The US dollar rallied against the Japanese yen during the course of the week and even broke above the ¥145 level. That being said, the market has pulled back just a bit, but I think we still see plenty of support near the ¥142 level, and I do think that we might be in the midst of a bottoming pattern. Furthermore, we are starting to see the US dollar stiffen it’s resolve against the basket of major currencies that we typically followed. In other words, we may be in the middle of turning things around.

The British pound initially did try to rally during the course of the week but gave back gains. All things being equal, the market looks as if it is going to be watching the crucial 1.35 level, as it is a major support level, based on the fact that it has been a major resistance barrier. All things being equal, the “market memory” should come into the picture, but if we break down below that level, then I think the British pound might find itself in a little bit of trouble. On the other hand, if we can break above the 1.3650 level, the British pound could really start to take off.

The German index did rally a bit during the course of the week, but it is starting to show signs of hesitation around the €24,000 level. At this point, the market might be a little bit overbought, and while we broke above a major resistance barrier, we got there so quickly that I think a little bit of sideways action probably makes a certain amount of sense. I think we are starting to see a lack of confidence in chasing the FOMO trader. Pullbacks are likely at this point.

The NASDAQ 100 took off to the upside during the course of the week but has given back enough gains to show signs of hesitation. The 22,000 level is going to be difficult to get above, as it is a large, round, psychologically significant figure, and close enough to the all-time highs that people will be paying close attention to it. If we do pull back from here, I think it only offers a buying opportunity given enough time, but we need to see some of this excess froth worked off here, just as we see it in multiple other indices around the world.

The euro initially fell during the course of the week, to reach the 1.12 region, before turning around and bounced. All things being equal, this is a market that I think continues to be very noisy, so I think at this point in time you are looking at this through the prism of a sideways consolidation range, as we had shot straight up in the air previously. With this being the case, the market is likely to continue to be very choppy, but if we do break down below the 1.12 level, then I think we have to go to the downside.

Silver has had a negative week, but at the end of the day, we are still trading in the same range, and it looks like the $33 level is important, so watch that very closely. Furthermore, the range is defined at $34 level above, and the $32 level underneath. With this, I think you will continue to see a lot of sideways action, but it does look like short-term dips continue to get bought in this environment as silver is continuing to build up a case to go much higher.

