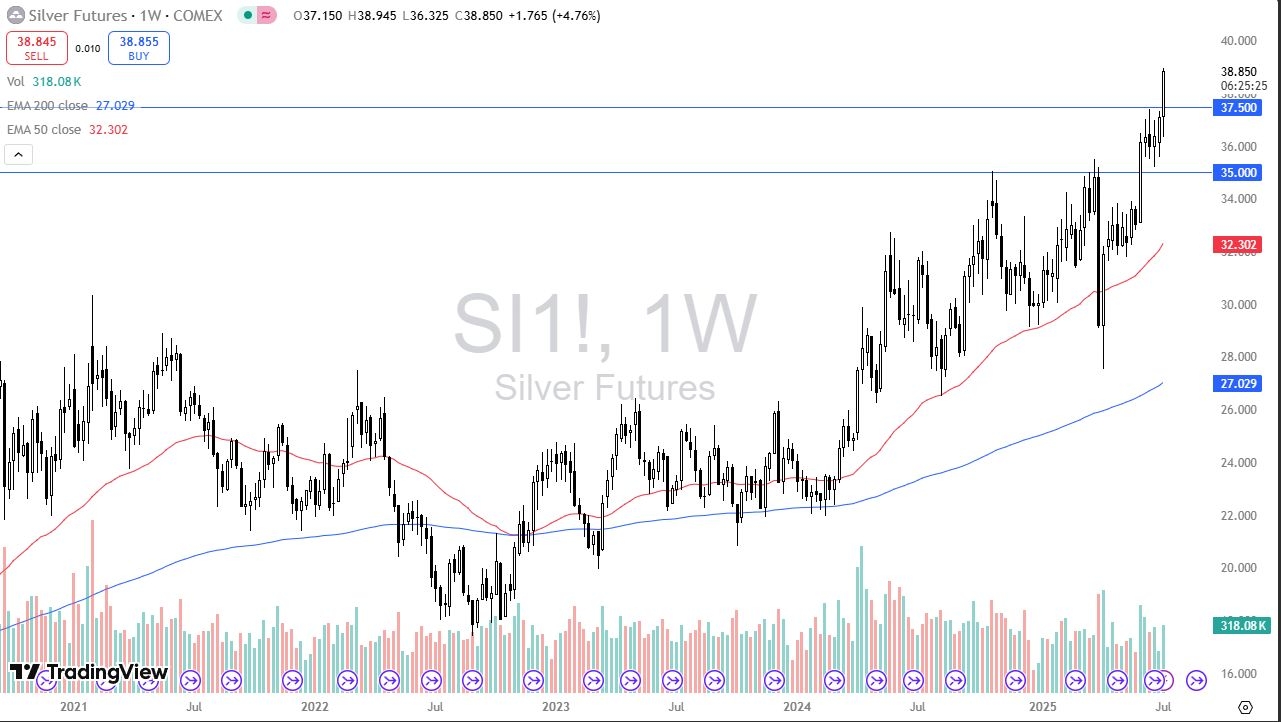

Silver has broken above a major resistance barrier in the form of $37.50, an area that has been difficult to get above the month. Ultimately, short-term pullbacks will end up being buying opportunities in this market, and if we can pull back toward the $37.50 level, then I think you have a real shot at the market finding a bit of “market memory” in this area. Based on the “measured move” of the previous consolidation, it’s likely that silver will try to get to the $40 level above.

The German index DAX rally during most of the week and even managed to pierce above the €24,500 level. The market breaking above that level was a bullish sign, but we have given back some of these gains, so I think we are still very much in the way of consolidation. Looking at this chart, the €23,500 level should be thought of as a short-term floor, and I think it makes a lot of sense that we go sideways for a little bit before continuing the overall uptrend as Germany tends to lead the way for the European Union.

The euro fell during the course of the week, as we are a little bit overdone at this point, and a pullback from here probably opens up the possibility of a move down to the 1.16 level. The 1.16 level is an area that previously had been resistant, and therefore it makes a certain amount of sense that the market sees that as a potential floor. If we break down below there, the market then goes down to the 1.15 level. To the upside, the 1.19 level is a significant resistance barrier, perhaps even a target.

The US dollar has recovered against the Mexican peso during the bulk of the week, using the 18.60 level as a support level. By rallying the way we have, the market looks as if it could try to continue this move, but I think this is probably one of the situations where we will be looking for signs of exhaustion in order to start shorting again. The 200 EMA sits just above the 19.00 level, so therefore it’s worth noting that the market is still very negative at this point. If we break down below the 18.50 level, then the US dollar could drop down to the 17.50 MXN level.

