The euro has had a slightly positive week against the Japanese yen, which quite frankly is a bit perplexing due to the fact that we have seen risk appetite get eviscerated yet again. Part of this might have to do with the fact that the Bank of Japan cannot tighten monetary policy any further, but the ¥160 level is an area that I think will continue to be important and perhaps support. If we were to break down below that level, then the euro is going to drop to the ¥155 level from what I can see. On the other hand, if we can break above the ¥165 level, that would be extraordinarily bullish.

The US dollar has dropped initially during the week, only to turn around and show signs of life again. All things being equal, this is a market that is still very much stuck in a range, and I think it can’t seem to pick up its feet. All things being equal, the market is moving on the latest headlines, and I do think that it continues to favor the US dollar overall, because the Canadians are certainly not backing down, despite the fact that they have very little chance of “winning the trade war.”

The German index initially tried to rally for the week, breaking well above the €23,000 level. However, we have seen the index fall rather significantly, breaking through the €22,500 level during the course of the week. Quite frankly, this is a very ugly candlestick, and we are now starting to press toward the bottom of the overall range that we have been in. If the DAX can stay above the €22,000 level, that might be a good buying opportunity, but we would need to see some type of bounce. With all of the noise coming out of the tariff wars, I expect more volatility, not less.

The US dollar initially tried to rally but gave back gains against the Swiss franc, as we continue to see a lot of noise globally. We are hanging around the 0.88 level, and quite frankly this is a market that doesn’t seem like it has anywhere to be at the moment. This does make a certain amount of sense considering that both of these currencies are considered to be “safety currencies.” With the absolute chaos that seems to be gripping the markets now, it makes quite a bit of sense that we continue to see both of these currencies chop back and forth against each other.

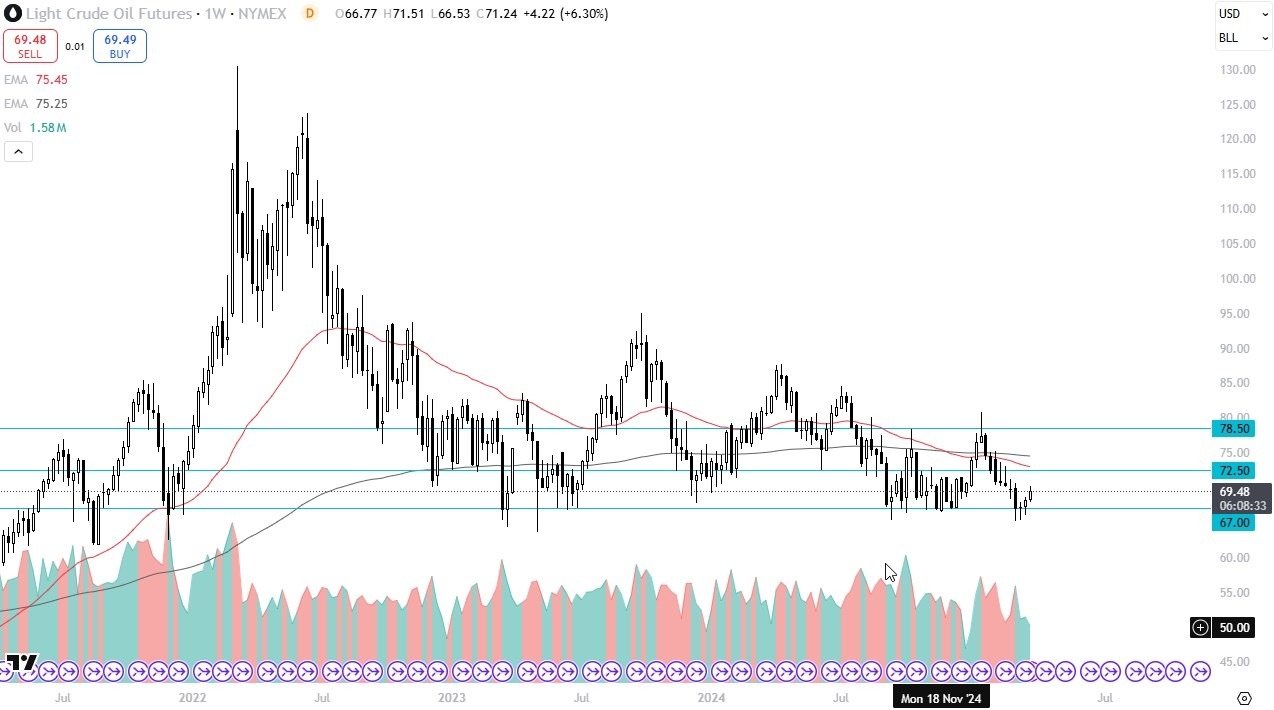

The West Texas Intermediate crude oil market has rallied significantly during the week, as we continue to be stuck in a bit of a range. I think the massive “floor in the market” will remain between the $65 level and the $67 level. As long as the market stays above there, it remains a “buy on the dips” type of situation, as traders continue to look for some type of momentum, but when you look at the longer-term charts, you can see that we had just tested a major bottom.

