Wall Street just turned bad news into good vibes.

Last Friday’s Non-Farm Payrolls (NFP) report came in well below expectations. The economy added only 73K jobs, far short of the 110K forecast. Worse still, June’s number was quietly revised down from 147K to just 14K — a far cry from the original report.

Despite this, equity markets rallied — this highlights a key factor: markets are now driven by the narrative of an interest rate cut.

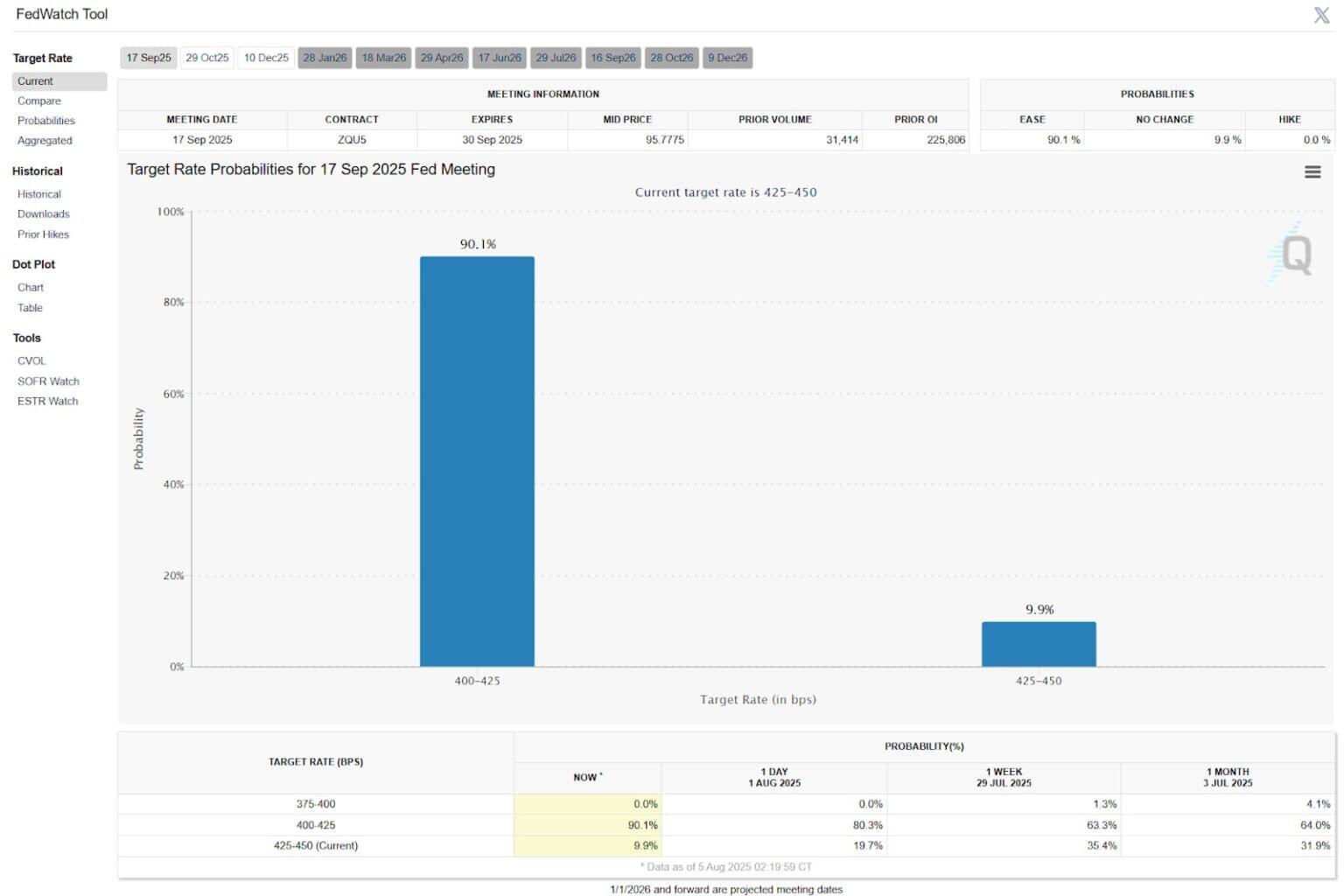

Traders now believe the Federal Reserve will be forced to cut rates as early as September, potentially bringing the federal funds rate down to 4.00–4.25%.

Source: Fedwatch Tool as of August 5th, 2025

On the CME FedWatch Tool, odds of a September rate cut jumped to 92.1%, up from just roughly 40% the week before. That same reading had been above 80% prior to last week’s FOMC meeting.

This kind of volatility in expectations shows that markets are highly emotional right now — highly reactive, and not rational.

Alchemy quick take

-

Institutions were looking for any excuse to rotate back in and raise equity prices.

-

The rate cut narrative, not fundamentals, is driving market movement.

-

Job creation is slowing, and AI risks future displacement.

-

Economic backdrop remains fragile, yet indexes push into resistance.

-

Markets climbed despite weak jobs data.

SPX technical snapshot

-

SPX has two major trendlines which are multi-year spanning, acting as support and resistance.

-

The index is trapped near the top of a rising wedge, a decision zone for bulls and bears.

-

Resistance aligns with the 0.618 Fibonacci extension at $6,427.79, and $6,860.77 as the next target.

-

Support lies at $6,145.68 and $5,625.59 — watch for a potential bounce if we get a pullback.

