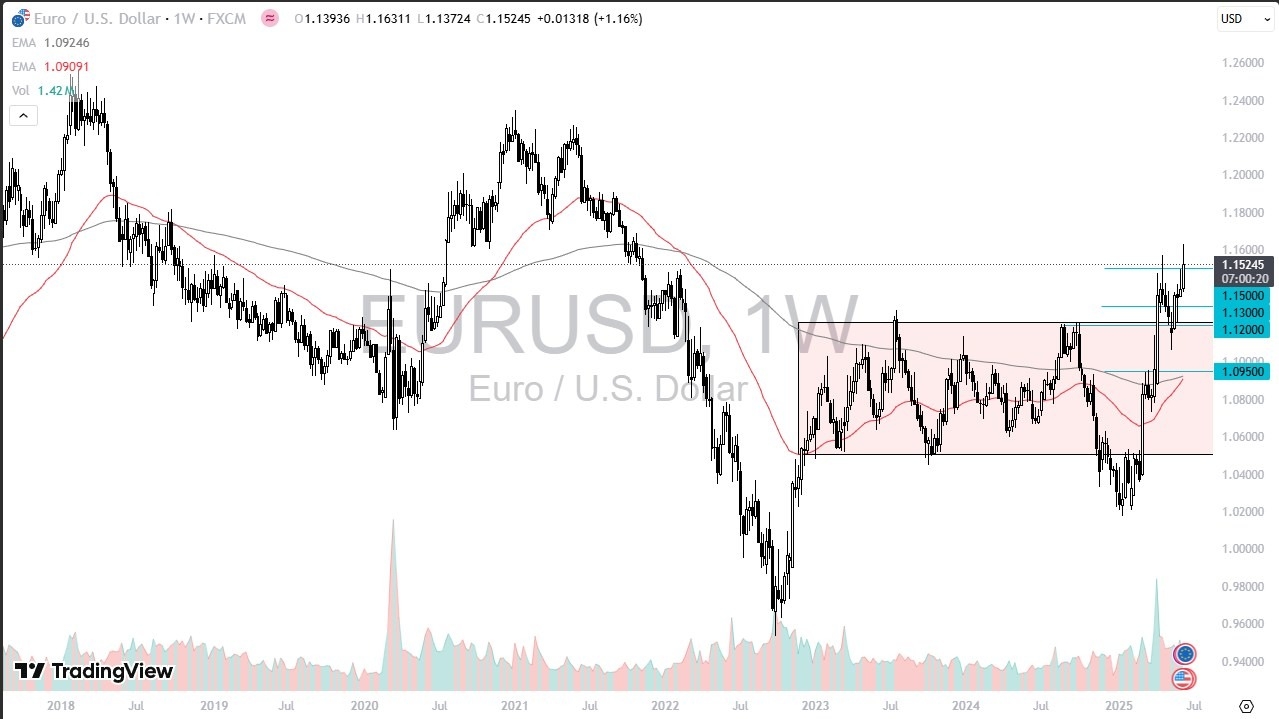

The euro rallied a bit during the trading week, breaking above the 1.16 level, but we have given back some of the gains after the Israeli airstrikes on the Iranian regime. This of course has people running toward safety currency such as the US dollar, so it does make sense that we have seen hesitation. However, earlier in the week we had seen quite a bit of bullish pressure, so one would have to assume that there is at least some demand out there for the euro. I suspect the next couple of weeks will be very violent but may have a bit of a bid for them.

The US dollar spent most of the week falling against the Mexican peso, but turned around after the airstrikes, and because of this we are sitting right at the 200 Week EMA. We are also at the crucial 19 MXN level, so if we were to bounce from here it would make a certain amount of sense, but I see a lot of resistance near the 19.40 MXN level, so whether or not it is going to truly rally remains to be seen, I think that could be an area where we could see some issue. A break above the 50 Week EMA could send this pair to the 20 MXN level.