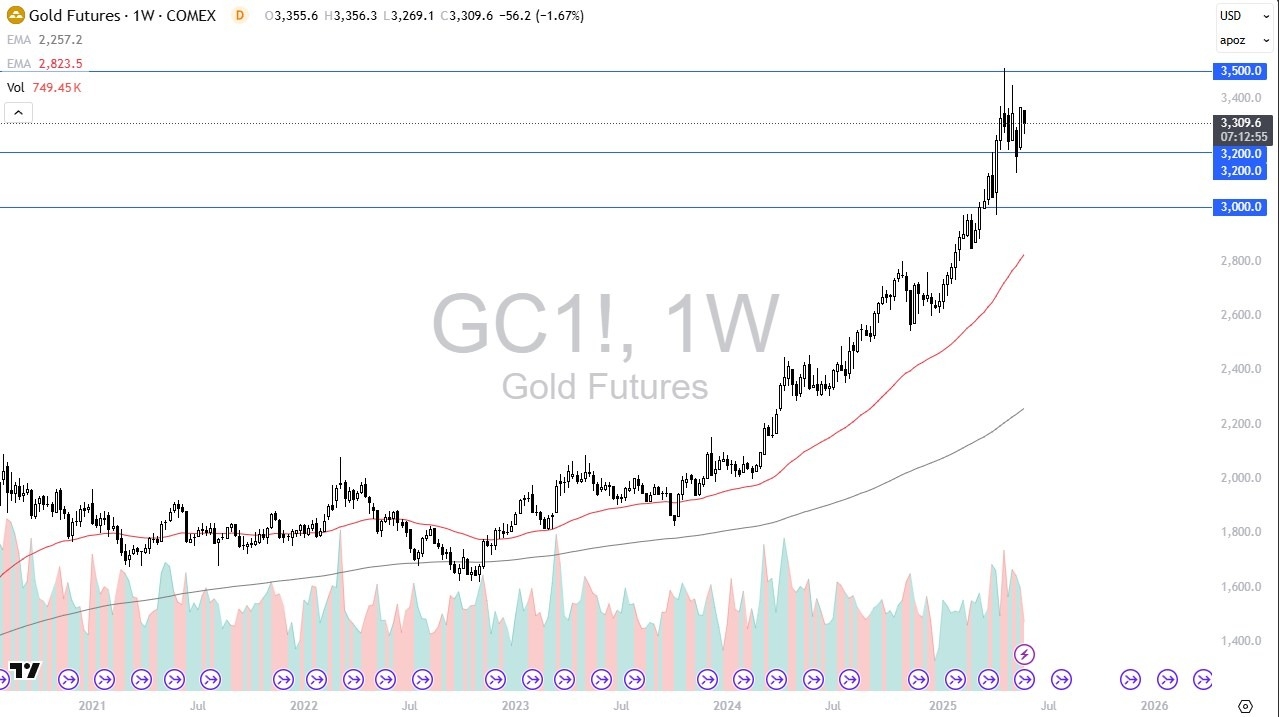

Gold markets had a somewhat negative week, but I think at this point I would not worry too much about the overall uptrend, because quite frankly we are in a situation where we need to work off a lot of excess momentum, and this means that we will probably try to find a range. Ultimately, the $3200 level continues to be supported, and I think it probably holds between now and then. If we break to the upside, then the $3500 level would be your next target, and of course a major resistance barrier that if we break above there, gold could really start to take off.

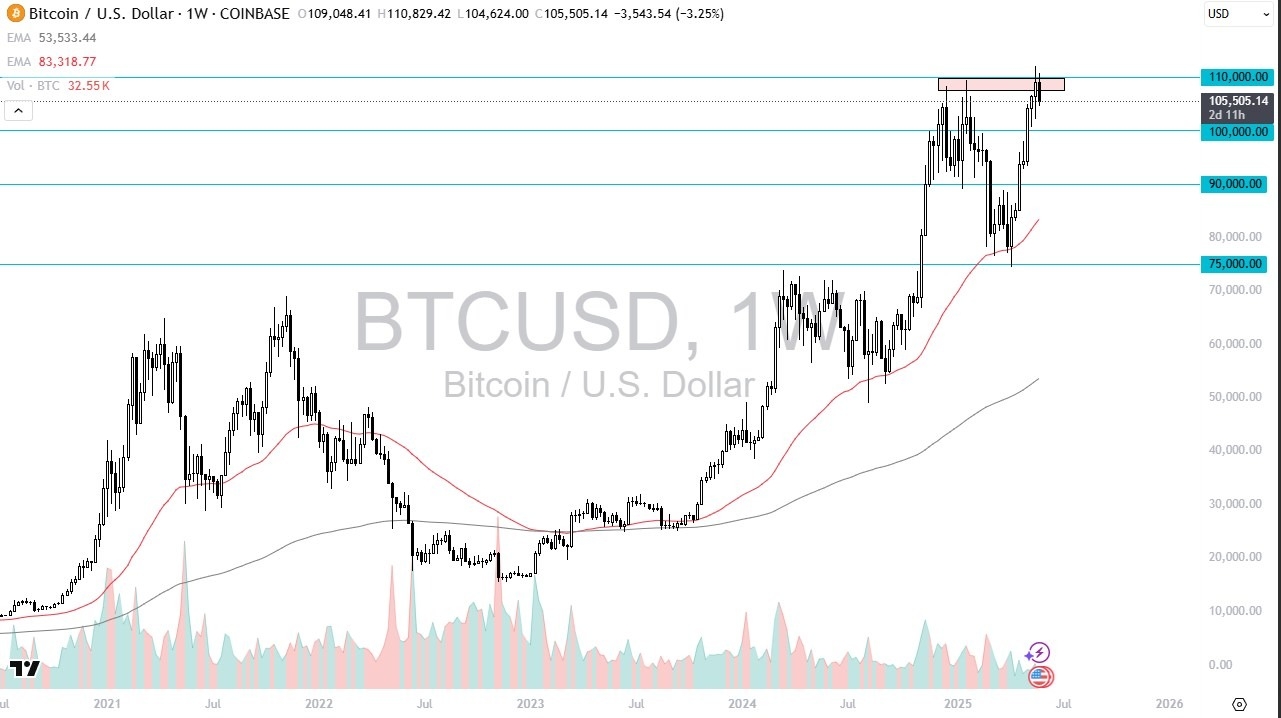

Bitcoin had initially tried to rally during the trading week, but we have found the area above the $110,000 level to be a bit too much for the market, and I think that ultimately Bitcoin is going to have to spend some time in this general area to attract enough inflows to finally break out to the upside pull back to the $100,000 level is entirely reasonable, but it will more likely than not end up being a buying opportunity and what has been extraordinarily bullish market.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.