The US dollar has rallied during the course of the week as we have now turned around to break above the ¥150 level. This is a market that is trying to find a bit of a bottom, as we just formed a little bit of a double bottom. That being said, the market has the 50 Week EMA above offering significant resistance, so a break above there could send this pair looking to the ¥155 level. On the other hand, if we break below the ¥148.50 level, then the market could drop down to the ¥145 level.

The NASDAQ 100 fell during the course of the week, to reach the 20,500 region. However, the question now is whether or not we can stay within the consolidation area that we have been in, or if we are in fact getting ready to break down. If we break down below the bottom of the candlestick for the week, we could see the NASDAQ 100 drop down toward the 20,000 level. The 20,000 level is a large, round, psychologically significant figure that is also backed up by the 50 Week EMA at the same time. On a break above the 21,000 level, I suspect that buyers will return to this market.

The Euro initially tried to rally during the course of the trading week but found the 1.05 level to be far too much to overcome, and we have since fallen toward the 1.04 level. At this point, the market is likely to see a lot of noisy behavior, as we continue to find the area between the 1.02 level the bottom, and the 1.05 level above as the top. All things being equal, this is a market that remains range bound from what I can see.

The gold market initially tried to rally during the week but has given back the gains as the market has formed a nasty candlestick. That being said, the market is likely to continue to see a little bit of turbulence, but at the end of the day, the market is still very much in an uptrend, and I would not be betting against them. After all, there are a lot of concerns when it comes to tariffs, and of course global trade in general. With this being said, I anticipate that the gold markets will remain bullish over the longer term, but in the short term might have a lot of issues.

The US dollar initially fell during the course of the week but has seen a lot of strength since then, only to show the market flexing its muscles. At this point in time, the market is likely to continue to see a lot of importance placed on the interest rate differential, and of course the fact that the Americans are likely to levy tariffs on the European Union, it will have a major influence on what happens with the Swiss economy. Remember, the interest rate differential most certainly favors the Americans.

Silver markets have plunged during the course of the trading week to test the crucial $31 level. The $31 level of course has been important multiple times, so the fact that we have pulled back to that area only to turn around and show signs of life in the short term could get people a little bit of hope, but the shape of this candlestick is so ugly that I would be very cautious at this point. In fact, I’m assuming that silver is going to end up dropping from here a bit further, perhaps trying to carve out the same range that we had been in previously.

The British pound has rallied a little bit during the trading week, reaching toward the ¥190 level, but it has not been able to break above there for a sustainable move. That being said, the market were to rally from here and break above that level, then I think the 50 Week EMA comes into the picture, as well as the ¥195 level above. On the other hand, if we were to break down below the candlestick for the week, we would have to pay close attention to the ¥187 level.

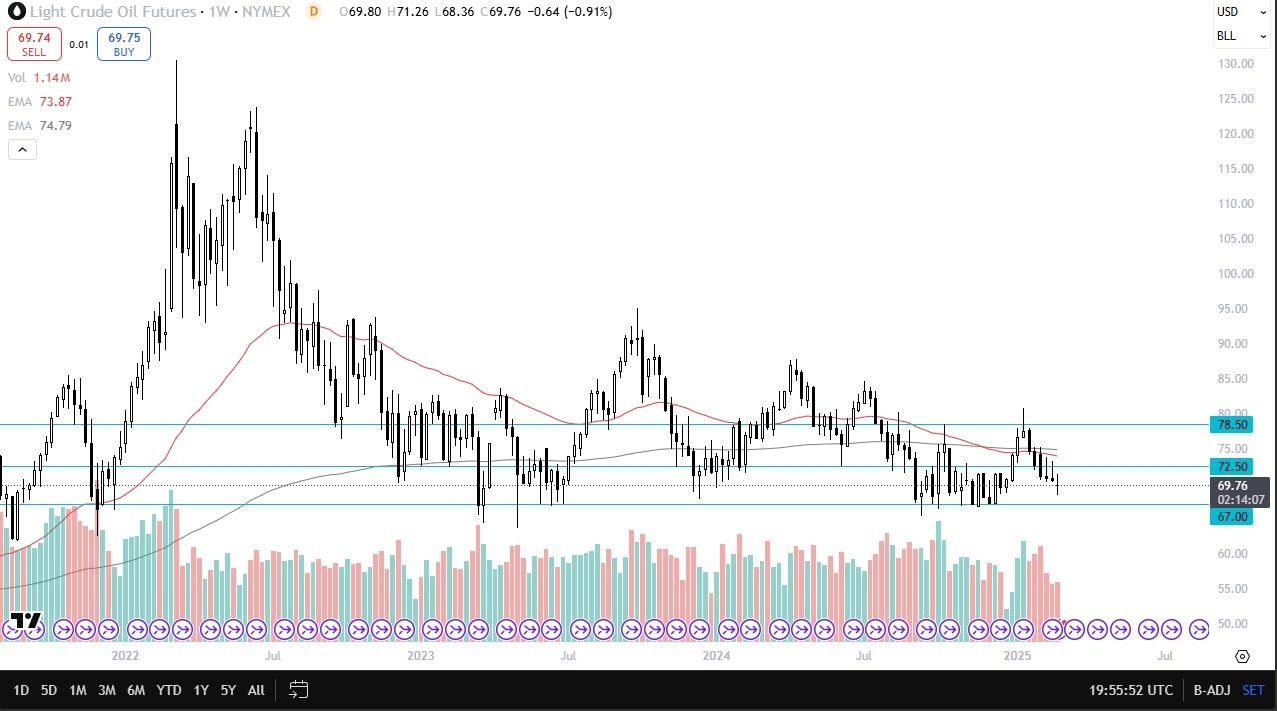

The Light Sweet Crude market has been back and forth during the course of the trading week, as we are trying to figure out where to go next. That being said, the market has been in a range for most of the last couple of years, so I suspect that we will continue to go back and forth. The $67 level should be a support level, and I think it’s also essentially the “bottom of the market” at the moment. If we turn around a break above the $72.50 level, then the market could go looking to the $78.50 level afterwards.

Ready to trade our Forex weekly forecast? We’ve made this forex brokers list for you to check out.