The German index initially tried to take off to the upside on Monday, as we gapped higher, only to turn around and fill the gap. That being said, the €23,500 level looks to be a significant support level as we have bounced nicely from there, and ultimately, I think we have a situation where the market has recently broken above significant resistance, and it’s likely that we will continue to see buyers on each and every dip. I suspect at this point the DAX will go looking to the €25,000 level.

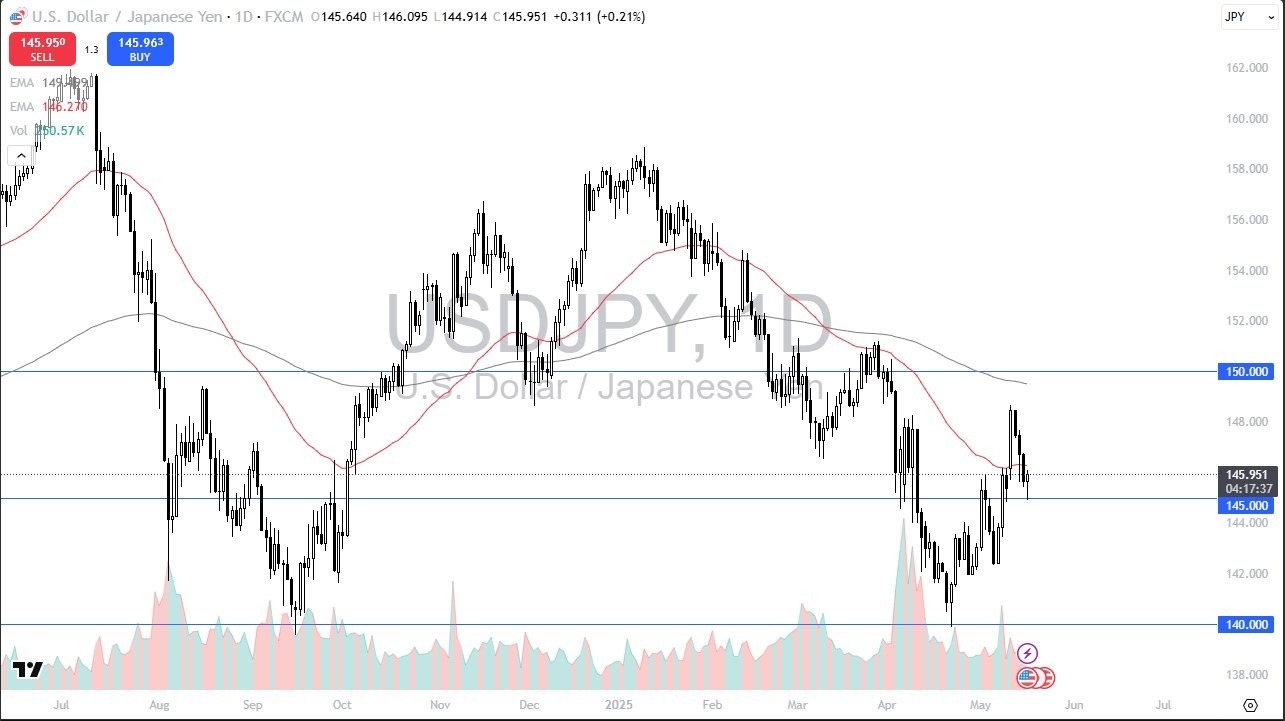

The US dollar initially fell during the week against the Japanese yen, but the ¥145 level has offered support. All things being equal, this is a market that continues to see a lot of volatility, but there are a lot of buyers underneath that will continue to come into the market and choose the US dollar due to the interest rate differential, as the Bank of Japan has absolutely no real chance of tightening anytime soon. Meanwhile, bonds are selling off in the United States, driving yields higher.

Gold has had a tough week, but it looks as if we are closing just below the crucial $3200 level. The $3200 level of course is a large, round, psychologically significant figure, and an area that a lot of people would be watching very closely. After all, it has served as support and resistance multiple times, and of course we are in the middle of a massive rally overall. With this being the case, I do suspect that if we can recapture the $3200 level, then it is possible that the gold market starts reaching toward the upside yet again.

