Saving for retirement via an IRA account is a sound financial decision. But beware: sometimes discreet fees can seriously hinder the growth of your savings. Here’s why you need to understand them – and limit them.

Individual Retirement Accounts (IRAs), whether Traditional or Roth, offer Americans valuable tax advantages as they prepare for retirement.

In a context where Social Security is often not enough to guarantee a sufficient income once the working years are behind you, good retirement planning becomes essential.

This makes IRAs an essential pillar of retirement planning. But their effectiveness can be seriously undermined by an often overlooked factor: fees.

Invisible but real IRA costs

Opening an IRA is, in most cases, free. But once the account is activated, a series of potential costs can begin to slowly erode your returns. There are three main categories of fees:

Maintenance fees

Some establishments charge an annual fee simply for keeping your account open. These fees can range from $20 to $50 a year, although more and more institutions are abolishing them, especially for high-balance accounts.

So, it’s crucial to compare offers before taking the plunge.

Transaction fees and commissions

If you buy or sell stocks, ETFs or other securities in your IRA, you could be charged between $5 and $20 per transaction. Even if the trend is downward.

These costs add up quickly for active investors.

Expense ratios

If you invest in mutual funds or ETFs, you indirectly pay management fees. A passive index fund can cost as little as 0.05%, while an active fund can exceed 1% a year.

Over the long term, this difference can cost you thousands of dollars.

The long-term impact of IRA fees

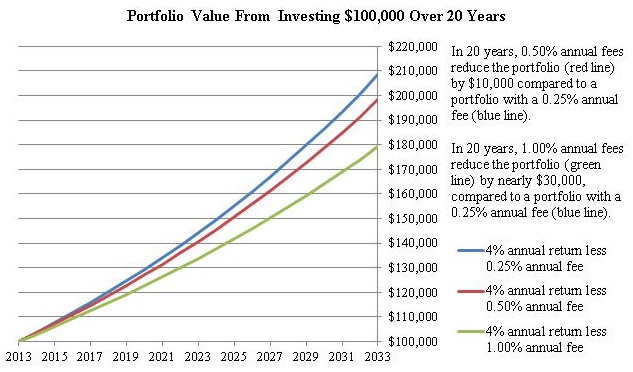

The seriousness of the problem lies in the fact that these costs are not one-off, but recurring. Even a small difference, say 0.25% per year, can translate into a loss of tens of thousands of dollars on your final capital over 20 years.

Let’s take an example: according to estimates from the US Securities and Exchange Commission (SEC), a fee differential of 0.5% can reduce the final value of your portfolio by almost $10,000 over 20 years, for an initial portfolio of $100,000. At 1%, the loss rises to nearly $30,000. In other words, when it comes to IRAs, fees are never a detail.

Source: US Securities and Exchange Commission

Tips for limiting IRA fees

To best protect your retirement savings, here are a few best practices to adopt:

- Compare fees before opening an IRA account. Choose transparent providers with low or no fees.

- Choose low-cost index funds or ETFs. Some providers, such as Vanguard, Fidelity and Charles Schwab, offer commission-free selections of ETFs and funds. These are effective options for diversifying your IRA without paying too much.

- Avoid advisors who charge wrap fees (flat-rate management fees for the entire account). If you need support, opt for a fee-only fiduciary advisor, paid by the hour or on a flat-rate basis.

- Limit your trading. The more you trade, the more you pay. A passive, long-term strategy is often more profitable and less costly.

Keep a close eye on your IRA fees

Preparing for retirement isn’t just about investing. It’s also about knowing how much you’re paying to invest.

In a world where every dollar counts, ignoring the fees on your Individual Retirement Account can be costly.

Conversely, making informed choices can make all the difference to the success of your retirement planning.

IRAs FAQs

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.