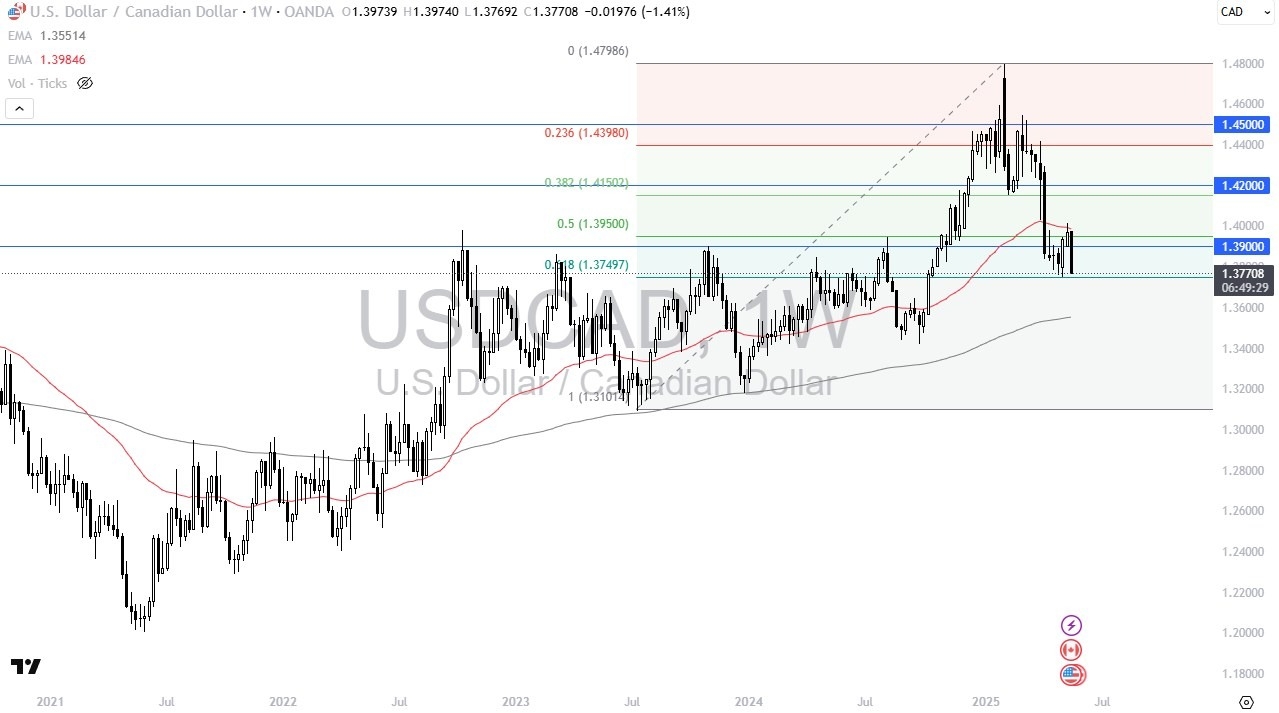

The US dollar has plummeted against the Canadian dollar during trading this past week, as we are now testing the crucial 1.3750 level. The 1.3750 level is an area that is very important, and at this point in time, the market is likely to continue to see a lot of volatility and potential support, but at this point, I would need to see the US dollar recapture the 1.39 level to begin to think about buying against the Canadian dollar, despite the fact that there is still no trade agreement between the 2 economies.

The crude oil markets have been all over the place during the week, as we tested the $65 level but then turned around to show signs of hesitation. The $60 level seems to be offering support, and if we can stay above that level, then I think you’ve got a real opportunity to go back and forth on short-term chart. I think that’s probably the most likely turn of events, but Donald Trump announced 50% tariffs being recommended against the European Union starting June 1, and that could be negative for oil, only time will tell. If we can recapture the $65 level on a daily close, then I think crude oil can rally quite nicely.

The US dollar fell rather significantly during the trading week against the Japanese yen, and now that we have more chaos involving tariffs, it’s possible that we could see the Japanese yen continue to strengthen. This flies in the face of the interest rate situation, and at this point in time I am fairly neutral about this pair. I believe there is a ton of support between current levels in the ¥140 level, so I am looking for stability and a turnaround to start buying. If we were to break down below the ¥140 level, that would be extraordinarily negative.

This might be one of the more interesting pears this week, as the United States and the European Union are about to ratchet up tensions as far as tariffs are concerned. It’s interesting to see that there is a lot of resistance right around the 1.14 level, extending to the 1.15 level. If we can take out the 1.15 level on a daily close, then I believe the euro will really start to take off. In the meantime though, it’s hard not to notice that we are struggling in an area that were resistance has been a mainstay of for some time. I favor the downside, at least for the moment but this is a very fluid situation. Ultimately, this will probably be a situation where traders pay more attention to the US dollar than anything else.