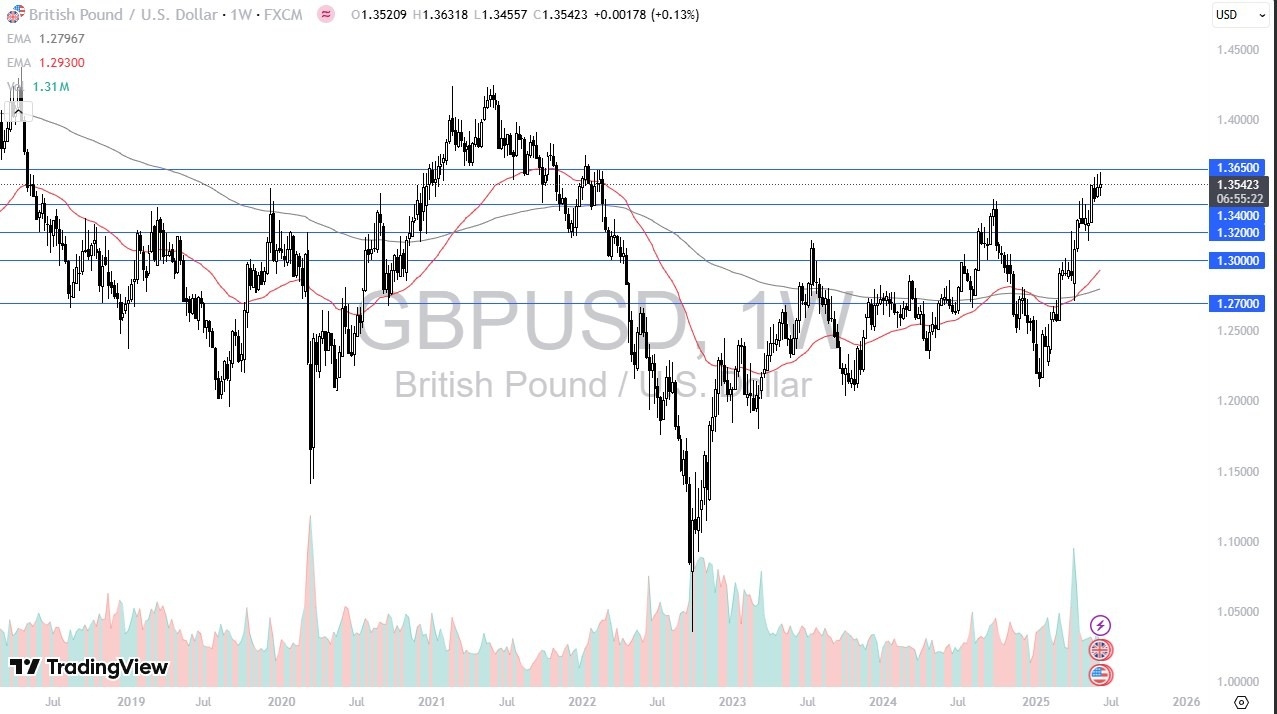

The British pound has been all over the place during the week, as we continue to see a lot of questions asked of the US dollar. That being said, after the airstrikes on Friday, we have seen a little bit of a pushback against risk-taking, so it’ll be interesting to see how this plays out. Ultimately, I think we have a scenario where traders will be looking at this through the prism of risk appetite, and right now we are currently trading in a range between the 1.34 level on the bottom and the 1.3650 level on the top.

The Australian dollar traders have seen the market go back and forth during the course of the week as we continue to watch the 0.6550 level as a massive barrier. If we were to break above there, then the market could go much higher, perhaps reaching to the 200 Week EMA near the 0.67 level, but ultimately with this neutral candlestick, I think we have a situation where the market is more likely than not to continue to grind sideways overall as we have no real clear direction.

The US dollar has spent most of the week falling, but it looks like the 0.81 level is trying to serve as some type of major support level, as it has proven itself to be important more than once. If we turn around and rally from here, this could form a massive “double bottom” in this pair. If we break down below the lows of the last couple of months, then it opens up a move down to the 0.80 level, which obviously is a large, round, psychologically significant figure. Keep in mind that both of these are considered to be safety currencies, but the Swiss franc is a little bit more “safer” than the US dollar.

