Buyers and sellers take turns in Tesla

With Elon Musk facing off against Donald Trump in the public square, Tesla ($TSLA) stock has been caught in the crossfire. Shares fell 15% last week on a closing baiss, giving back roughly half its gains from the prior two months.

With the increase in newsflow, message volume on Stocktwits reached its highest level of 2025, with sentiment sitting at its most bearish since early March and mid-February. When asked with a Stocktwits poll, 49% of the 17,600 respondents indicated the Musk-Trump feud has made them more bearish on Tesla stock. Needless to say, sentiment is quite negative among retail right now.

However, those looking for an easy short may be surprised to find a more mixed chart than expected. Prices are stuck between support near 270-280 and resistance near 365-385, with the 200-day moving average still rising despite the volatility. Plus, since the 2023 low near 100, there has been a series of higher lows and higher highs…which is currently in jeopardy.

Bulls want to see prices stabilize above support here, or else they risk a move down toward 200-210. Not going down here would potentially provide the latest higher low and set up for the real test, if a new high above 385 can be made.

My primary point is that there’s a lot of volatility in the stock right now and despite the clearly bearish tilt from retail, the downside bet doesn’t look like a sure thing. But it’s definitely one to keep an eye on, particularly as a bellwether for the broader market and U.S. government policy.

Are SpaceX’s troubles Rocket Lab’s gain?

It’s not just public companies linked to Musk that are in the potential crosshairs of Trump and his administration. With rumors around SpaceX being cut out of the space race flying high (no pun intended), retail investors are looking at Rocket Lab ($RKLB) as the primary beneficiary.

With the increase in newsflow, message volume on Stocktwits reached its highest level of 2025, with sentiment sitting at its most bearish since early March and mid-February. When asked with a Stocktwits poll, 49% of the 17,600 respondents indicated the Musk-Trump feud has made them more bearish on Tesla stock. Needless to say, sentiment is quite negative among retail right now.

However, those looking for an easy short may be surprised to find a more mixed chart than expected. Prices are stuck between support near 270-280 and resistance near 365-385, with the 200-day moving average still rising despite the volatility. Plus, since the 2023 low near 100, there has been a series of higher lows and higher highs…which is currently in jeopardy.

Bulls want to see prices stabilize above support here, or else they risk a move down toward 200-210. Not going down here would potentially provide the latest higher low and set up for the real test, if a new high above 385 can be made.

My primary point is that there’s a lot of volatility in the stock right now and despite the clearly bearish tilt from retail, the downside bet doesn’t look like a sure thing. But it’s definitely one to keep an eye on, particularly as a bellwether for the broader market and U.S. government policy.

