- Bitcoin has been somewhat back and forth during the trading session here on Wednesday, but that’s not a huge surprise considering that we are currently waiting for the FOMC interest rate decision.

- While most Bitcoin fanatics don’t recognize the correlation, there’s a huge correlation now, mainly due to institutional trading and what the U.S. dollar will make other assets do.

- So, with that, Wall Street has taken a bit of a pause. Plus, it’s probably worth noting that the same people who control the Bitcoin ETFs in New York will likely be away from any type of trading activity on Thursday as well as it is the Juneteenth holiday, a fairly new holiday here in the United States.

Longer Term Higher?

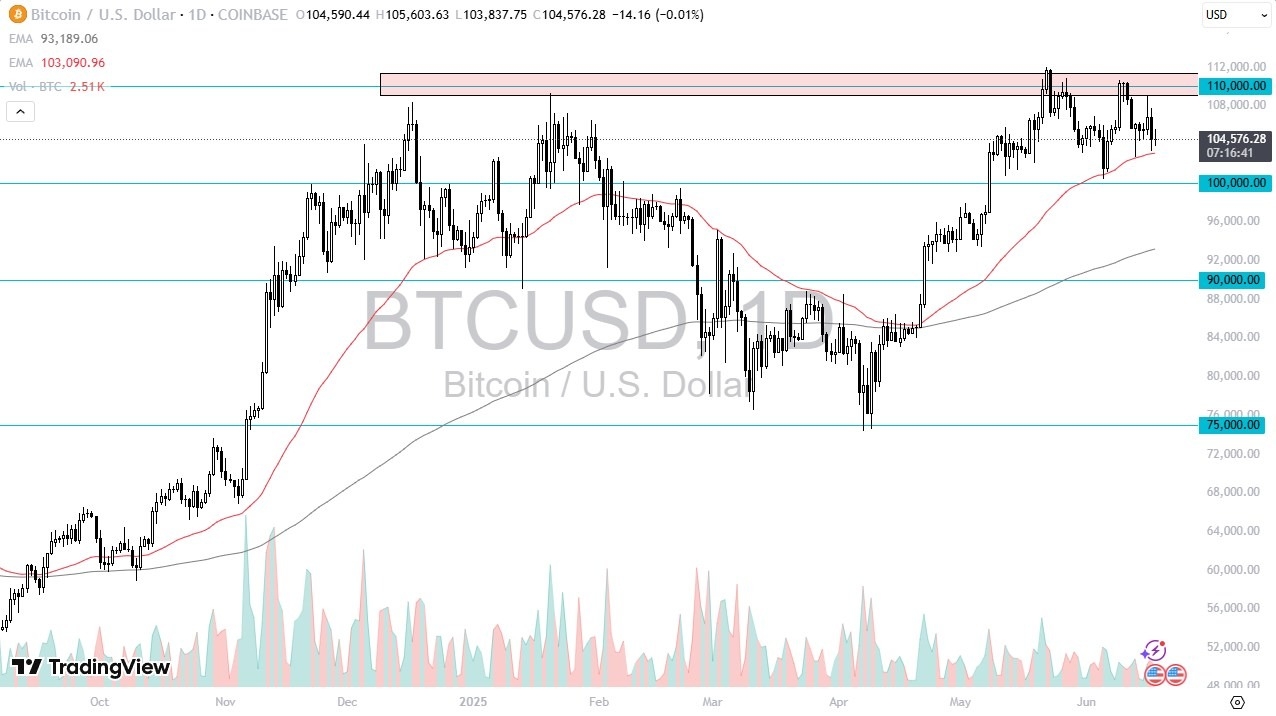

So, with all of that being said, you have to look at this through the prism of the longer term and the potential for movement. The 50 day EMA underneath of course offers a bit of support with the $100,000 level underneath there offering even more. But I think you have a situation where breaking down below could really rattle the market. I don’t think that’s the case though.

I think more likely than not each of these pullbacks will continue to offer a buying opportunity. The $110,000 level is an area that has been resistant to buyers, even though we did break as high as 112,000 at one point.

But with that being said, I think it’s only a matter of time before we break out. We had a 40 % gain and really all we’ve been doing here over the last several weeks has been grinding away, consolidating, killing off some of the froth that had undoubtedly entered the market. Sometimes you pull back, sometimes you go sideways. Right now, I think, we’re just going sideways before the next push higher. Short-term buying on the dip is still possible, but I have no interest in shorting this market.

Ready to trade daily BTC/USD forecast & predictions? We’ve made a list of the best Forex crypto brokers worth trading with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.