Stock indices in the US have opened mildly higher on Wednesday after finally recouping their 2025 losses on Tuesday. The focus is now on whether US stocks can achieve fresh record highs that were reached earlier this year.

The drivers of the recent US equity market recovery have been positive tariff news, trade deals and tech deals with cash-rich Saudi Arabia. This has sent US tech stocks soaring in recent days. Nvidia is higher by 13% in the past 5 days and it is extending gains once more on Wednesday, it is higher by more than 3%. Over the past month, the Magnificent 7 is no longer a drag on the S&P 500, as a whole, the group’s stock price has surged above its 200-day sma, which is a sign of upward momentum. So far this week, the Magnificent 7 is outperforming the overall S&P 500 index, which is a sign that investors prefer growth stocks over value as the US improves its trading partnerships with key nations and President Trump sells Nvidia chips to leaders of the Middle East.

Chart 1: Magnificent 7 and the S&P 500 index, YTD chart. Source: XTB and Bloomberg

For most of 2025, retail investors have been a powerful stabilizing force for the market. They were buying the US even as the market fell earlier in the year. The buy low message was a powerful driver for retail investors, since they ploughed in $67bn into US equities and ETFs in Q1 of 2025, down slightly from the $71bn they spent in Q4 2024. This suggests that 1, the retail trader was a powerful stabilizing force for US stocks when they sold off through to mid-April, and secondly, that the retail investor is becoming more important as a market participant. As a percentage of total equity market volume for US stocks in Q4 2024, retail trade accounted for 19.5%, up from 18.5% in Q3 and from 17% a year earlier, according to Bloomberg data sourced by XTB.

The increase in retail trading can be accounted for by the massive surge in Big tech stocks in 2024, as the AI trade caught the imagination of the retail community. In 2025, investors seemed more concerned about missing a dip buying opportunity rather than buying into a bear market. Typically, retail investor sentiment has been used as a contrarian signal for more ‘sophisticated’ market participants. When retail traders were buying, other market participants may sell. However, in 2025, retail traders showed that they had the right instinct.

The question now is, will retail traders continue to buy into this rally? We can get an indication of retail demand by looking at the CFTC data for noncommercial net longs for the S&P 500, which is released weekly. This suggests that retail buying has tapered off in Q2.

The rally is being led by the big-name US stocks like Nvidia, AMD etc, which tend to be favoured by retail traders. However, retail traders may be ready to take profit at these levels and look for another sell off to extend their long positions. Thus, US stocks may not be able to rely on the support of the retail trading community to push indices to fresh record highs.

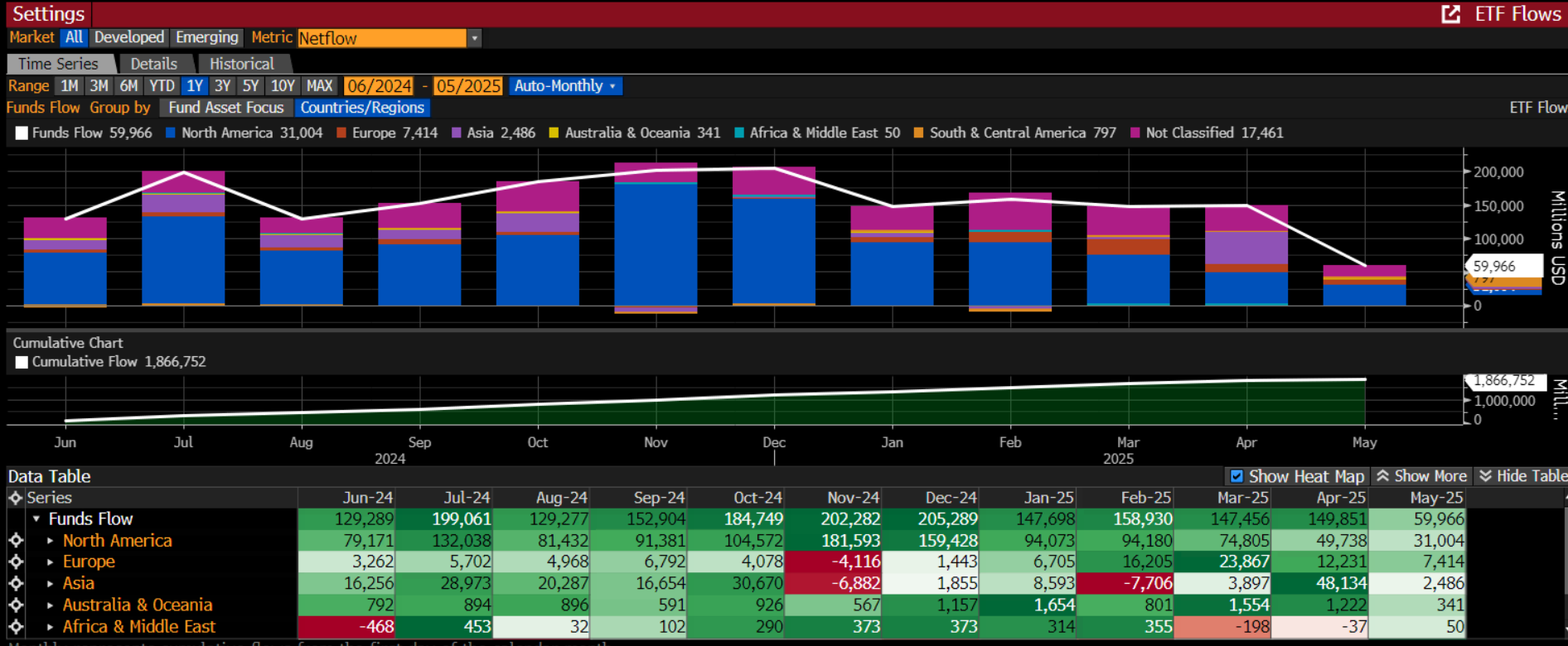

Chart 2: Monthly ETF flows by region. Source: Bloomberg

Monthly ETF flows also suggest that passive investors, which include a large number of retail traders, are favouring bonds as well as equities. There has been a notable shift back into the US, which has seen flows pick up over recent months, whereas flows into Europe have pulled back after peaking in November 2024. This supports the view that US stocks will play catch up with European equities for the rest of this year, it may also suggest that retail traders are favouring the US over Europe, which may help US stocks to rally in the future.

Overall, the powerful rally in US stocks may be due a breather on Wednesday, as a lack of news flow curbs investor enthusiasm. However, we will be watching retail flows closely. If US stocks are to make fresh highs this year, then the retail trading community needs to be onboard.