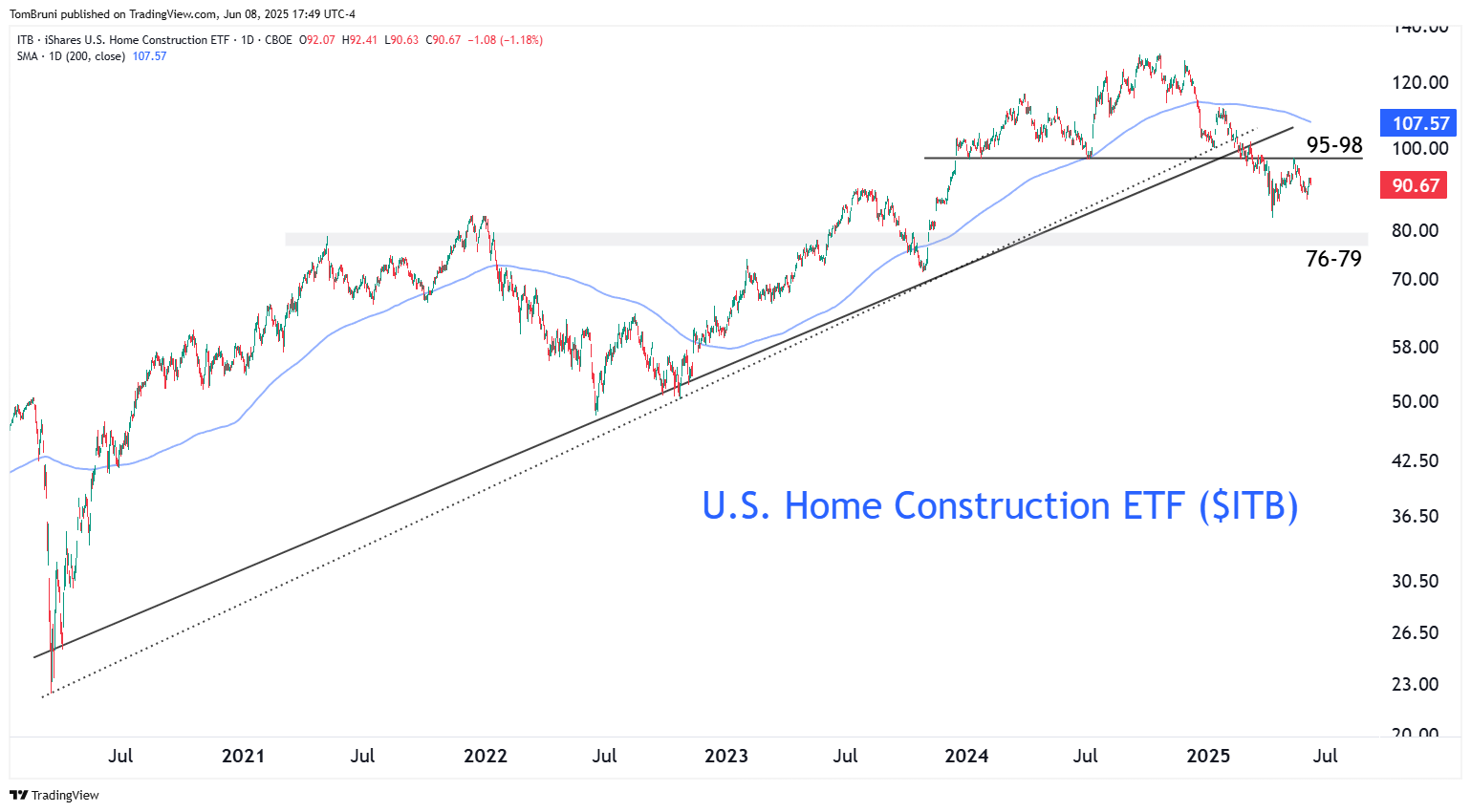

US home construction ETF remains vulnerable

Switching gears from the space race, let’s ground ourselves and check in on the U.S. housing market. For the last two years high interest rates and record prices have kept the housing market in a standstill, with the post-pandemic upgrade cycle also cooling significantly too. The housing market is a major piece of the economy and consumer spending so this weakness is a concern. Luckily the strength in the labor market has kept a lid on the damage so far.

Nevertheless, the chart of the U.S. Home Construction ETF ($ITB) remains at risk. Shares quietly fell 36% from their October highs to the April lows and have recovered only a small portion of that drop compared to the broader market. Prices broke through the uptrend from their 2020 lows and horizontal support near 95-98 that’s been intact for several years. The 200-day moving average is also sloping lower, signaling a continued negative shift in the long-term trend.

With the biggest weightings being D.R. Horton, Lennar Corp., NVR, Inc., PulteGroup, Sherwin Williams, Home Dpeot, and more…stock market bulls do not want to see this weakness accelerate to the downside. But the longer we stay below the 200-day and broken support near 95-98, the higher the chances that occurs in my view.