Gold markets initially pulled back a bit during the trading week, only to find massive support at the $3000 level. The $3000 level of course is a large, round, psychologically significant figure, but after the recent bullish flag that we had formed, the implied “measured move” suggest that gold is going to go looking to the $3300 level. As long as there is chaos, and let’s be honest here, it seems like a lot of countries are looking for it, gold will continue to be a major beneficiary. I have no interest whatsoever in shorting this market.

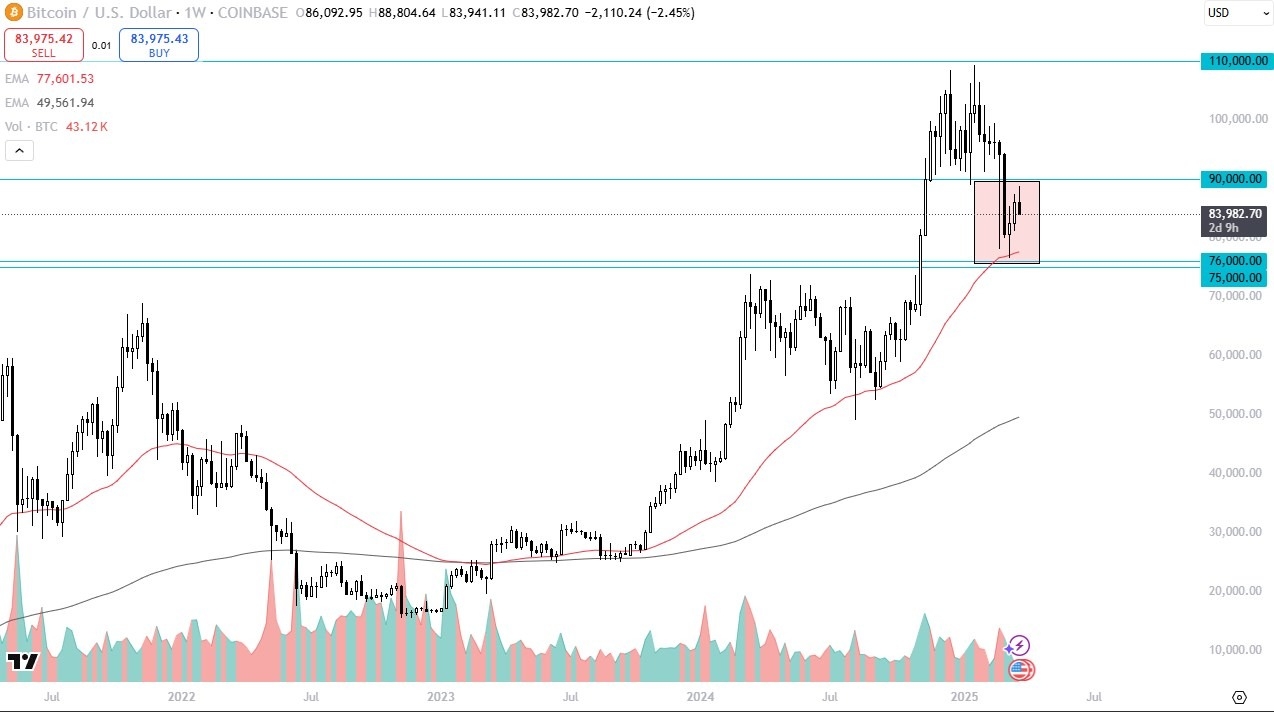

Bitcoin initially tried to rally during the course of the week, only to turn around and show signs of negativity. The $90,000 level above is a major resistance barrier, and if we can break above it would obviously be a very bullish sign. However, Bitcoin is essentially dead money at the moment, so we will have to wait and see whether or not the $75,000 level holds as massive support. It’s also worth noting that the 50 Week EMA sits right around that area as well. All things being equal, we are still in a range, but this last week looks ugly.

The NASDAQ 100 continues to look terrific, and as long as Donald Trump continues with tariff threats, this will be the fate of most indices. That being said, we are getting a little overdone at this point, so either we are going to get something along the lines of 2008, or we are going to pump the brakes fairly soon. Regardless, this is not a market you need to be messing around in. Let the big institutions come in and pick the market up, before trying to follow them.

Ready to trade our Forex weekly forecast? We’ve made a list of some of the best regulated forex brokers to choose from.