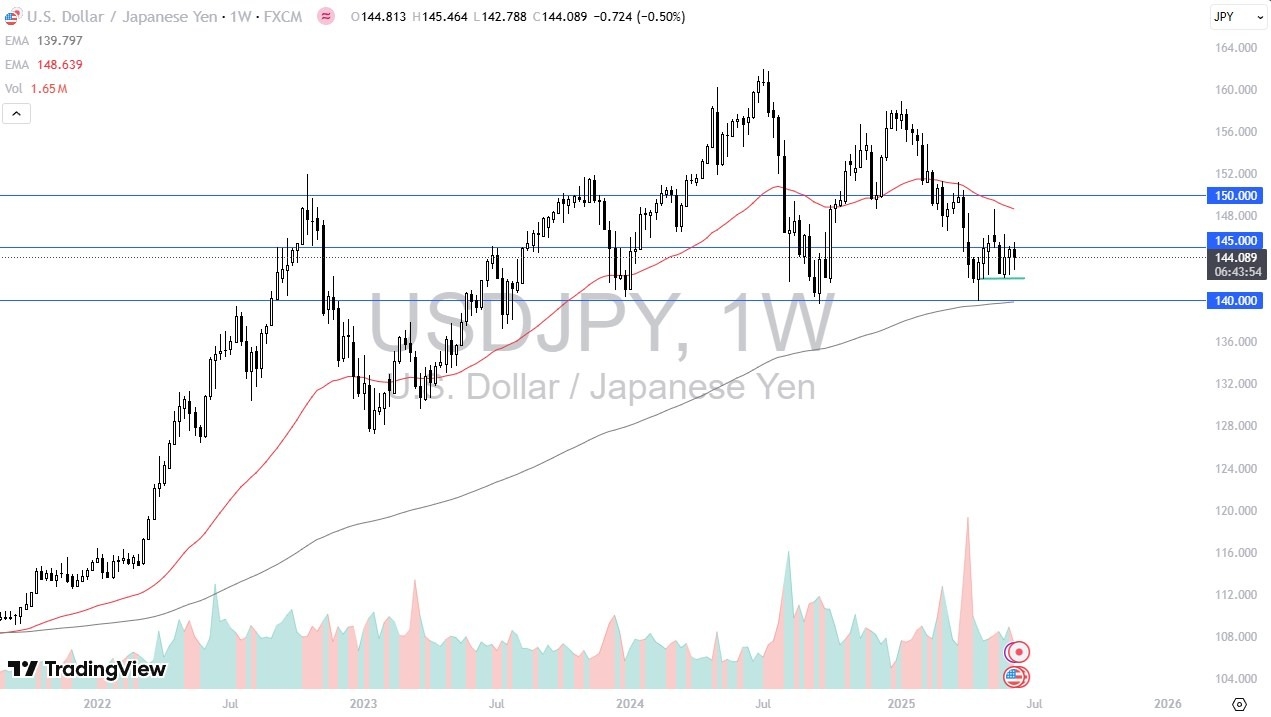

The US dollar spent most of the week falling against the Japanese yen but also turned around here, and now I think you have to look at the ¥145 level as a major resistance level, and breaking above it could open up a move to the upside. With this being said, I think you have a situation where we are in the midst of trying to form some type of bottom, and therefore I think you will continue to see a lot of sideways back and forth volatility. Ultimately, I think you have to look at this through the prism of consolidation more than anything else.

Gold markets have rallied quite significantly during the week, as traders continue to worry about the situation in the United States. That being said, I think you have a scenario where we will continue to see a lot of noisy behavior, but I think it’s probably only a matter of time before we $3500 level and breaking above that obviously unleashes the next leg higher. Short-term pullbacks should continue to see support near the $3300 level, followed by the $3200 level.

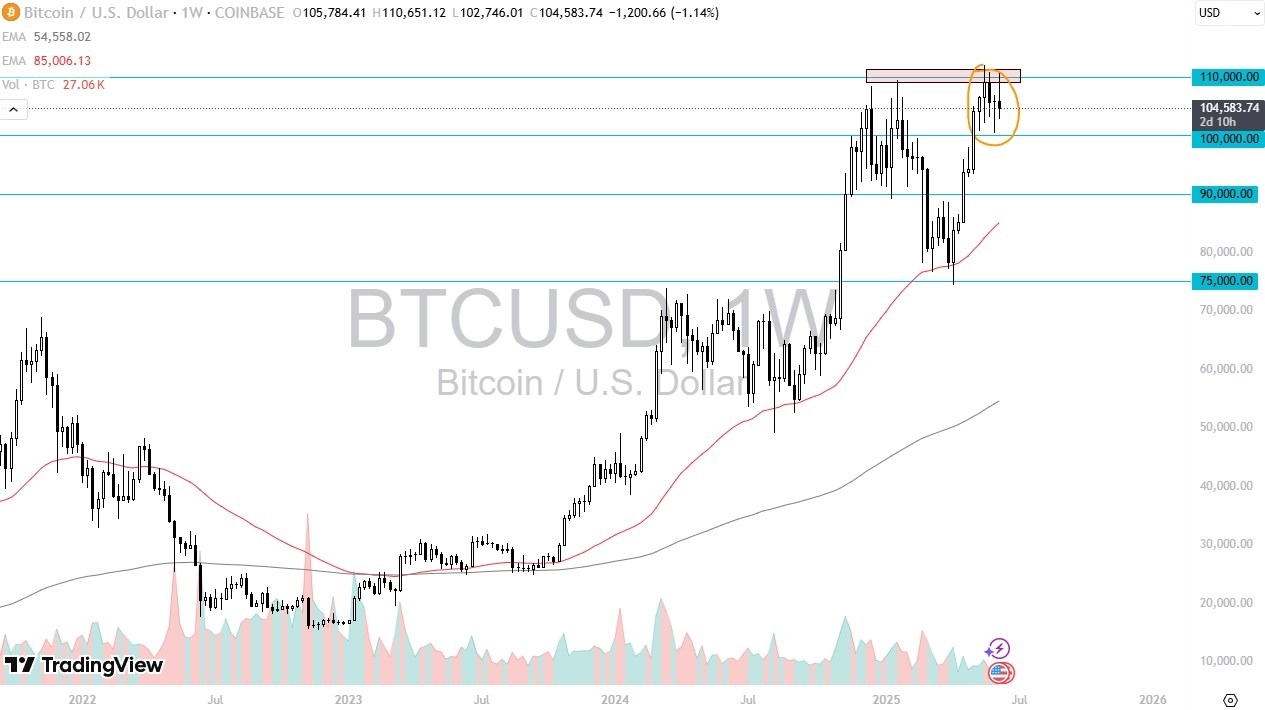

Bitcoin has been all over the place during the trading week, as we are basically in the middle of the range. The range is currently sitting between $100,000 on the bottom, and $110,000 in the top. With this, I think you have a lot of choppy volatility, but we are still very much in an uptrend, so we could just spend some time working off extra froth from that huge move over the last couple of months. I have no interest in shorting this market at all.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.