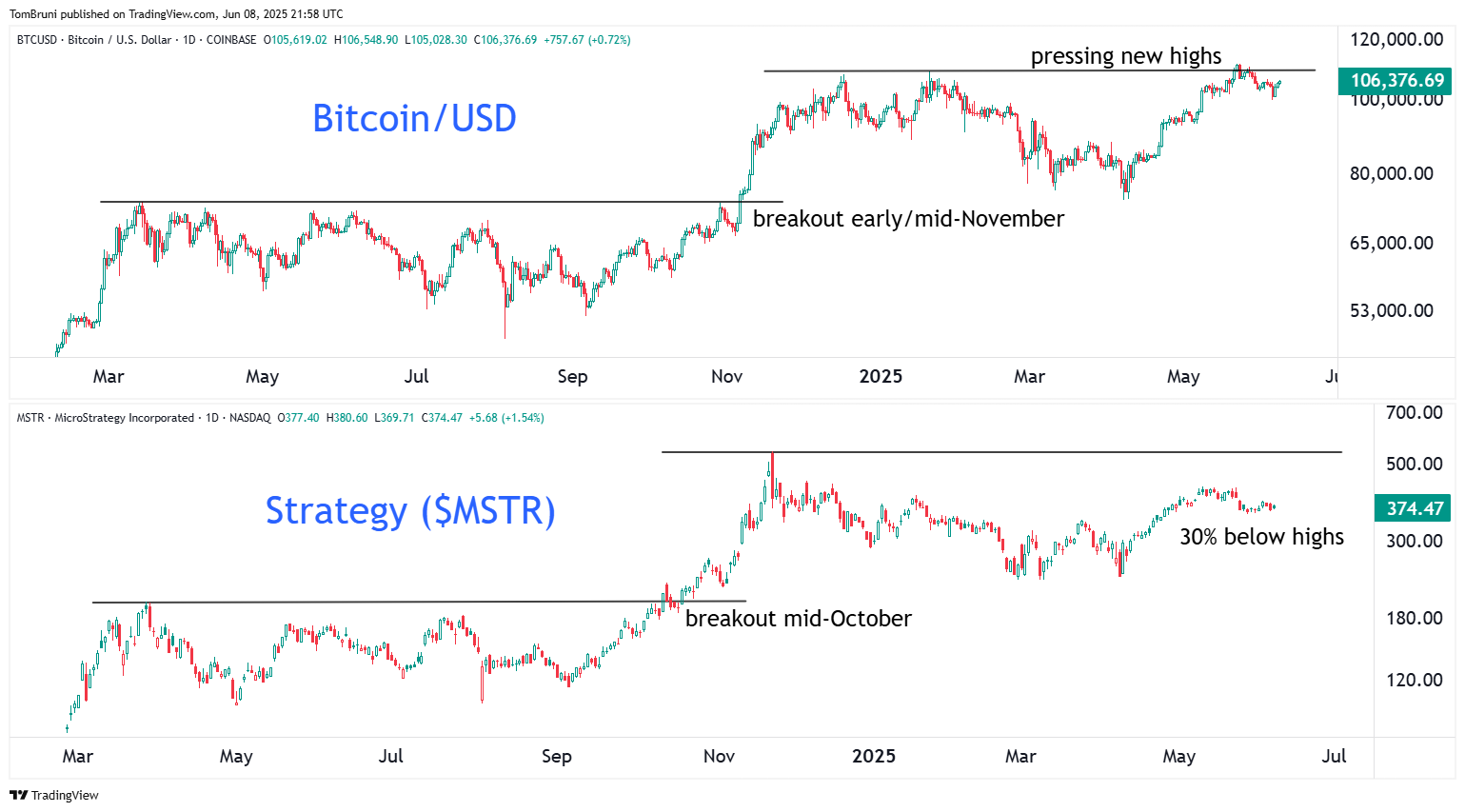

Are equity investors over the Bitcoin-proxy trade?

In honor of Stocktwits’ recent launch of Cryptotwits which was advertised above, let’s dive into some crypto charts retail investors and traders are talking about right now.

The first is MicroStrategy ($MSTR), now known only as Strategy, which is the OG leveraged Bitcoin treasury play in the equity market. What investors are trying to decide right now is whether stocks like Strategy have lost their luster given the proliferation of Bitcoin ETFs and other, more direct ways to access crypto exposure in a traditional investment account. We’ve seen GameStop and others gain short-term fanfare from buying Bitcoin, but once the conversation returns to business fundamentals much of those gains are given back.

Even Strategy is having a tough time keeping pace with Bitcoin lately. In late 2024, the stock broke out several weeks ahead of the crypto market and was a leading indicator of the strength to come. However, now we’re seeing Bitcoin push to new all-time highs while Strategy remains down 30%.

Time will tell if the stock plays catch-up, but some are viewing this as a continue decoupling of Bitcoin and equities which would suggest playing Bitcoin (or the crypto market) directly might be the better bet. Or at least own crypto-linked businesses with real fundamental drivers, not just those trying to financially engineer their way into traders’ hearts in the short-term.

Will it be all good in the $HOOD after S&P 500 snub?

If we’re talking about retail investors, crypto, and bull market behavior, then we need to end with a look at Robinhood ($HOOD). The stock broke out above resistance near 70-75 last week on rumors that it would be added to the S&P 500 Index during Friday’s rebalancing.

Unfortunately for the bulls, no index changes were made and the stock traded down about 6% after hours on Friday. Still, the broader narrative around Robinhood remains intact, with Stocktwits sentiment still near its highest levels of the year.

Whether or not prices can hold steadily above 70 after this news will determine whether short-term momentum remains intact. If not, some backing and filling will likely occur before the next leg higher, especially given how extended it is from its 200-day moving average (which sits near 40). Either way, retail has its eyes on this stock and is looking for much higher prices.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!