The US dollar has been going back and forth against the Swiss franc during the bulk of the week, as we continue to hang on to the 0.79 level. This is an area that’s been important in the past, and it is worth noting that the previous week formed a hammer. If we can break above the 0.80 level, there might be a short term rally just waiting to happen to the 0.81 level. If we were to break above there, that could change quite a bit. Nonetheless, this is a market that is more likely than not going to continue to be somewhat sideways and choppy.

The US dollar rallied significantly during the trading week, reaching toward the crucial ¥148 level. If we can break above the ¥148 level, then it’s possible that the US dollar goes looking to the ¥151 level, followed by the ¥159 level. All things being equal, this is a market that I think continues to be very noisy and I do believe that buyers will come in and try to pick up value on short-term pullbacks with the ¥142 level being a major floor in the market at this point. Interest rate differential continues to favor the US dollar, so please keep that in mind as it could be a major factor.

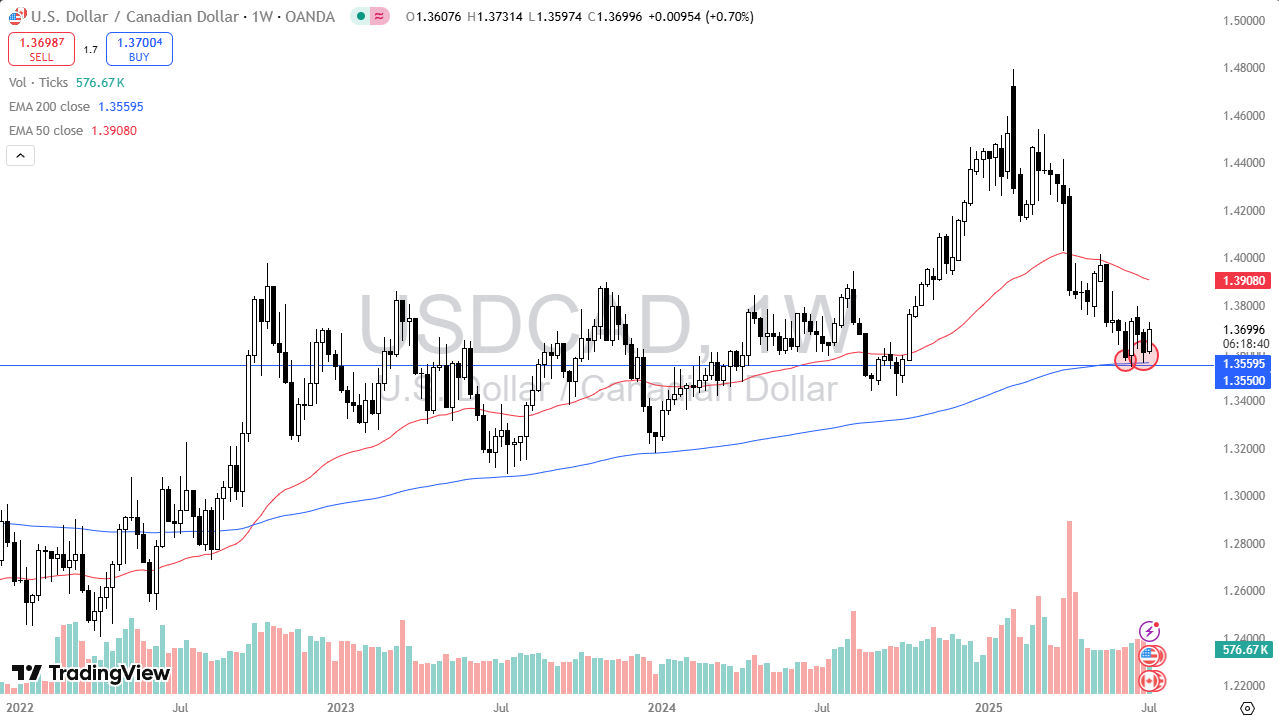

The US dollar rallied significantly during the week, as we continue to see a lot of sideways action, with the 1.3550 level underneath offering support, especially now that the 200 Week EMA is in that general vicinity. The 1.3750 level above is significant resistance, so I think we continue to go back and forth in this area, trying to figure out where the next move is. It’s very neutral at the moment, but it is worth noting that there is a massive amount of support just below.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.