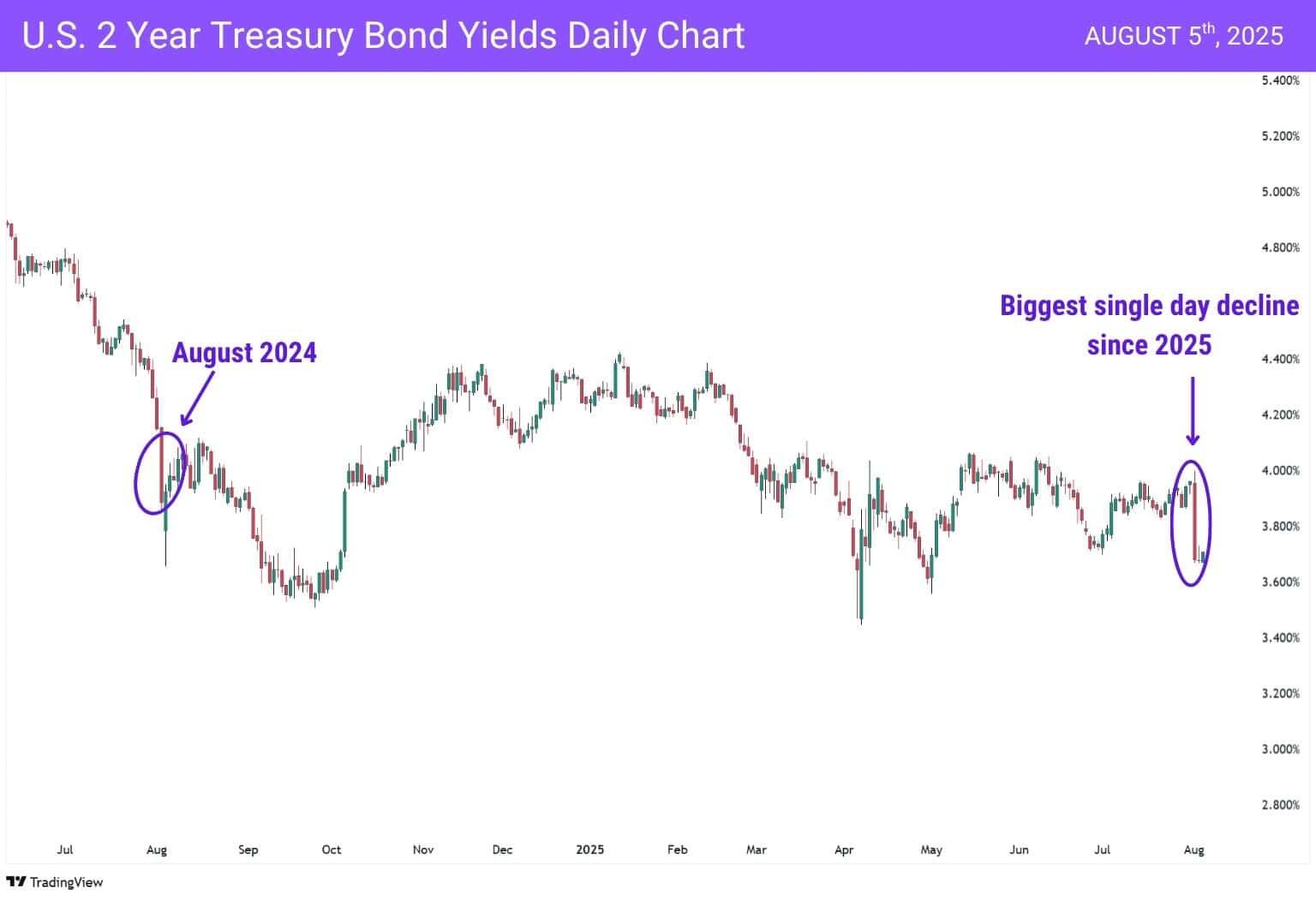

Bond yields drop as rate cut bets spike

While stocks pushed higher, bond markets moved the other way. The 2-year Treasury yield dropped more than 25 basis points after the NFP release. This was the biggest single-day fall in nearly a year.

Bond yields represent the return investors demand for lending money to the government. When yields fall, it usually means demand for bonds is rising. This often signals that investors are moving into safer assets and expecting weaker economic conditions ahead.

Why are yields falling?

While stocks pushed higher, bond markets moved the other way. The 2-year Treasury yield dropped more than 25 basis points after the NFP release. This was the biggest single-day fall in nearly a year.

Why are yields falling?

It is not because inflation is collapsing. It is because growth expectations are getting worse. Traders now expect the Fed to cut, but bonds are reacting to weakness, not optimism — this signals a major divergence in the current equity price action, and the underlying expectation.

This points to a deeper problem. The Fed may be forced to cut not because the market is healthy, but because something has broken. It is a rescue move, not a reward.

Historically, this kind of shift often marks the start of a Fed pivot, which I discussed in my quarter 3 equities outlook.

And Fed pivots have not been bullish turning points for equities. They usually follow damage — not prevent it.

Final take

Follow the money for now, but stay cautious. The market is pricing in rate cuts on the back of weak economic data, not strong growth. This rally is sentiment-driven and may not be sustainable without real improvement in fundamentals.

Key considerations for traders

-

Bond markets are signalling caution, with sharp yield declines suggesting deteriorating growth expectations.

-

Rate cut expectations are elevated, but remain sensitive to incoming data.

-

Macro conditions are weakening, with soft job creation and downward revisions confirming labour market stress.

This phase may still offer opportunity, but it is increasingly defined by positioning and narrative. Consider tightening risk and preparing for shifts in sentiment.