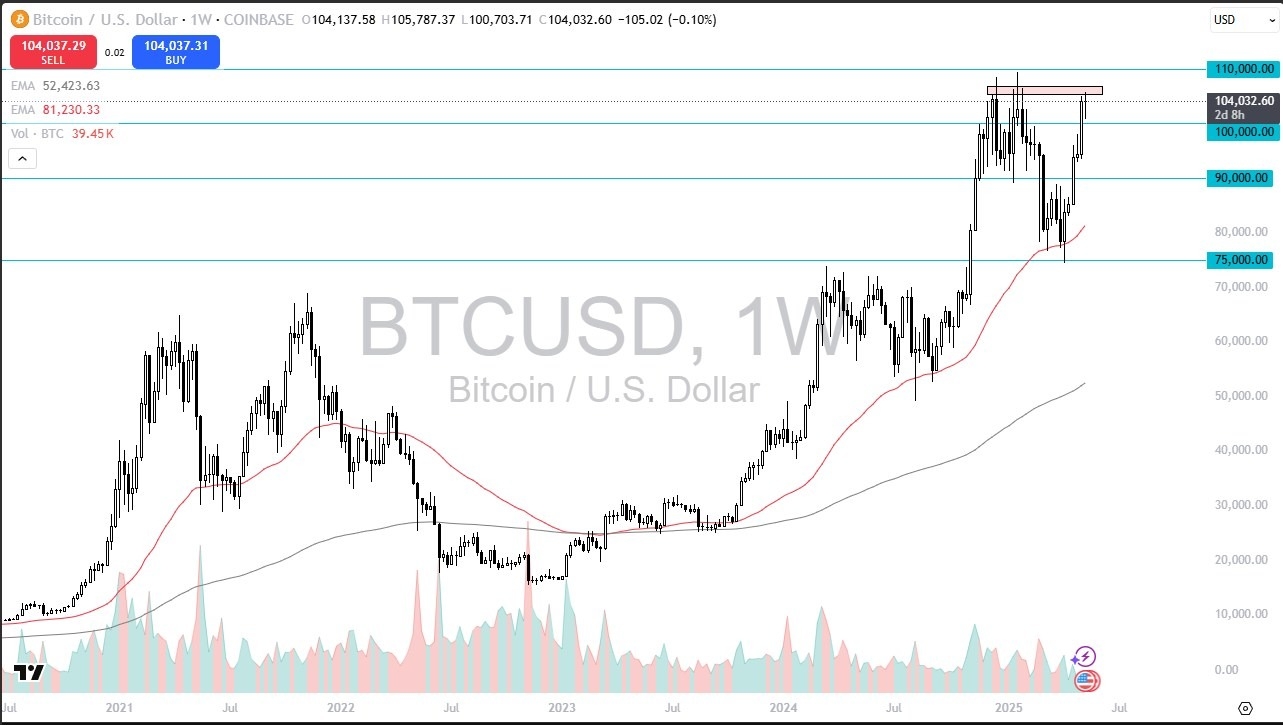

Bitcoin has a pretty choppy week but ultimately ended up settling on a fairly unchanged turn of events. All things being equal, this is a market that continues to find buyers on dips, and therefore I suspect it is probably only a matter of time before we break out above the crucial $106,000 level, allowing us to take a serious look at breaking above the $110,000 level. The $100,000 level underneath is likely to be massive support, as we continue to see Bitcoin performs fairly well, and at this point it more or less needs to digest some of the massive gains.

The NASDAQ 100 has exploded to the upside yet again, as buyers continue to flood into the marketplace. The 21,000 level will more likely than not end up being support, right along with the 20,000 level. Ultimately, I think any short-term pullback is more likely than not going to be a buying opportunity as we continue to reach towards the 22,000 level above which was a major all-time high. This obviously is the goal of bullish traders out there, and with this momentum it’s hard to argue that they won’t be able to do it.

