- The US dollar has rallied rather significantly during the course of Tuesday trading, completely wiping out most of the selling pressure from the Monday session.

- This suggests that US dollar selling pressure is somewhat limited, and it also suggests that perhaps people are looking to try to take advantage of the interest rate differential over the longer term.

- After all, you get paid to hang on to this trade, and that will continue to be the case going much further into the future.

A Tale of Two Central Banks

Currently, the Bank of Japan has a major problem. The biggest problem that I see is the fact that the Japanese Government Bonds continue to see a serious lack of demand. In other words, the debt market in Japan is starting to freeze up, which is absolutely disastrous. This is a situation that the Bank of Japan will be forced to address, and the only thing that they can do is start buying the bonds themselves. This is quantitative easing, and it’s coming back to Japan sooner than most people realize.

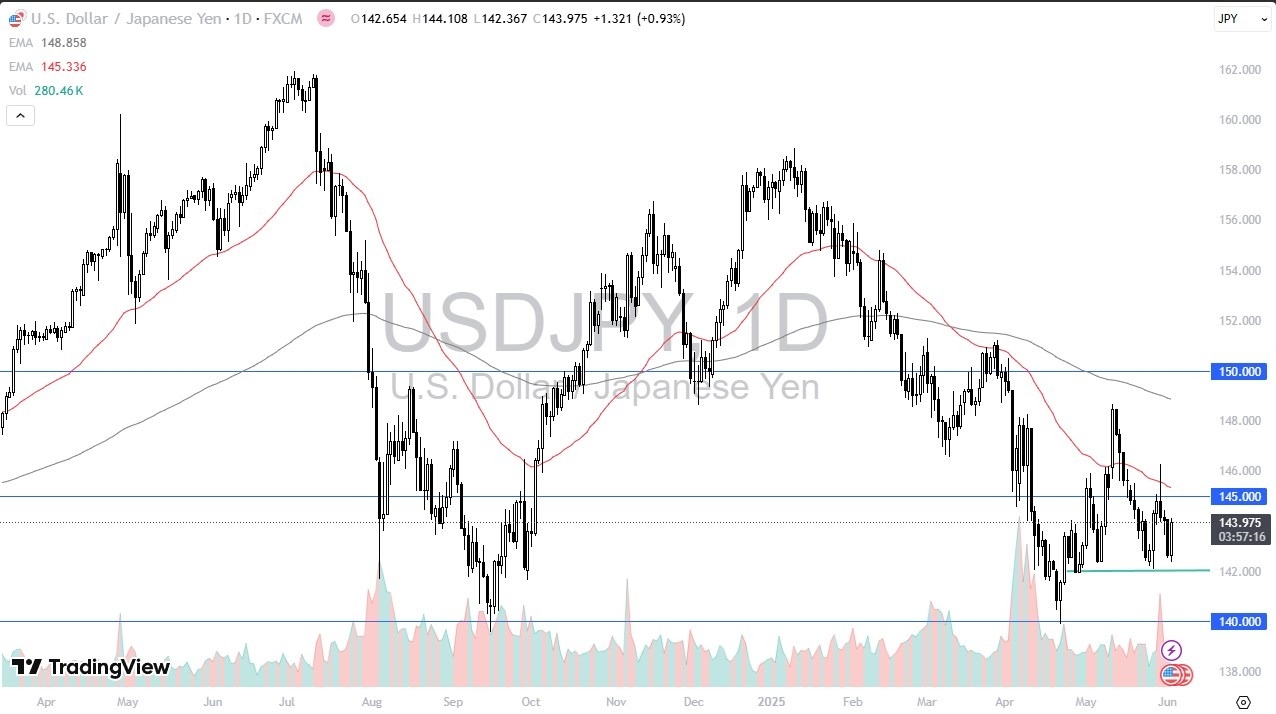

On the other side of the Pacific Ocean, we have the Federal Reserve, which although is starting to see a little bit of weakness in the US economy, the reality is that we are probably several months away from seeing the US cut interest rates, and even then, we are probably talking about 0.25% at that time. In other words, the interest rate differential will continue to favor the US quite drastically, and as long as that’s the case, I do think there is a bit of a bid in this market. The ¥142 level continues to be important, and even if we broke down below that level, then I think you have a ¥140 level offering support. On the other hand, if we do rally from here, and break above the ¥145 level, we will then overtake the 50 Day EMA, which could have traders buying the US dollar again.

Want to trade our USD/JPY forex analysis and predictions? Here’s a list of forex brokers in Japan to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.