The German index has been all over the place during trading for the week, and the announcement on Friday of upcoming US tariffs on the European Union has caused even more chaos. That being said, it is a bullish market at the moment, and it’s very likely that we see a lot of noise but perhaps “buying on the dip” in the DAX. I have no interest in shorting this market, and I do believe that eventually it goes breaking to the upside, perhaps even looking toward the €25,000 level, although it may take some time.

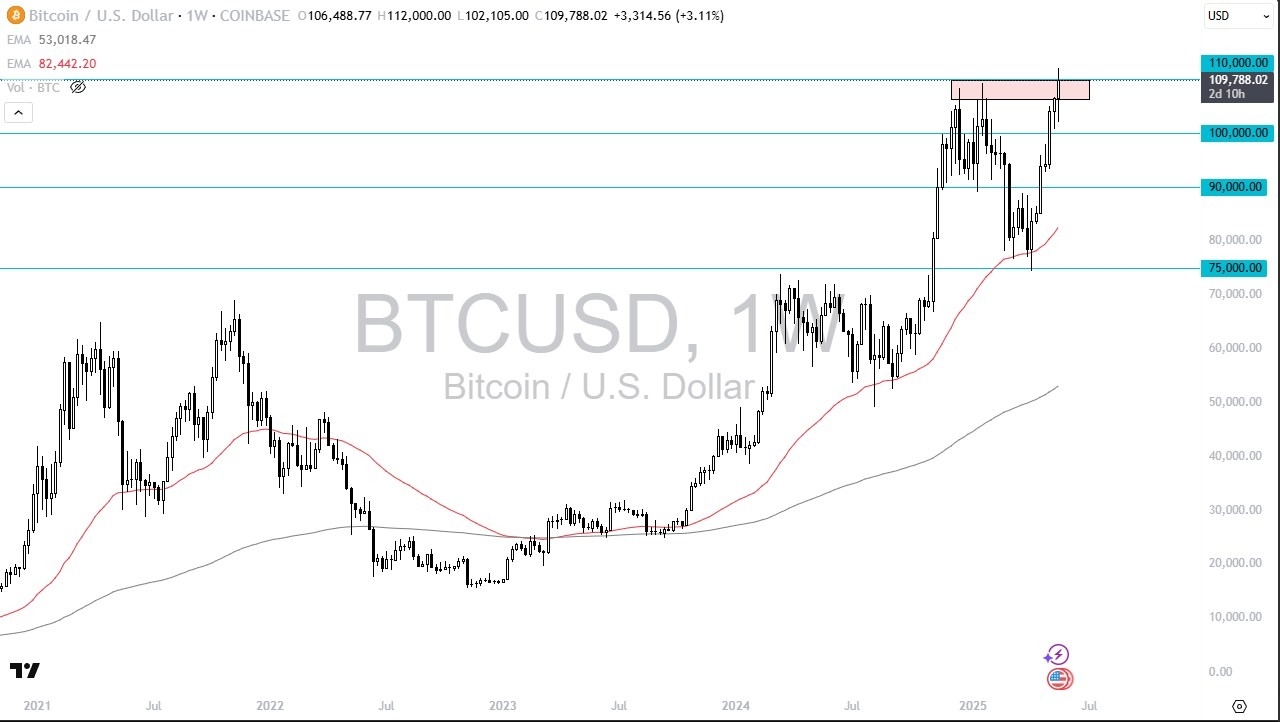

Bitcoin has been extraordinarily bullish during the week, and we are in the process of trying to break out. I think ultimately, the Bitcoin market should continue to go higher, but it’s also worth noting that we have drifted a little bit below the $110,000 level as we are closing out the week, so there is a very real possibility that we will pull back a bit from here, but I would anticipate that there should be buyers underneath willing to get involved. With the risk appetite being hammered by the announcement of tariffs, this could be a little bit of a “knock on effect” on Wall Street as Bitcoin is now an ETF.

The NASDAQ 100 has fallen a bit during the trading week, but quite frankly, this is a market that’s been extraordinarily bullish and despite the fact that we are now starting to hear the bloviating about tariffs, the reality is that the market needed a reason to pull back a bit, and now it has received that reason. With that being the case, I do think that this dip will more likely than not open up the possibility of buying again.

The British pound broke higher during the course of the week, after forming 3 shooting stars, a very neutral candlestick, all of which suggested that the resistance was going to hold. As I write this analysis, we are threatening the 1.35 level, so I do think that out of all of the currencies that I follow right now, the British pound might be one of the big winners as they are already in agreement with the Americans and therefore the tariff situation has plenty of clarity in the United Kingdom. Short-term pullbacks more likely than not offer buying opportunities.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.