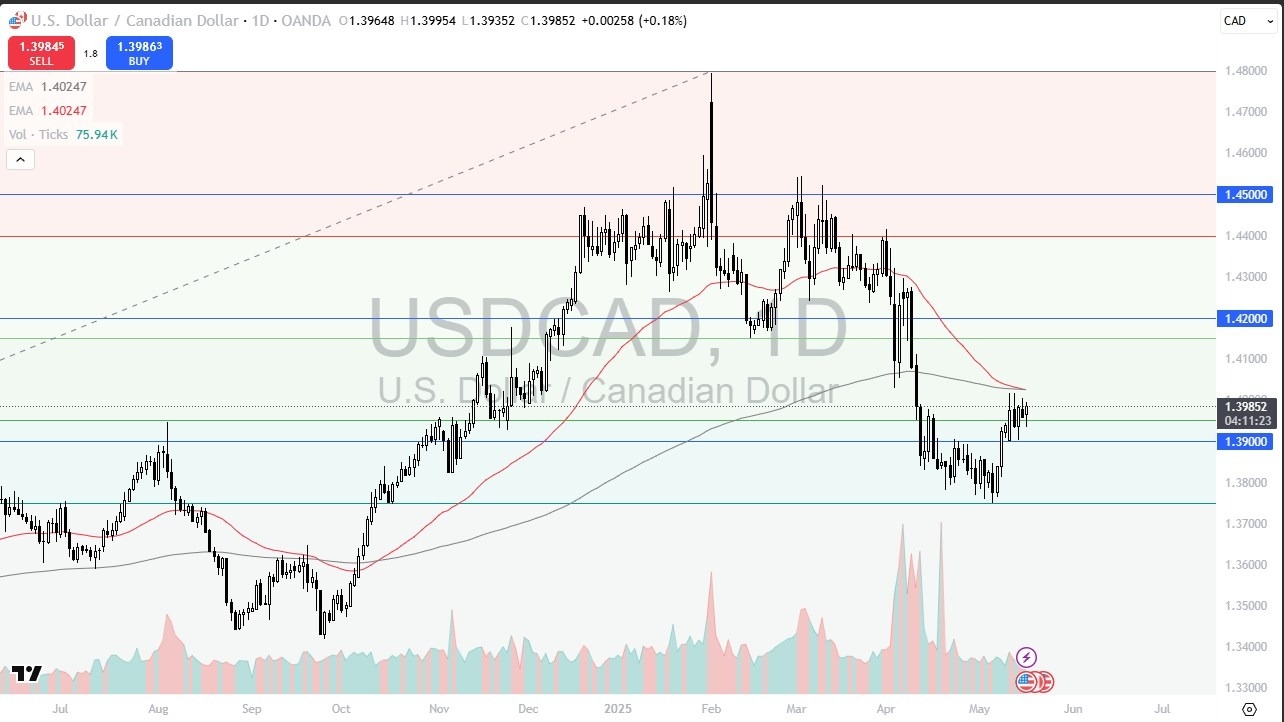

The US dollar initially pulled back against the Canadian dollar during the week but has turned around to show signs of support. The market continues to see a lot of upward momentum, and at this point in time the US dollar continues to strengthen against multiple other currencies, so the Canadian dollar probably won’t be any better, especially as the United States and Canada still do not have a trade deal worked out. Ultimately, short-term pullbacks and a break above the 200 Week EMA both represent more momentum going to the upside.

The British pound has been all over the place during the week, essentially settling for a neutral candlestick. That being said, we have seen 3 shooting stars in a row on the weekly chart at the 1.34 level, which is an area that has been significant resistance previously. Because of this, I’m still looking to the downside, and I think short-term rallies open up the opportunity to sell the British pound. If we can break above the 1.35 level, then that would be a major break out and we could go much higher. In that environment I would anticipate that the US dollar is probably struggling against most currencies, not just the British pound.

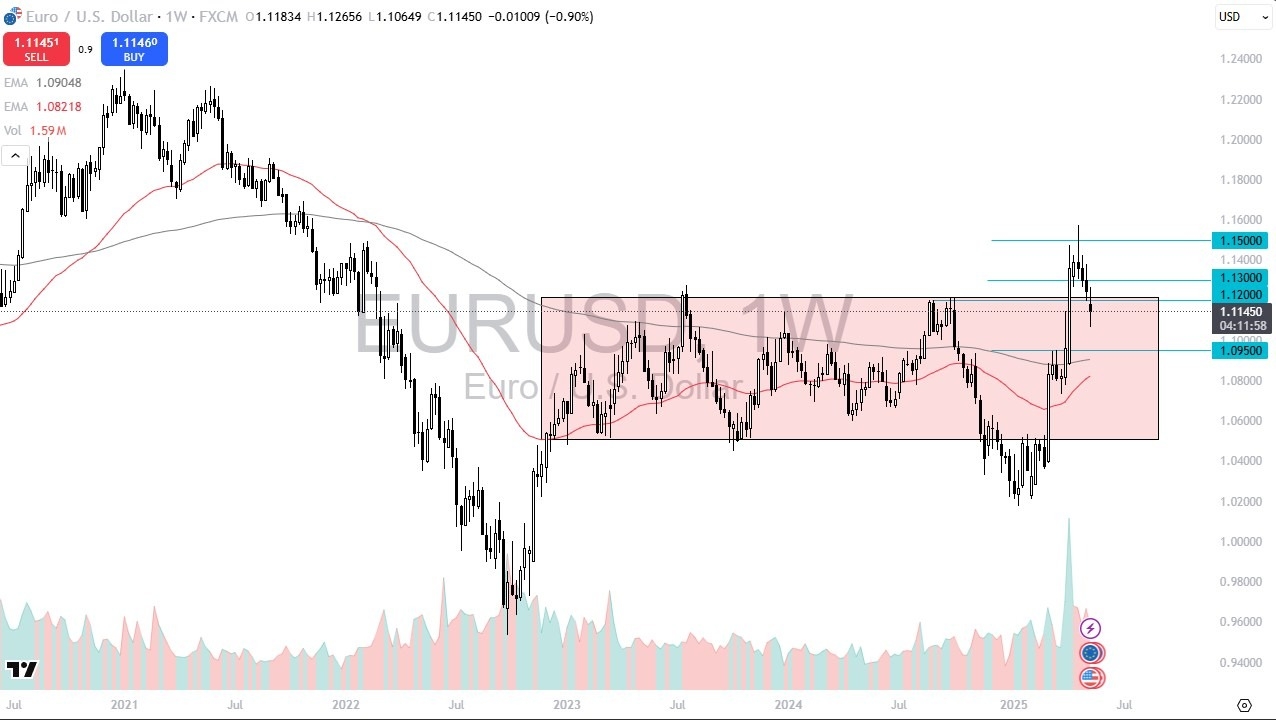

The euro has been very negative during the week, gapping lower before turning around and filling that gap, and then plunging, before bouncing. All things being equal though, we ended up selling off quite nicely, and it looks as if the euro is going to continue to go lower, as we have reentered the previous consolidation area with the 1.12 level offering a bit of resistance during the previous couple of years, and now that we have jump back into that rectangle, I think we could start dropping to the 1.0950 level. A break above the 1.13 level opens up the possibility of a retest of the 1.15 handle.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.